Hey fam!

This week brought signs of a market awakening, along with several positive headlines. Let’s break them down:

quick weekly news

Kevin Hassett emerges as a frontrunner for the FED Chair

Let’s start this digest with a macro shift the crypto market is closely watching, as leadership changes at the Federal Reserve move into focus. With Jerome Powell’s term ending in May, Donald Trump is expected to nominate a new Fed chair in the coming months. Kevin Hassett has emerged as the front-runner, and markets are increasingly viewing him as a crypto-friendly option due to his clear bias toward faster and deeper rate cuts.

Hassett has consistently argued that the Fed is moving too slowly on easing and has pushed for more aggressive stimulus to support growth. This is especially important for risk assets after two consecutive 25 bps cuts have already shifted the policy tone toward easing. If confirmed, Hassett would likely accelerate the pivot to cheaper liquidity, reinforcing expectations for a looser monetary environment in 2026.

There is still uncertainty around how his appointment would be structured, as Hassett is not currently a voting member of the FOMC. Scenarios range from replacing a sitting governor to a rare split of leadership roles at the Fed. While unconventional, any path that results in stronger political backing for rate cuts is being interpreted as structurally supportive for capital markets.

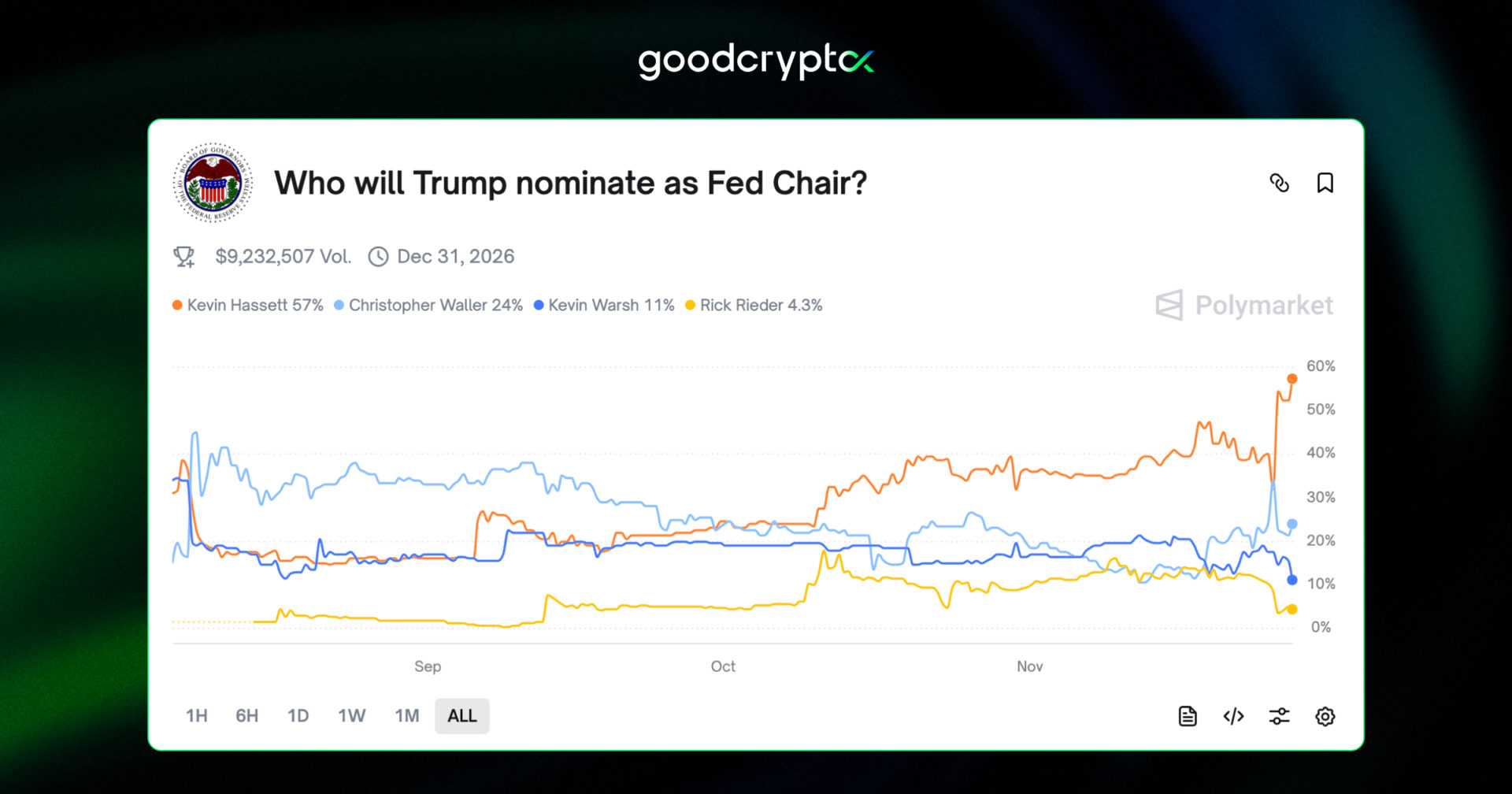

For crypto, the implications are net positive. A more aggressive easing cycle typically boosts liquidity, risk appetite, and speculative flows into digital assets. In addition to that, Hassett has invested in Coinbase, showing his interest in crypto. Even before any formal decision, the market is already beginning to price in the possibility of faster monetary expansion next year. This backdrop historically aligns well with upward momentum in Bitcoin and the broader crypto sector. According to Polymarket, the odds of Hasset receiving Fed chair are ~57%:

Source: Polymarket

S&P downgrades USDT’s dollar peg rating to the lowest score

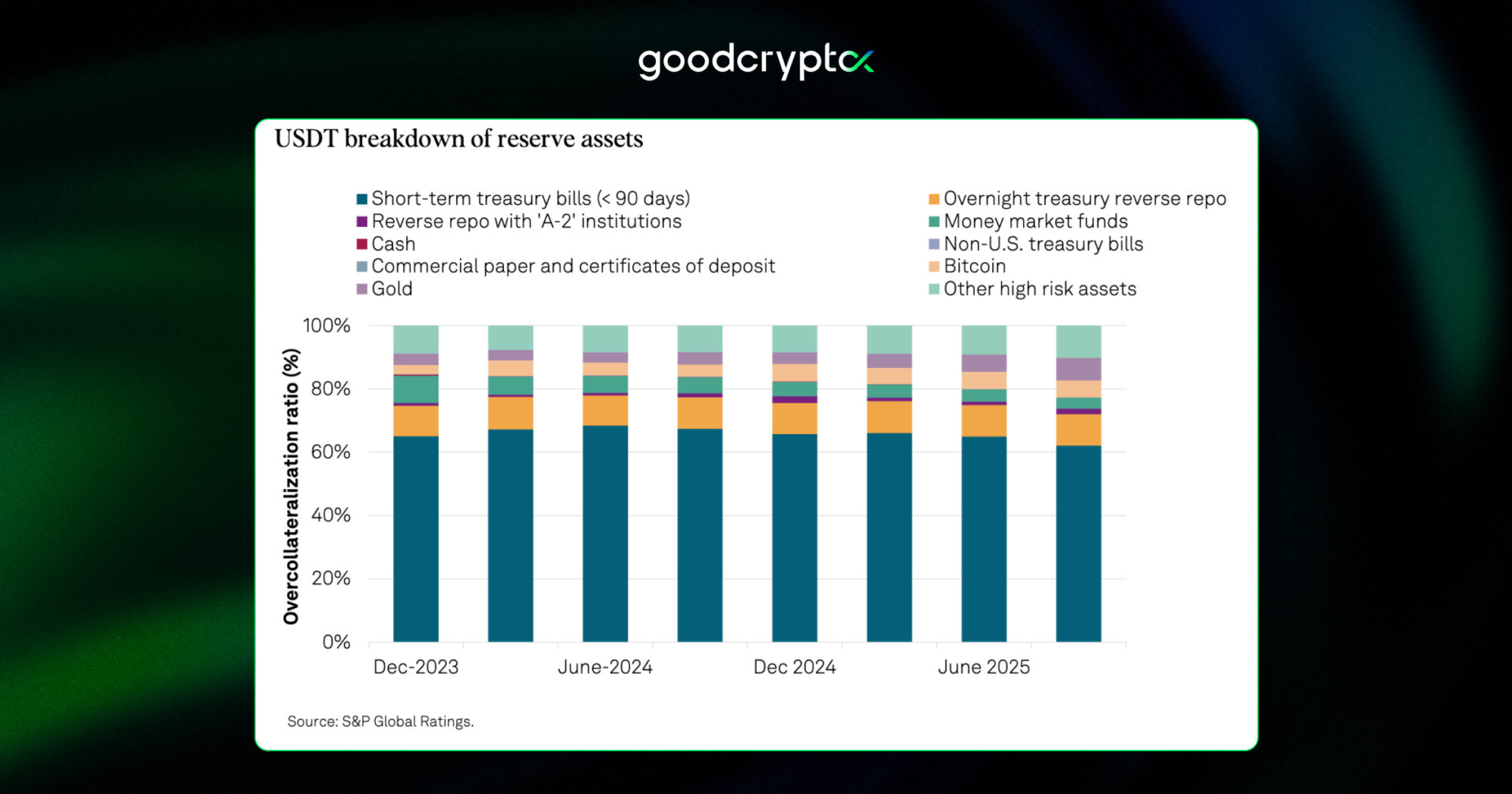

Continuing with some less positive news, S&P Global Ratings delivered a major headline for the stablecoin sector by downgrading Tether’s $USDT to the lowest tier on its stablecoin stability scale. The agency cited concerns over reserve composition, pointing specifically to exposure to higher-risk assets such as Bitcoin, gold, loans, and corporate bonds, which could weaken collateral coverage during periods of market stress.

Source: S&P Global Ratings

According to S&P, Bitcoin now accounts for 5.6% of $USDT backing, exceeding the stablecoin’s overcollateralization buffer, meaning a sharp $BTC drawdown could pressure full reserve coverage. The report also highlighted regulatory leniency in El Salvador and the lack of a full, independent audit as key risk factors, even though roughly 75% of reserves remain parked in low-risk U.S. Treasurys and short-term instruments.

Tether strongly rejected the downgrade, calling the assessment misleading. CEO Paolo Ardoino pushed back on the credibility of traditional rating agencies, arguing that legacy models fail to properly evaluate digitally native money and overlook USDT’s real-world resilience, liquidity, and global utility.

Notably, the downgrade lands amid a structural expansion phase for stablecoins. With regulatory clarity improving in the U.S. under Donald Trump’s administration and the total stablecoin market cap exceeding $300B, Tether now holds over $112B in U.S. Treasurys and 116 tons of gold. This growing reserve footprint has fueled comparisons of Tether to a quasi–central bank, underscoring just how systemically important $USDT has become, despite ongoing scrutiny.

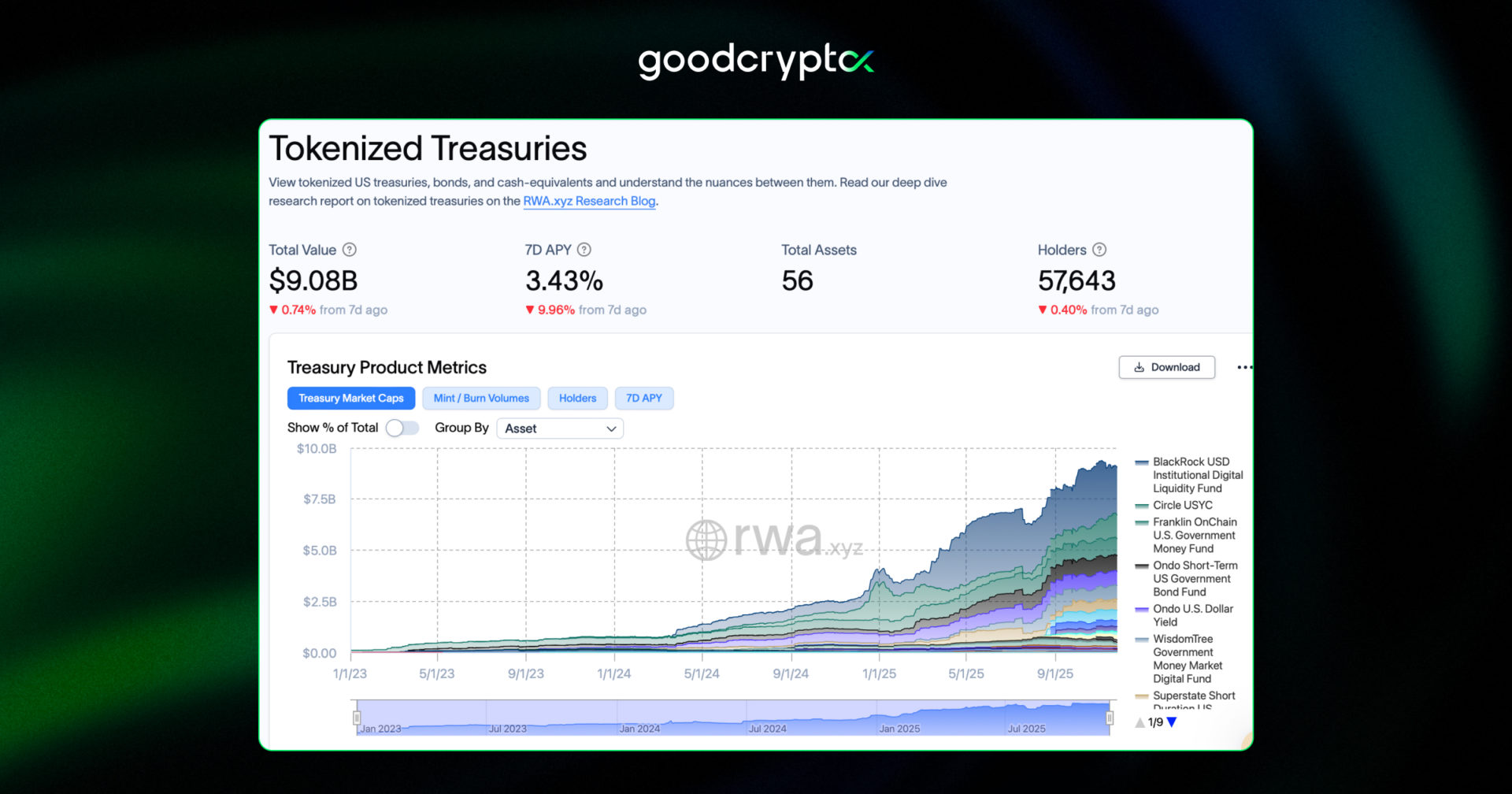

Tokenized money market funds surge to $9B, however, BIS warns of new risks

Speaking of financial news, the Bank for International Settlements reported that tokenized money market funds have surged to nearly $9B in on-chain assets, up almost 10x from ~$770M at the end of 2023. These on-chain funds, backed primarily by short-term U.S. Treasurys, are rapidly becoming a core source of yield and collateral across DeFi and institutional crypto markets.

While the BIS acknowledges its appeal as a higher-quality alternative to stablecoins, it also flagged new systemic risks. The core concern is a structural mismatch: tokenized funds settle instantly on public blockchains, while the underlying assets still settle through traditional financial rails. In periods of heavy redemptions, this timing gap could create liquidity stress and forced asset sales, amplifying volatility.

Risk is further elevated by the tight integration with stablecoins and leveraged trading, as some tokenized funds allow rapid conversion into stablecoins or serve as collateral for leveraged crypto positions. The BIS warned that these feedback loops could enable faster contagion than in traditional money markets, especially if on-chain liquidity thins during market shocks.

On the adoption front, major asset managers are accelerating deployment. BlackRock’s BUIDL fund now dominates the sector with over $2.5B in tokenized assets, while Franklin Templeton’s BENJI fund has surpassed $844M following its expansion via the Canton Network.

Source: RWA.xyz

Together, these moves signal that tokenized Treasurys are quickly evolving from an experiment into a systemically relevant on-chain financial layer.

Grayscale files with the SEC to convert Zcash Trust into a spot ETF

Let’s finish our digest with some positivity on the ETF front, as Grayscale filed with the U.S. Securities and Exchange Commission to convert its Zcash Trust into a spot ETF, potentially marking the first spot ETF tied to a privacy coin. The filing was made via a Form S-3 and would allow the product to list on NYSE Arca if approved.

The move follows Grayscale’s growing lineup of approved crypto ETFs, including spot products for Bitcoin, Ether, Dogecoin, and XRP. Since the landmark approval of spot Bitcoin ETFs in early 2024, issuers such as BlackRock, Bitwise, and Grayscale have rapidly expanded into altcoin exposure, signaling continued institutional appetite for diversified crypto ETFs.

Markets have already reacted strongly. Zcash has surged over 50% in the past 30 days and more than 1,000% year-over-year, as speculation builds around potential ETF-driven inflows. The rally positions $ZEC as one of the strongest large-cap performers of the cycle, fueled by both ETF optimism and rising demand for onchain privacy.

The narrative is also gaining traction among traditional crypto investors. Earlier this month, Winklevoss-backed capital flowed into $ZEC as part of a corporate crypto treasury strategy, adding to speculation that privacy assets could reclaim mindshare alongside Bitcoin in the next phase of institutional adoption. If approved, the Zcash ETF would represent a major regulatory milestone for privacy-focused cryptocurrencies.

how to trade with Stochastic Oscillator?

📊 The Stochastic Oscillator (STOCH) is a momentum indicator that shows where the current price sits relative to its recent range. It helps traders spot early trend shifts, fine-tune precise entries, and avoid chasing late FOMO moves.

Why STOCH matters:

- Trade crossovers: %K and %D crossovers often signal momentum exhaustion before price makes a clear move;

- Spot reversals: Overbought (above 80) and oversold (below 20) zones highlight areas where trends frequently reverse;

- Catch hidden momentum: Bullish and bearish divergence between price and STOCH can confirm upcoming breakouts or breakdowns.

📖 Want to spot momentum shifts before the crowd and sharpen your entries? Learn how to do it in the full Stochastic Oscillator guide by goodcryptoX.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!