Welcome to the crypto world!

Check out the latest highlights from the past week in our Good Crypto digest. For real-time updates, follow us on Twitter or Telegram.

quick weekly news

Coinbase expands spot crypto trading for international institutional investors

In a recent blog post, Coinbase revealed plans to offer spot trading services for Bitcoin (BTC) and Ethereum (ETH) against USD Coin (USDC) to institutional investors outside the United States. The exchange aims to launch these services on Dec. 14, expanding later to include retail investors, more tokens, and new trading features in response to regulatory uncertainties in the U.S. landscape.

“We recognize the hesitancy among some asset issuers and members of the crypto community to engage with U.S. exchanges due to the evolving and uncertain regulatory landscape in the United States,” announced the Coinbase team on its official X (formerly Twitter) account.

BlackRock’s revised Bitcoin ETF proposal eases entry for Wall Street banks

BlackRock’s updated proposal for a spot Bitcoin exchange-traded fund (ETF) seeks to simplify the process for major financial institutions like JPMorgan and Goldman Sachs, enabling them to engage through the creation of new shares using cash rather than cryptocurrencies.

The adjustment, presented during a meeting with the United States Securities and Exchange Commission (SEC) by six BlackRock members and three from Nasdaq on Nov. 28, introduces an in-kind redemption “prepay” model, as showcased in a SEC memo filling. This innovation allows these banking giants, limited by regulations against holding Bitcoin or crypto directly on their balance sheets, to partake as authorized participants for the ETF. If approved, it may pave the way for massive financial entities to enter the crypto sphere.

The FASB major accounting rules change pave the way for US firms to embrace Bitcoin

A recent Financial Accounting Standards Board (FASB) rule change, effective December 2024, permits U.S. companies to accurately display the value of their crypto holdings on financial statements. Previously, crypto values could only be adjusted downward, limiting firms from reflecting gains unless assets were sold, and hindering adoption.

This shift allows firms to report gains and losses on crypto, opening avenues for Bitcoin as a strategic asset and fueling potential adoption. Experts highlight the substantial corporate interest in integrating crypto into accounting practices, signaling a notable milestone for companies considering Bitcoin on their balance sheets.

OKX DEX suffers $2.7 million hack due to leaked admin key

On Dec. 13, SlowMist Zone, a blockchain security firm, disclosed a critical vulnerability on OKX DEX. The security breach, initiated at approximately 10:23 PM UTC on December 12, 2023, was facilitated by the exploitation of a leaked admin private key, which gained access during a routine contract upgrade. The situation subsequently escalated due to the inadvertent upgrade by the administrator to a malicious version of the contract, thereby prolonging the unauthorized withdrawal of digital assets.

Following the breach, Scopescan reported users’ accounts of the incident, noting that the exploited contract was isolated and halted after contacting the DEX. PeckShield estimated the loss at approximately $2.7 million across various cryptocurrencies and advised users to revoke allowances if necessary.

Bollinger Bands explained

When examining the SMA, a central red line of the Bollinger Bands, the indicator provides an instant picture of the market’s direction. will quickly indicate the market’s direction. Bollinger Bands, with their upper and lower bounds (blue lines) surrounding the SMA (red line), depict market volatility. Narrow bands hint at a potential surge, while wide bands forecast turbulence.

- SMA shows the direction of the short-term price.

- The more significant the difference between the upper and lower bands, the more Volatility

Pro Tip: Before you decide on a trading strategy, be sure to determine whether or not the market is bearish or bullish. It’s critical to employ the right system for market sentiment. This will guide your choice of trading system and highlight effective signals from the noise.

Explore one of the most widely used technical indicators with a complete guide for traders exemplified by Good Crypto charts here.

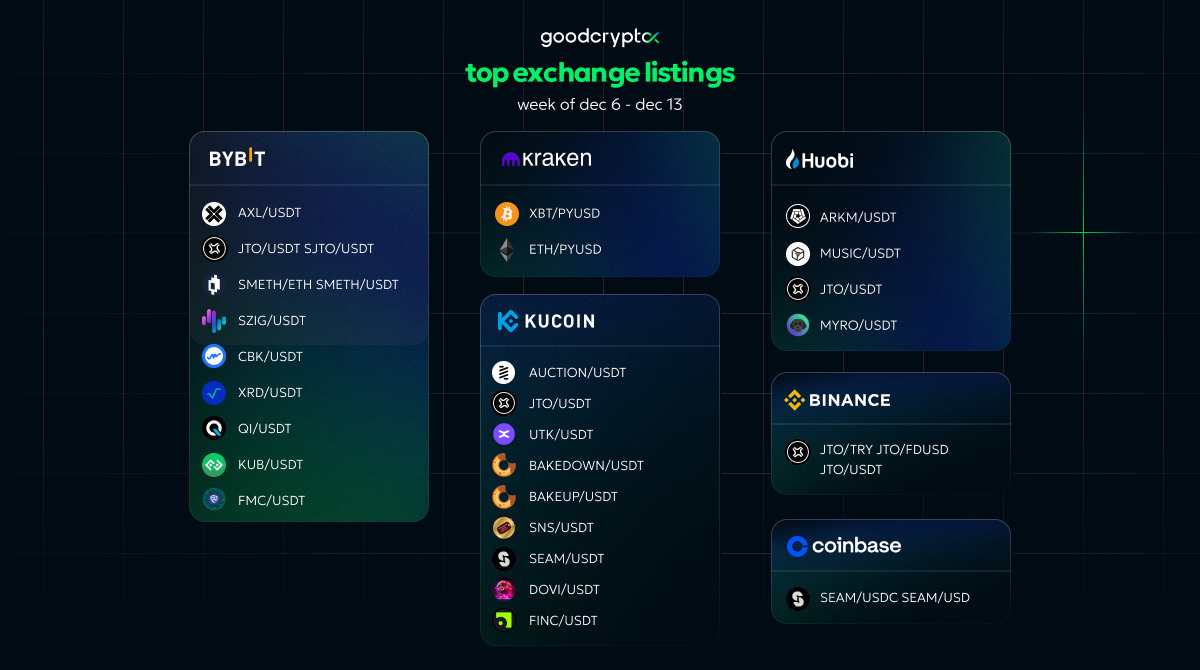

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!