Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

Sequence and Google Cloud boost web3 gaming

Sequence, a platform by Horizon Blockchain Games, has partnered with Google Cloud to enhance web3 gaming development. This collaboration aims to simplify the process for developers by integrating Sequence’s comprehensive web3 tools with Google’s cloud computing services. The initiative is designed to allow developers to focus on creating engaging gameplay without the complexities of web3 technology.

Launched in 2019, Horizon Blockchain Games has successfully raised $53.3 million through funding rounds, propelled by its NFT-based game “Skyweaver” and its robust technology stack. The partnership with Google Cloud will bring a seamless full-stack integration of Sequence’s development platform to the cloud, offering a range of tools from wallets to smart contract management.

Google Cloud’s Director for Games, Jack Buser, emphasized that Sequence will alleviate the technical burdens of web3, ensuring a smooth experience for both developers and gamers. Greg Canessa, President and COO at Sequence, echoed this sentiment, highlighting the platform’s mission to let game creators concentrate on innovation rather than the intricacies of blockchain infrastructure.

Grayscale’s ETF sees record Bitcoin outflows

Grayscale’s Bitcoin Trust experienced a historic outflow of $443.5 million in a single day, signaling potential concerns as the Bitcoin price continues to drop from recent highs. The United States spot Bitcoin ETFs collectively saw $326 million leave on March 19, marking the largest outflow for these funds to date. If the current rate of outflow persists, Grayscale could deplete its assets under management, which stood at over $23.7 billion, within four months.

While Grayscale faced significant outflows, BlackRock, Fidelity, and Bitwise’s ETFs reported net inflows, albeit modest in comparison to the broader market movement. BlackRock’s iShares Bitcoin Trust led with $75.2 million in inflows, followed by Fidelity’s Wise Origin Bitcoin Fund and Bitwise’s Bitcoin ETF. The outflows coincided with a Bitcoin price dip to $62,400 on March 19, compounding a week of declines after reaching a peak of $73,835 on March 14.

The trend of outflows, particularly from GBTC, raises questions about investor sentiment and the future of Bitcoin ETFs in the U.S. market. With the SEC’s stance on cryptocurrency ETFs remaining cautious, the industry watches closely as these financial products navigate a volatile market landscape.

Bitcoin slides below $62K ahead of anticipated halving event

Bitcoin’s price has dipped below $62,000, reinforcing the narrative of a pre-halving correction as the crypto community anticipates the upcoming halving event. Despite a nearly 15% drop from its recent peak, analysts, including Capriole Fund’s Charles Edwards, suggest that the months surrounding Bitcoin’s halving typically see high volatility but offer the best risk-reward period for investors in the following year.

Edwards predicts a shutdown of inefficient mining operations post-halving, which is expected between April 18 and 20, potentially affecting Bitcoin’s supply dynamics. Meanwhile, CryptoQuant CEO Ki Young Ju points to spot Bitcoin ETF flows as a significant market driver, noting that post-halving mining costs will necessitate higher Bitcoin prices for miner profitability.

The market sentiment is mixed, with some analysts like Rekt Capital suggesting further potential for a price drop to shake out weak hands before the market resumes its uptrend. Historical patterns show significant retracements before previous halvings, followed by eventual recoveries and bull runs. With the 2024 halving approaching, the impact of institutional investment through spot Bitcoin ETFs adds a new dimension to the market’s behavior, making this halving period distinct from past cycles.

Coinbase to Introduce Futures for DOGE, LTC, and BCH

Coinbase has revealed its intention to introduce futures trading for Dogecoin, alongside Litecoin and Bitcoin Cash, targeting an April 1st launch date. The exchange has submitted letters to the U.S. Commodity Futures Trading Commission indicating its plan to use the “self-certification” process, which allows them to list the futures contracts without waiting for formal approval, provided they comply with regulatory standards.

The decision to list Dogecoin futures is backed by Coinbase’s assessment that DOGE has outgrown its meme coin status, gaining sustained popularity and community support. This move positions Dogecoin as a significant player in the crypto market. At the time of the announcement, DOGE’s price saw a 17% increase, trading at $0.15.

Coinbase’s strategic move to list these futures contracts could be seen as an attempt to influence the SEC’s stance on crypto assets, particularly those based on proof-of-work consensus mechanisms similar to Bitcoin. In 2022, Coinbase expanded its offerings by acquiring FairX, a CFTC-regulated derivatives exchange, to provide crypto derivatives trading to its U.S. customers, aiming to make the derivatives market more accessible to retail investors.

simple vs exponential moving average (SMA vs EMA)

The 20-day Simple Moving Average (SMA) and the 20-day Exponential Moving Average (EMA) are key tools for traders. But what do they reveal about the market?

🔵 The 20-day SMA is depicted as a blue line, providing a broad view of market sentiment over a fixed period. It’s a sum of closing prices over 20 days, divided by 20.

🟣 The 20-day EMA, shown as a purple line, gives more weight to recent prices, making it more responsive to new information. It’s ideal for identifying the current momentum of a trend.

Both SMA and EMA are plotted directly on the price chart, serving as dynamic support and resistance levels that traders closely monitor.

📘 For a more rigorous analysis, though, the Moving Average Trendline can be added to smooth out price volatility and highlight the direction of the market trend. The Moving Average Ribbon consists of multiple MAs of varying lengths plotted together, creating a ‘ribbon’ that can signal trend changes and potential areas of support or resistance.

💡 Discover the nuances of these essential tools and how they can complement your trading strategy. Ready to learn more?

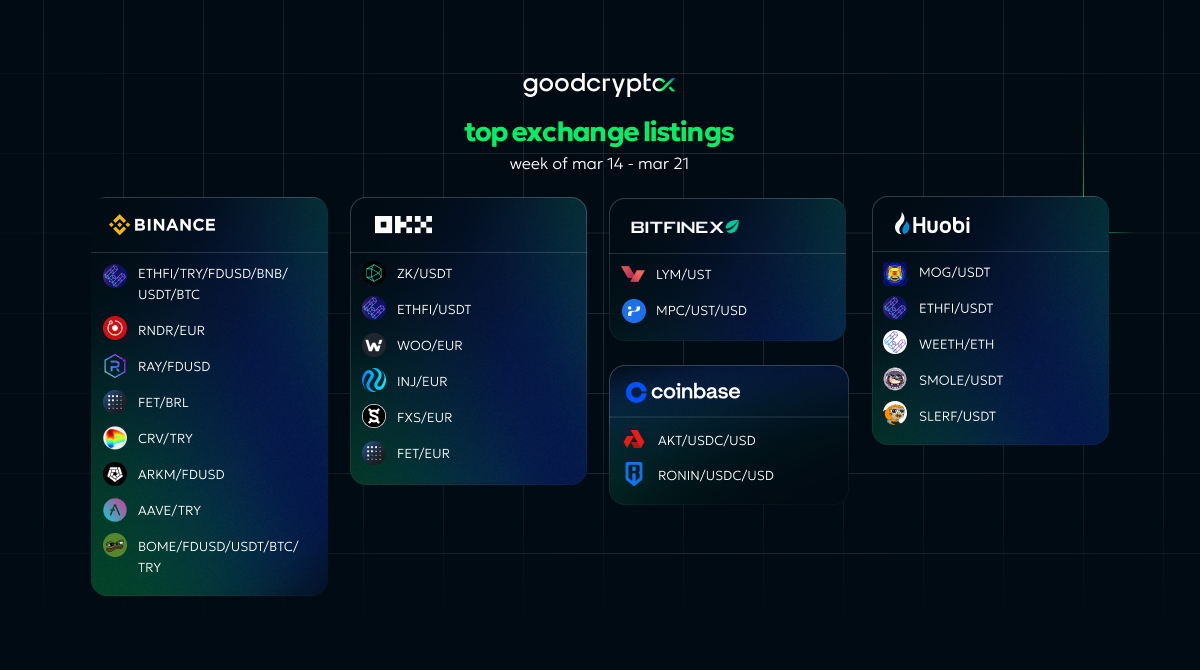

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!