Hey there! 👋

This week’s geopolitical clashes rattled the crypto market as headlines poured in. Let’s recap what happened over the past seven days:

quick weekly news

Trump retreats from Greenland tariffs

Let’s start with the biggest story of the week that had a major impact on the markets – the U.S.-EU dispute over Greenland. Donald Trump’s push to acquire Greenland has been ongoing for some time, but until this week, no concrete actions had been taken by the United States.

Tensions escalated late last week when Trump began repeatedly proposing a “purchase” of Greenland from Denmark, while U.S. officials reportedly considered financial incentives for Greenlandic citizens ranging from $10,000 to $100,000 per person. However, Denmark, supported by a coalition of several European countries, rejected the proposal.

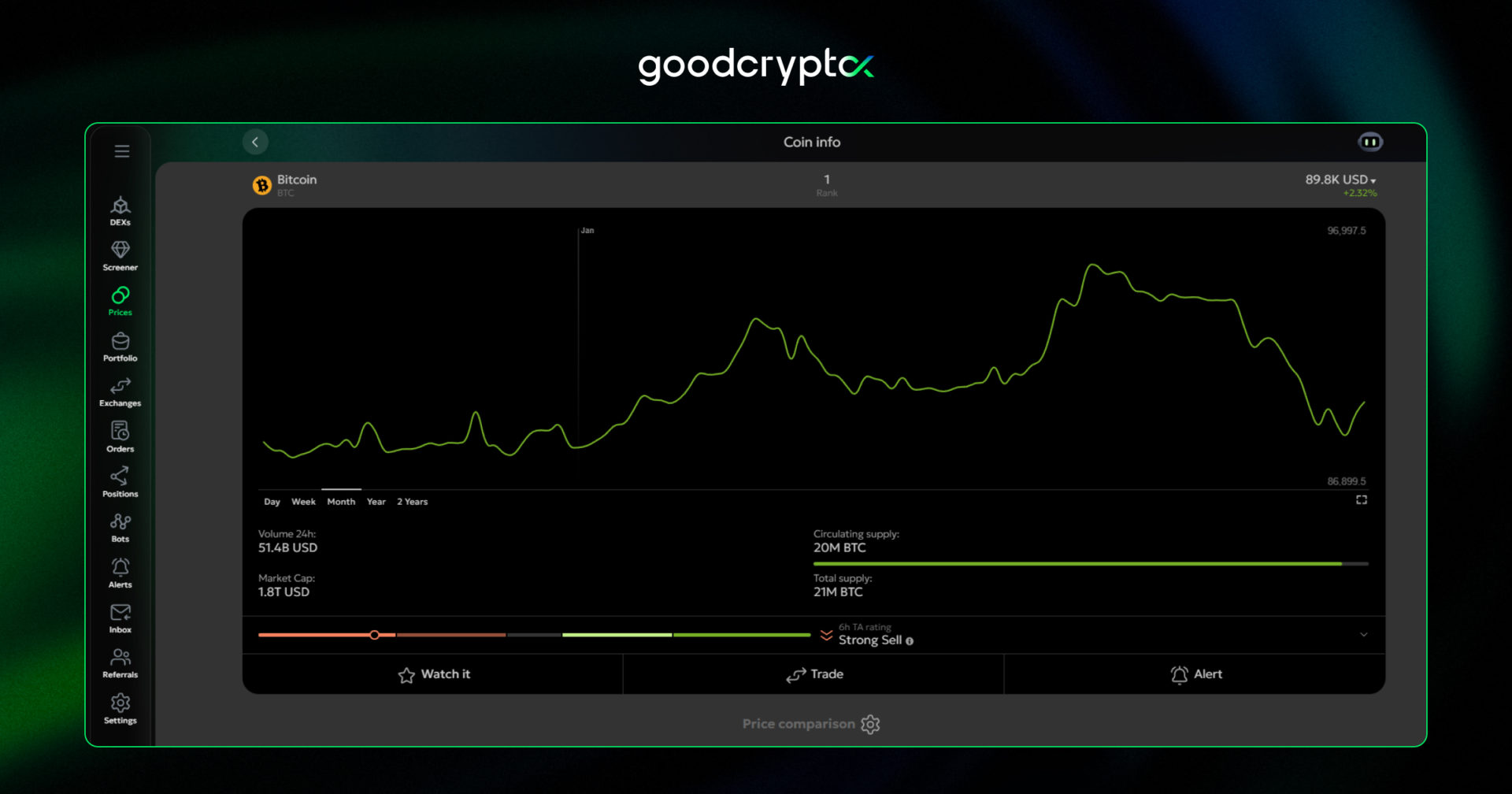

On Monday, Trump threatened to impose higher tariffs on key EU countries that opposed the Greenland deal following Denmark’s rejection. Bitcoin reacted with a sharp sell-off, approaching a monthly low near $87K.

Later, European leaders responded to Trump’s pressure by reaffirming their opposition to any sale of Greenland and instead announced a framework agreement to strengthen security measures on the island in cooperation with the U.S. and NATO allies. Shortly after, Trump said that he would suspend the tariff plans and was now exploring a diplomatic agreement on Greenland following talks with NATO. This reversal helped revive the crypto market during the week, despite it closing with a notable overall loss.

Crypto market steadies as Japan’s bond market chaos eases

Another headline that cooled crypto market FOMO was the rebound in Japan’s long-term government bonds. Japanese government bonds are a key factor in the global borrowing environment, where each price drop, leads to rise in interest rates, steadily pushing up global borrowing costs.

Rising global borrowing costs are generally a red flag for crypto, which is still considered a highly speculative and risky asset, often prompting investors to withdraw funds from such markets. However, this week, Japanese government bond yields stabilized as bond prices spiked.

Nevertheless, CoinDesk reports that the stabilization of Japanese bond prices “does not signal a return to risk-taking.” Still, it has provided some support to the crypto market, which was especially important amid rising political tensions this week.

The U.S. Bureau of Labor Statistics will release the Initial Jobless Claims and QoQ GDP growth reports

However, some of the key economic news is going to be released a little later this week, as we expect the Initial Jobless Claims and QoQ GDP growth reports.

Those two are key indicators suggesting the strength of the U.S economy which might be dounbted due to the multiple tariffs implied by Donald Trump in 2025 with inflation being key metric but not the only one influenced by the tariffs imposed. Usually, the market prices in the “forecasted” data from multiple platform, but in case of the data turns out to be weaker or stronger, this might push the market up or down.

According to Investing.com, Initial Jobless Claims are forecasted to rise by 11K, from 198K to 209K this week. Meanwhile, the platform expects QoQ GDP growth to reach 4.3%, up from 3.8% in Q2. This suggests that the market anticipates the U.S. economy strengthening despite tariff-related risks, even as the labor market shows slight signs of softening.

Delaware Life, BlackRock Offer Bitcoin Exposure Through Fixed Indexed Annuity

Delaware Life, a U.S.-based insurance company, has announced the inclusion of the BlackRock U.S. Equity Bitcoin Balanced Risk 12% Index as an option in its Fixed Index Annuity (FIA) portfolio.

FIA contracts provide clients with principal protection while offering the potential for limited upside growth. Clients make periodic payments to the insurance company and, in return, receive protection against market declines. Typically, gains are tied to an index, such as the S&P 500, without direct market exposure.

With this move, Delaware Life becomes the first company to offer an FIA option that includes crypto exposure, allowing clients to invest not only in traditional indexes like the S&P 500 but also in indexes that incorporate Bitcoin.

awesome oscillator (AO) trading strategies

📊 The Awesome Oscillator (AO) is a momentum indicator that measures shifts in market strength by comparing short-term and long-term momentum. It helps traders confirm trends, anticipate reversals, and filter out fake breakouts.

AO trading strategies:

- Zero Line Crossover: Spot buy and sell signals when the AO histogram crosses the zero line. When it moves from negative to positive, it signals a buy; when it crosses back below zero, it signals a sell.

- Scalping Strategy: AO works across all timeframes, including fast charts like 1-minute and 15-minute. Use it to trigger multiple short-term entries and exits, capturing momentum as it builds and fades.

📖 Want to trade momentum like a pro and spot reversals before they hit? Read the full Awesome Oscillator guide by goodcryptoX.

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!