Hey, fellow traders! 👋

This week has been a solid one for the crypto market, bringing some positive news and insights that could shape the future of the industry. Let’s explore the key highlights from the past seven days in this digest 👇

quick weekly news

U.S inflation rises less than expected

First off, let’s talk about the U.S. economy. We often return to this topic, as its performance, along with the country’s gradual shift toward embracing crypto, sets the tone for the broader crypto market.

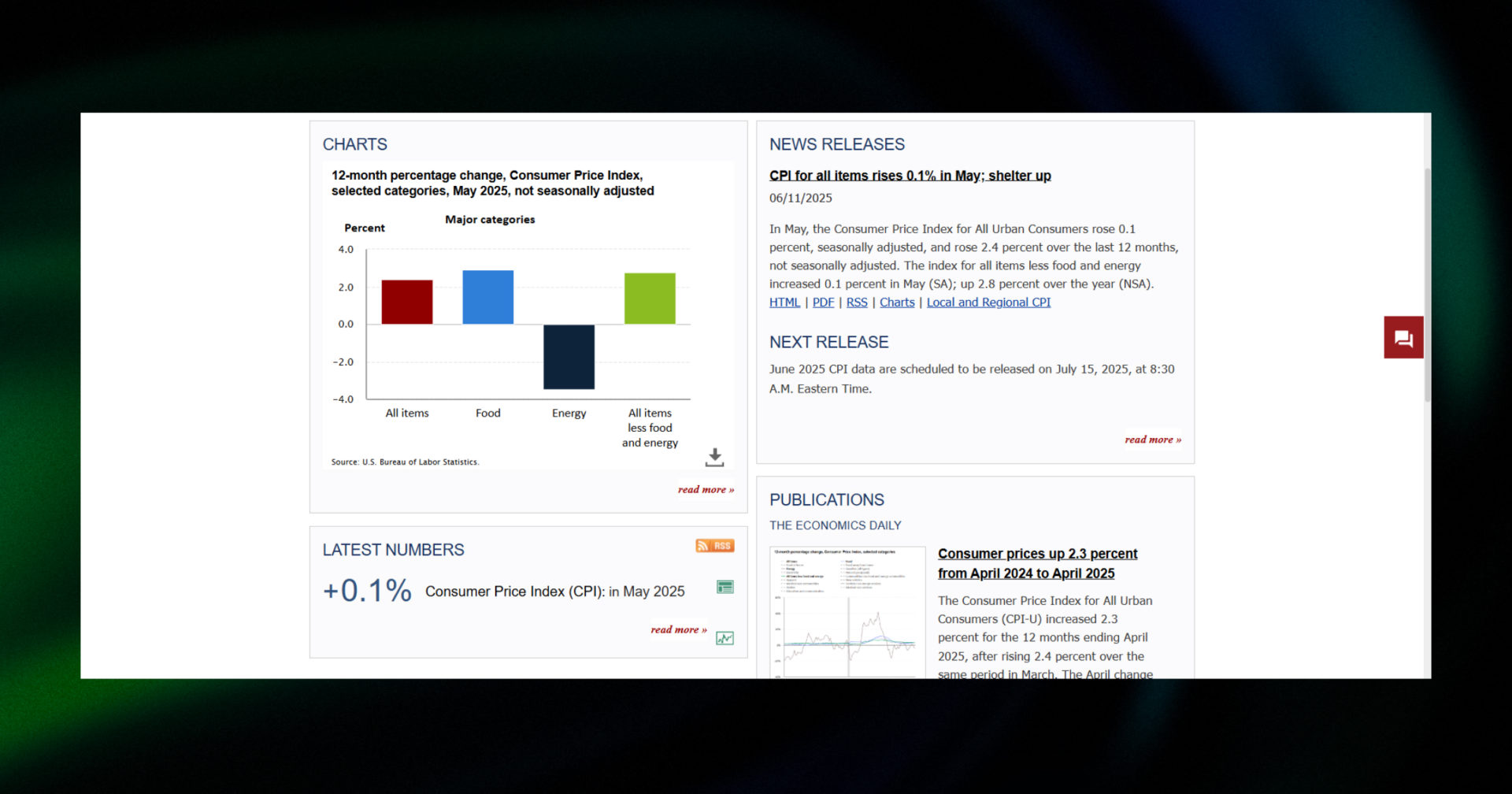

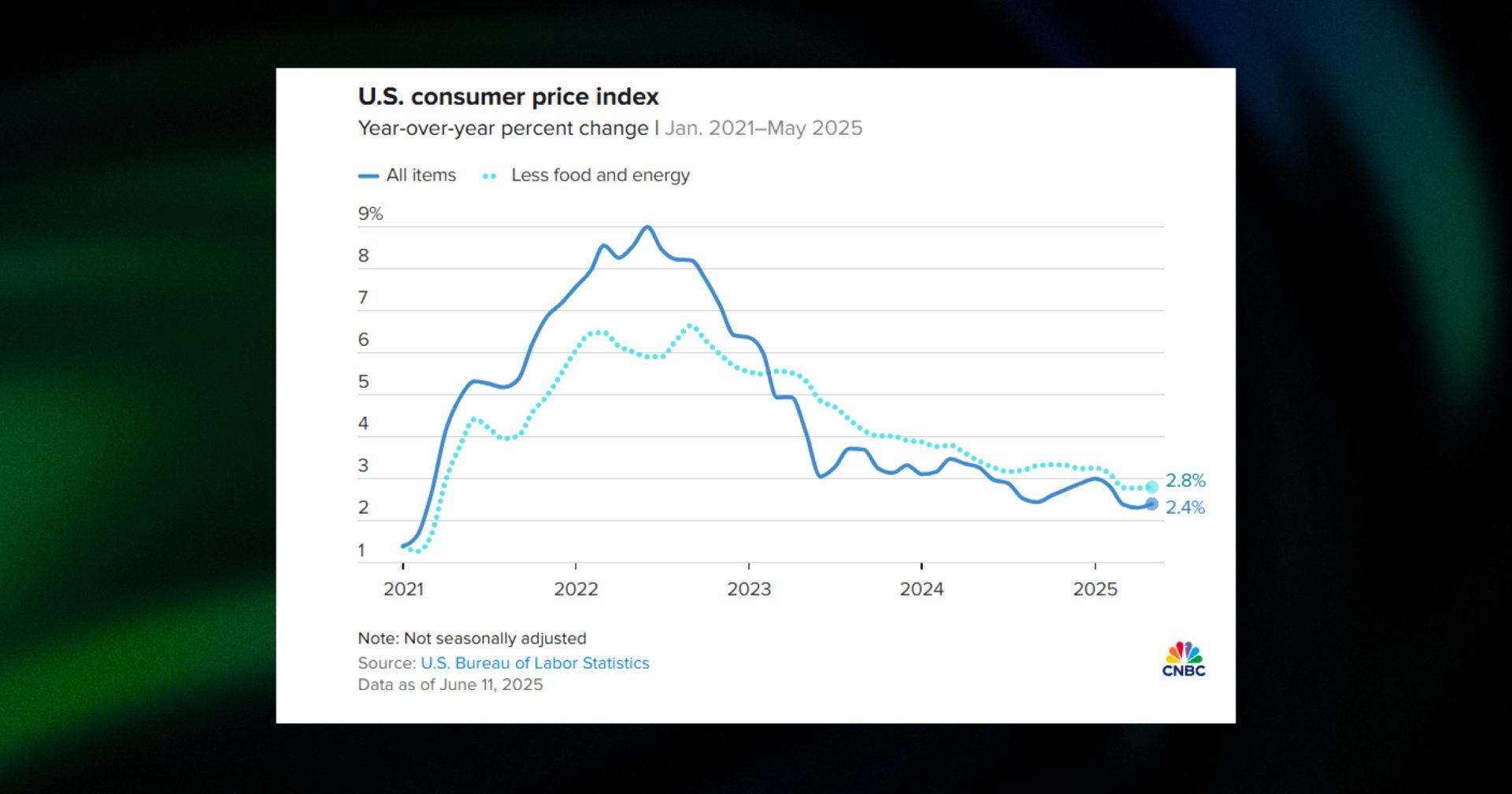

This week, the U.S. Bureau of Labor Statistics reported a 0.1% increase in the Consumer Price Index (CPI) for May, bringing the year-over-year rate to 2.8%. Despite this growth, the inflation numbers came in lower than expected, analysts had forecast a 0.3% monthly increase and 2.9% YoY inflation.

However, despite the positive surprise, Bitcoin didn’t react strongly. In fact, after an initial positive move, its price has slightly declined over the past 24 hours. But why?

One reason could lie in the specifics of what drove inflation lower. According to CNN, the main factor behind the slower-than-expected price growth was a drop in energy prices, which are down 3.5% this year.

Source: Bureau of Labor Statistics

At the same time, analysts had expected inflation to rise due to new U.S. tariffs, which are still likely to go into effect and may negatively influence future interest rate decisions. Ironically, the decline in energy prices was largely tied to global energy price trends, which were themselves influenced in part by these very tariffs.

So, even if the U.S. government eases or removes some tariffs, that could actually drive energy prices back up, leading to renewed inflationary growth.

Bitcoin spot supply vanishes

According to crypto media outlet CoinTelegraph, Bitcoin trading volume has dropped to the lowest levels of the current bull market cycle, while funding rates in perpetual swaps have turned negative. This is a surprising development for a token that is still trading near its ATH and may signal waning interest from retail investors.

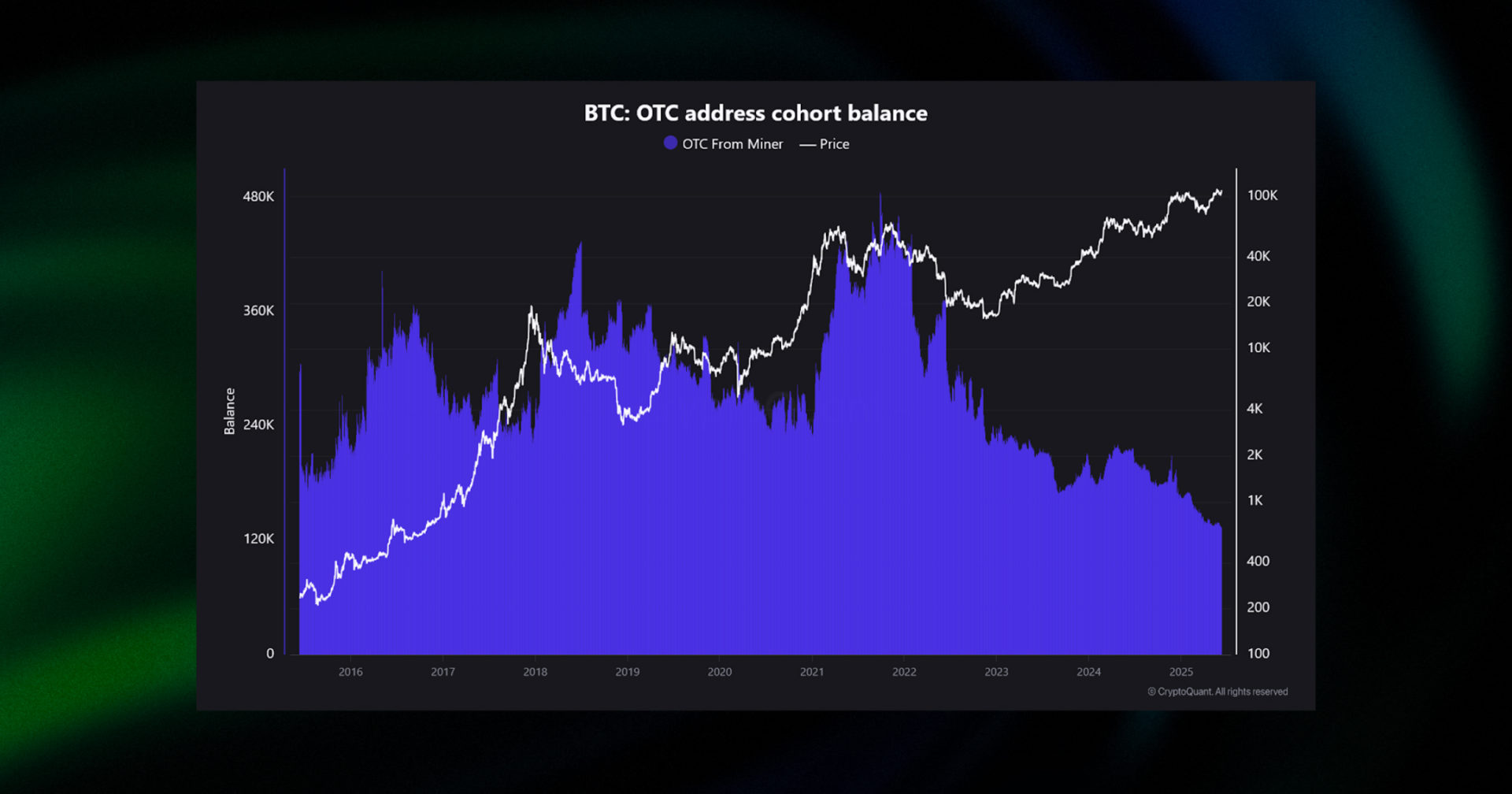

However, despite these negative retail metrics, key market players appear to be in a phase of “stealth accumulation,” steadily tightening the available supply of Bitcoin.

One of the traditional indicators of such activity is Bitcoin reserves held on exchanges, which are often the main custodians of the circulating supply. Currently, these reserves have dropped to levels last seen in August 2022. This trend typically suggests that investors are gaining confidence in Bitcoin’s long-term potential and are moving their assets into cold storage wallets, away from exchanges.

In addition to declining exchange reserves, Cointelegraph also highlights a decrease in Bitcoin balances among miners on OTC markets.

Taken together, these factors point to a shrinking supply of Bitcoin in the market, a dynamic that, according to basic market principles, could contribute to upward pressure on its price.

SEC eyes exemption framework to boost crypto innovation

A few days ago, Paul Atkins spoke at the SEC’s Crypto Task Force Roundtable on Decentralized Finance.

There, he emphasized that “the American values of economic liberty, private property rights, and innovation are in the DNA of DeFi,” highlighting that the movement is a key part of the current administration’s policy agenda.

Atkins also criticized the previous SEC leadership under Gary Gensler, stating that it discouraged American participation in blockchain innovation by imposing legal barriers. He called for renewed support for the blockchain industry and referenced Donald Trump’s vision of making the U.S. a global crypto capital.

As a step toward this goal, Atkins directed the SEC staff to explore an “innovation exemption” – a form of conditional exemptive relief that would allow both registrants and non-registrants to bring on-chain products to the U.S. market.

The reasoning behind this move lies in the outdated nature of the current U.S. securities regulatory framework, which was designed to regulate issuers and intermediaries like broker-dealers, advisers, exchanges, and clearing agencies. As Atkins pointed out, “The drafters of these rules and regulations likely did not contemplate that self-executing software code might displace such issuers and intermediaries.”

crypto asset reserve bill lands in Ukraine’s parliament

This week, the U.S. wasn’t the only country making strides in crypto adoption – Ukraine also took a significant step forward.

On Tuesday, a Ukrainian parliamentarian submitted a new crypto bill to the Verkhovna Rada, proposing to allow the National Bank of Ukraine (NBU) to hold cryptocurrencies like Bitcoin as part of its reserves.

According to Yaroslav Zhelezniak, one of the bill’s initiators, Bill №13356 does not mandate the NBU to acquire cryptocurrencies, but it gives the institution the flexibility and legal authority to do so. The decision on when, how much, and which cryptocurrencies to acquire would remain entirely at the discretion of the National Bank.

Zhelezniak added that the bill aims to integrate Ukraine into global financial innovations, strengthen the country’s macroeconomic stability, and unlock new opportunities for the growth of its digital economy.

awesome oscillator (AO) explained

📊 The Awesome Oscillator (AO) is a momentum indicator that reveals shifts in market strength by comparing short-term to long-term momentum. It helps you confirm trends, front-run reversals, and filter out fake moves.

How to read AO:

🔸 Zero Line Cross: AO crossing above zero signals bullish momentum, while crossing below zero indicates bearish momentum;

🔸 Bar Color Change: Green bars mean momentum is increasing, while red bars signal that it’s weakening, indicating early clues for trend shifts;

🔸 Twin Peaks: Two consecutive peaks or troughs, where the second is higher (bullish) or lower (bearish), suggest a possible reversal.

📖 Want to trade momentum like a pro and spot reversals before they hit? Read the full Awesome Oscillator guide by GoodCrypto.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!