Hey fam!

The crypto market had a bit of everything this week: some losses, some wins, and plenty to talk about. Let’s unpack the biggest headlines in this digest:

quick weekly news

US shutdown ends, crypto progress resumes as Trump signs bill

We’re kicking off this digest with one of the most anticipated events of the week – the end of the record 43-day U.S. government shutdown with $619B+ borrowed. President Donald Trump signed a bipartisan funding bill passed by both chambers of Congress, signaling the full reopening of federal operations. The bill restores federal operations until January 30, giving lawmakers additional time to negotiate a broader, long-term budget plan.

The reopening of the government is particularly important for the crypto sector, as it allows key federal agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to resume operations. The SEC has been reviewing several spot Bitcoin, Ethereum, and Solana ETF applications, while the CFTC prepares for the November 19 confirmation hearing of Mike Selig, Trump’s top pick to lead the agency. Meanwhile, the Treasury Department can now move forward with its review of public comments on the GENIUS Act, a legislative proposal focused on stablecoin regulation.

Despite the positive implications for policy and regulation, the crypto market reacted with little enthusiasm. Bitcoin and major altcoins remained largely flat, suggesting that investors may still be cautious amid broader macroeconomic uncertainty. Historically, previous government reopenings have triggered stronger market rebounds, but for now, the focus remains on whether renewed federal activity will accelerate long-awaited regulatory clarity for the crypto industry.

SEC chair pledges no ‘lax enforcement’ on crypto under market structure

Despite the end of the shutdown, the crypto market can’t “relax” completely, as SEC Chair Paul Atkins outlined how the agency plans to regulate digital assets under the pending market structure bill. Speaking at the Federal Reserve Bank of Philadelphia, Atkins emphasized that the SEC’s “Project Crypto” initiative aims to modernize oversight by creating a clear token taxonomy anchored in the Howey test.

Atkins noted that while some tokens may initially qualify as investment contracts, they shouldn’t remain classified as securities forever once their projects mature. He also suggested that certain crypto assets, such as digital commodities, collectibles, and network tokens, would fall outside SEC jurisdiction, leaving only “tokenized securities” under its direct oversight.

With the end of the shutdown, the market structure bill continues to advance through Congress, with Senate committees refining its language. Atkins stressed that this legislative progress does not mean looser regulation, saying, “Fraud is fraud,” reaffirming the SEC’s commitment to investor protection while supporting clearer, more tailored rules for the digital asset industry.

Bybit finds 16 blockchains with the power to freeze user funds

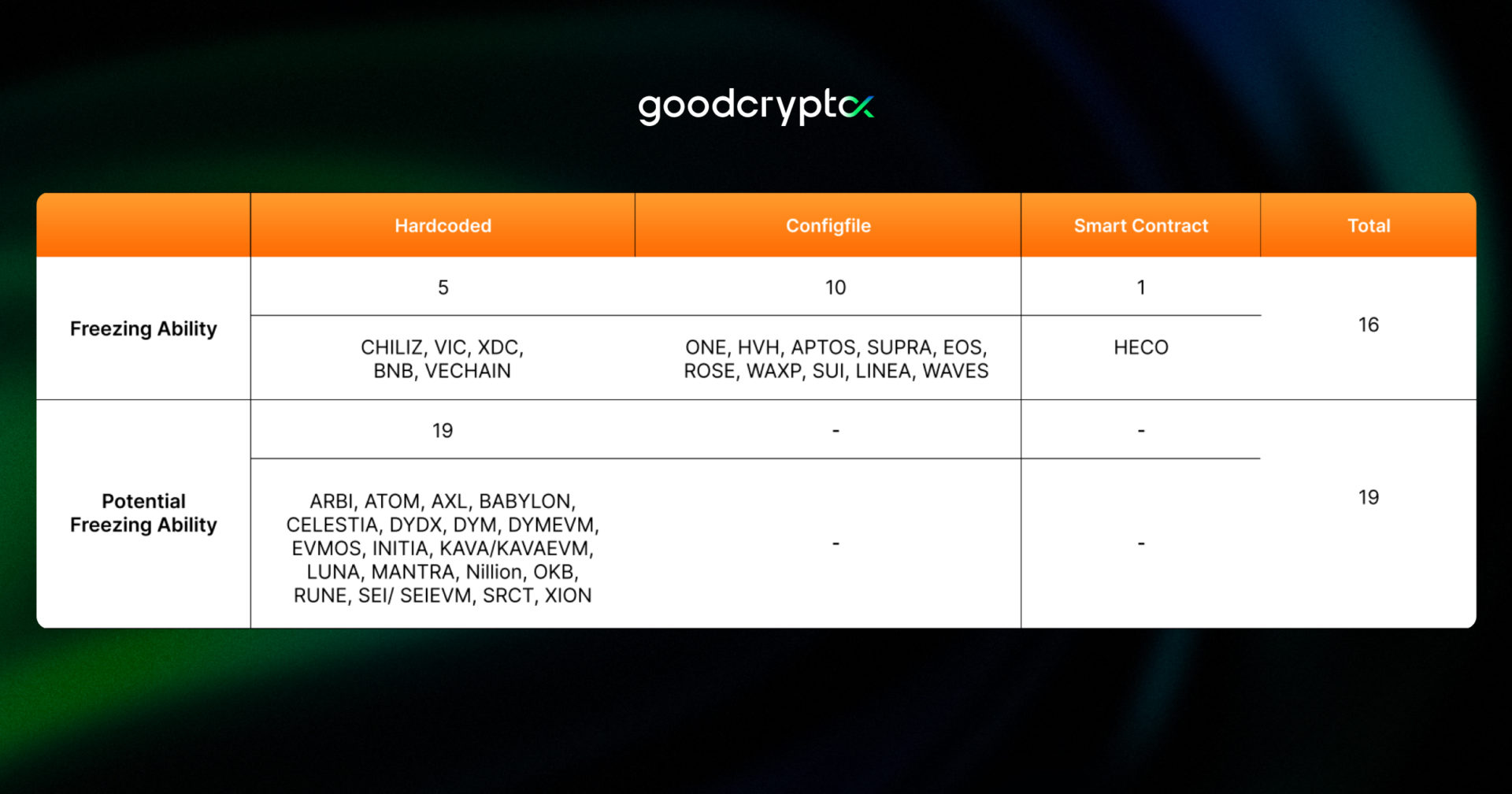

Another hot news item this week came from Bybit Lab. Bybit’s Lazarus Security Lab has revealed that 16 out of 166 blockchains analyzed have built-in capabilities to freeze or restrict user funds, raising fresh questions about decentralization in supposedly trustless networks.

Source: Lazarus Security Lab Report

The study used AI-driven analysis combined with manual review to uncover the underlying mechanisms, showing that emergency controls are more common than many users realize.

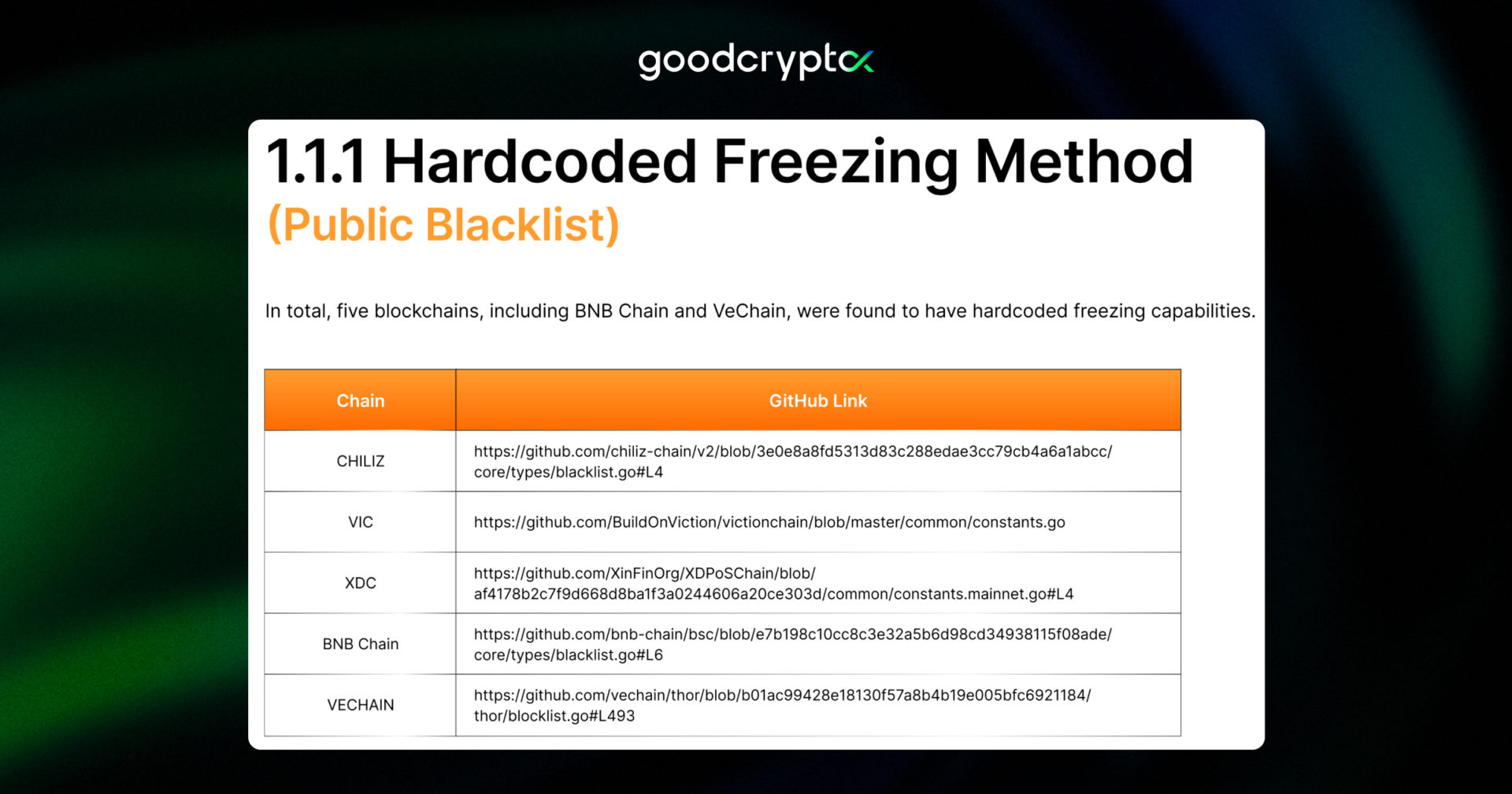

The report identified three main ways funds can be frozen: hardcoded blacklists embedded in the blockchain code, configuration files controlled by validators or core developers, and on-chain smart contracts. Notably, BNB Chain, VeChain, Chiliz, Viction, and XDC Network have freezing functions hardcoded directly into their source code, while Aptos, Eos, and Sui rely on validator-controlled settings.

Source: Lazarus Security Lab Report

Heco Chain stands out as the only network using a smart contract to manage freezes.

Beyond these 16 networks, the researchers highlighted 19 other blockchains, particularly in the Cosmos ecosystem, that could introduce freezing mechanisms with minimal protocol changes. While such tools can protect against hacks or theft, Bybit’s team warns they also blur the line between security and centralization, leaving the broader crypto community to question how truly decentralized these blockchains are.

Turbo Energy to pilot tokenized financing for renewable energy projects on Stellar

The final news of the week comes from Spain. Turbo Energy, a global provider of AI-optimized solar energy storage technologies and solutions, is piloting tokenized financing for hybrid renewable energy projects, starting with a solar and battery installation at a supermarket in Spain. The project, in collaboration with Taurus and the Stellar Development Foundation, will use blockchain-based debt instruments to improve liquidity and broaden investor access to clean-energy funding.

The initiative will tokenize Power Purchase Agreements through Turbo Energy’s SUNBOX solar storage systems, creating a scalable framework for commercial and industrial solar financing. Taurus will manage the renewable-energy tokens on Stellar, enabling fractional, on-chain participation and making green energy projects more accessible to investors.

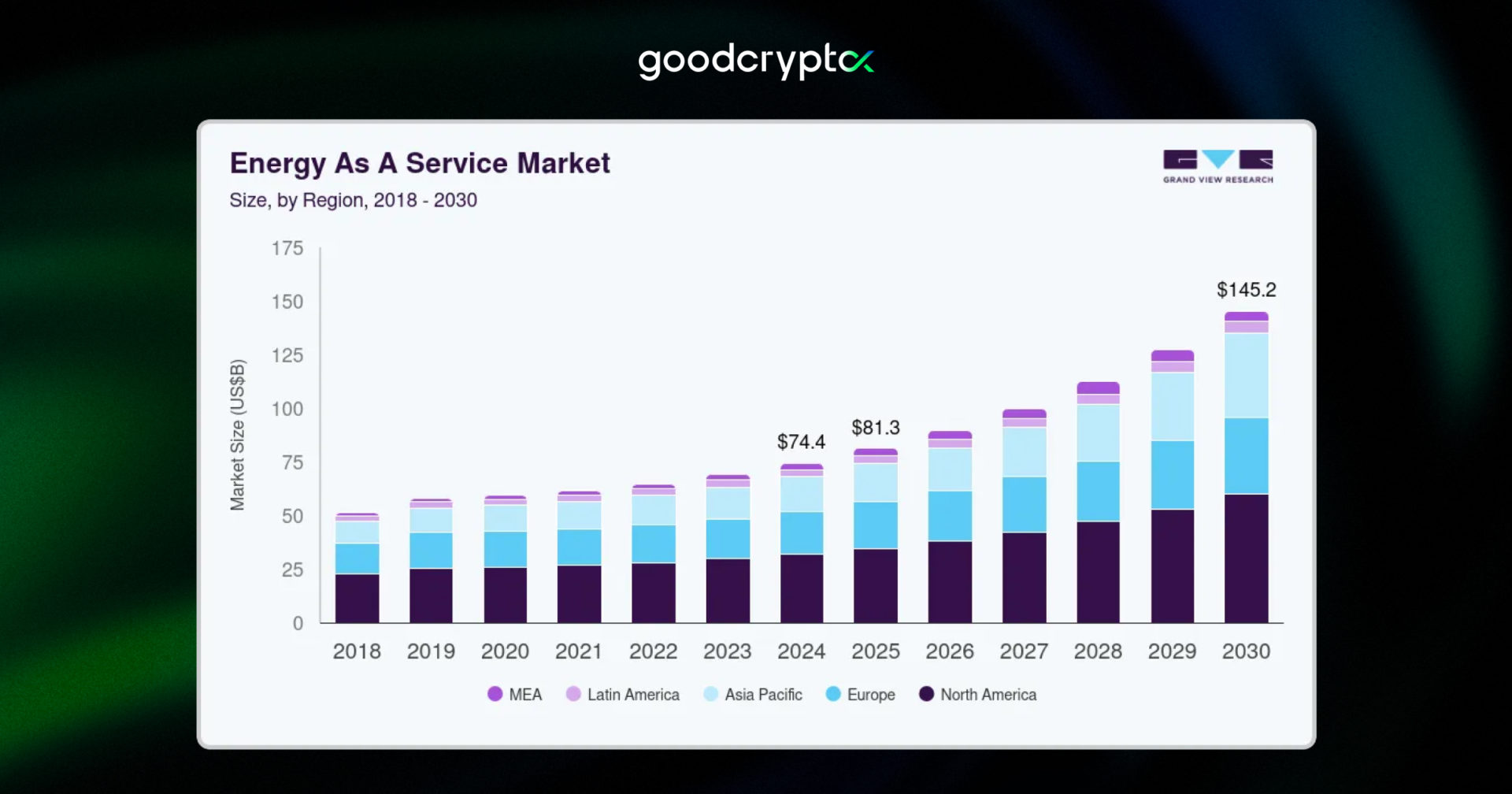

This pilot reflects the growing trend of combining blockchain with eco-friendly solutions, following examples like Enel’s tokenized solar farms on Algorand and Brazilian and UK companies integrating renewable energy with crypto operations. The global Energy-as-a-Service market, valued at $74.43B in 2024, is expected to more than double by 2030, highlighting the potential for blockchain-based financing in clean energy.

Source: Grand View Research Energy As A Service Market Report

how to trade with trend lines?

📈 A trend line connects swing highs and lows, helping visualize market direction and highlight important price zones. It serves as a key trading tool to identify dynamic support and resistance levels, spot potential reversals, and confirm breakout setups across any timeframe.

How to draw a trend line:

🔸 Connect at least two swing highs or lows, with more touches increasing its validity;

🔸 Base your lines on closed candles rather than wicks for accuracy;

🔸 Ensure the trend line doesn’t cross through candle bodies to keep it reliable.

Want to master drawing and trading with trend lines? Dive into our complete Trend Line trading guide and discover pro tips, examples, and strategies.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!