Liquidity is a topic that always pops up but it’s not often explained clearly. We’re certain that every crypto enthusiast has heard about Bitcoin liquidity and market liquidity. The question is, how to calculate liquidity and how to find the most liquid exchange? Good Crypto provides you with the perfect tool: a Liquidity Checker!

Let’s explore the topic, but first things first.

- 1.What is liquidity in trading?

- 2. Cryptocurrency liquidity as an indicator of confidence

- 3. What influences Bitcoin liquidity?

- 4. The most liquid exchanges all on Good Crypto

- 5. Other benefits Good Crypto can bring you

What is liquidity in trading?

The liquidity definition

Liquidity refers to how easily an asset can be bought or sold at a stable price on a specific market. If you can sell or buy an asset and at any time and in any quantity without influencing market price the market is considered liquid. The more price changes when buying or selling a lot, the less liquid the market is considered to be.

What does liquidity mean for crypto traders?

The liquidity of a cryptocurrency is determined by several factors – from its popularity to real-world use cases of the traded asset. To better understand the concept of liquidity and liquidity meaning, it’s crucial to introduce the order book of a certain market. The order book is the list of buyers and sellers’ Limit orders, which make or create liquidity on the market. When someone needs to buy or sell the crypto asset immediately, they create a Market order, which executes against the available orders in the order book – takes liquidity.

To conclude, the liquidity definition: in finance, it relates to how “liquid” value is. How easily can you convert any asset or investment into fiat currency?

By now you should be able to define liquidity: liquidity refers to the volume in the order book of a market. But let’s dive into an example.

Cryptocurrency liquidity as an indicator of confidence

Real-time liquidity can be explored with the Liquidity Checker by Good Crypto.

The liquidity of cryptocurrencies is undoubtedly an important parameter that you should pay attention to when devising your trading strategy. The bigger you are willing to create a position, the more important the liquidity of the asset.

A liquid crypto market can be entered or left without influencing the price too much.

Think about buying $10,000 worth of a TOP-500 altcoin, while its daily trading volume is $20,000. In the best case, if you don’t want to push the price up and incur huge slippage, you’d have to accumulate your position over a week or even a few weeks. Illiquid assets often become subjects of speculations, and pump and dump schemes. It is easier for pumpers to influence the price of an illiquid asset by buying or selling a large chunk of the daily volume of this asset. If the asset has low crypto liquidity, this “large chunk” of daily volume would cost the buyers less money and still create a significant increase in value.

Crypto market liquidity, an example

What is a liquid market? We will explore an example of a highly liquid market and one with low liquidity. Someone plans to Buy or Sell 1 BTC having an appropriate amount of USDT or BTC on balance. Let’s take a look at how to do this.

At the time of writing, BTC is worth about $60,400.

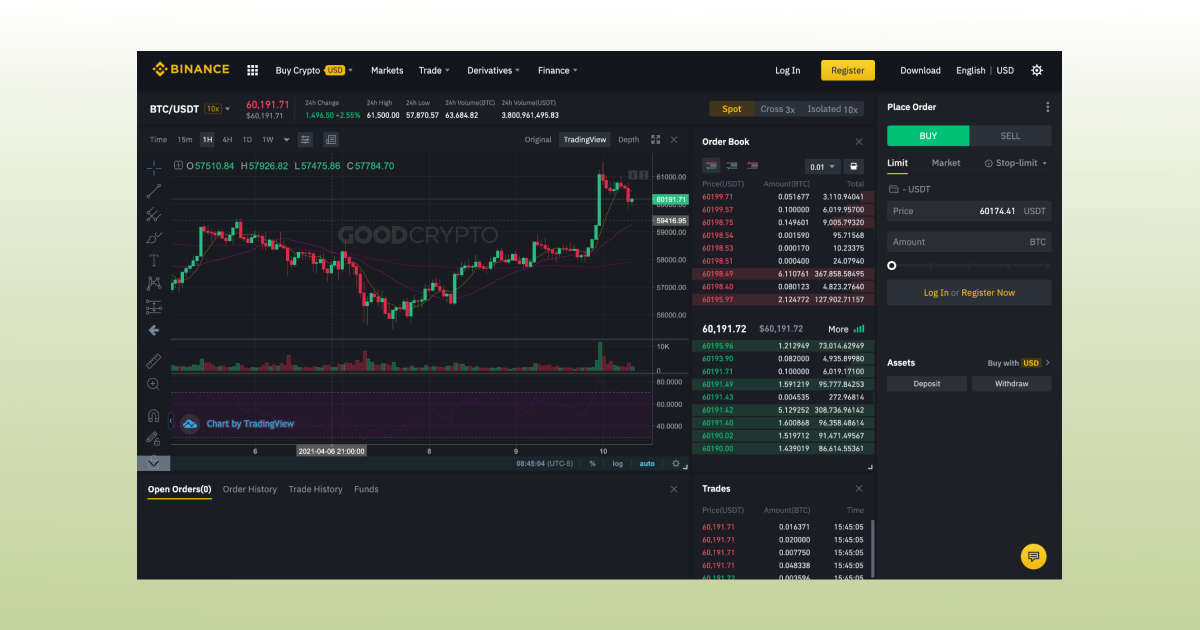

First, let’s look at the BTC/USDT pair on the Binance exchange.

In the right section of the trading interface, you can see the above-mentioned order book and the last price at which BTC was bought or sold. From the order book, we can see that the lowest price at which someone is ready to Sell BTC is $60,195.97 and there is 2.1244772 BTC available at this price.

If someone submits a Market Buy order at the moment of the screenshot, its order will be matched against that offer and the last price of BTC/USDT would become $60,195.97. We can see from the other side of the order book that the highest price at which someone is willing to Buy BTC is $60,195.96. In this case, the liquidity on Binance for BTC/USDT is good, since both the buy as the sell side have a decent volume of orders available.

Let’s take a look at an alternative exchange.

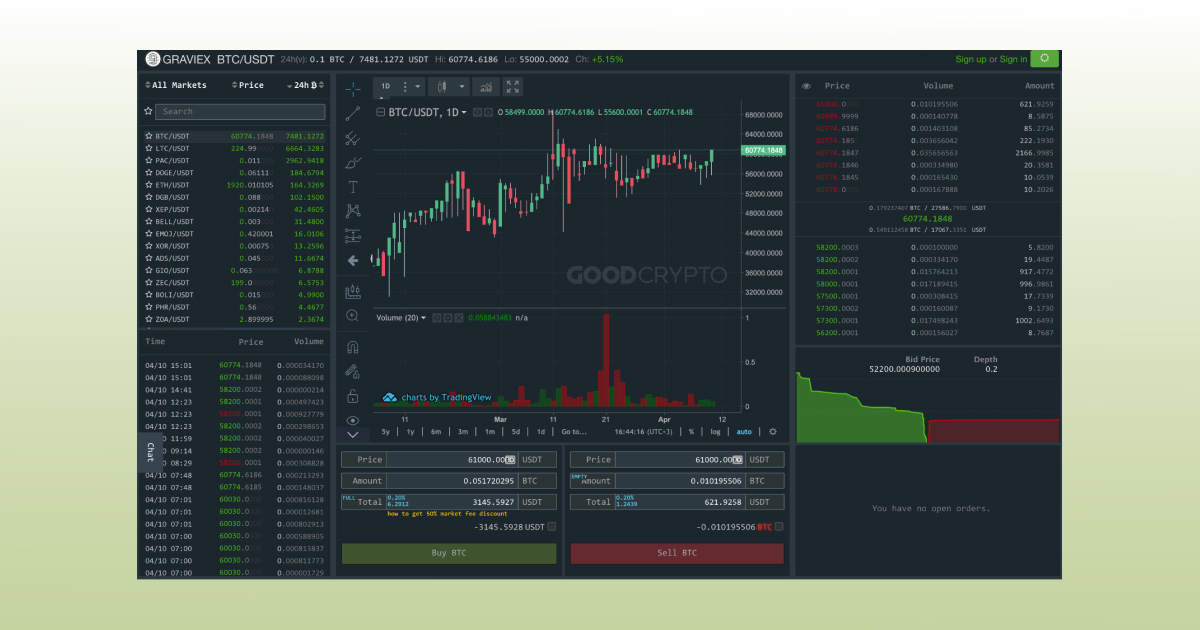

In this example, the lowest selling price is $60,770.00 and the highest bid is 58,200.00.

This shows the first issue of a low liquidity market, the spread.

Spread means the difference between the lowest selling price and the highest buying price. In this case, it’s a difference of 4.3%, which is huge. The Binance market on the other hand only had a spread of $0.01 which presents near 0%.

The biggest issue is when performing a buy. Let’s suppose that you want to buy 0.05 BTC. On Binance, you will simply grab a small part of the order available at the top level of the order book at $60,195.97.

However, on the alternative exchange your order will create slippage.

Price slippage represents a loss for the trader due to low liquidity on the Buy or Sell side of the order book.

Market buying 0.05 BTC on the alternative exchange would move the price to $61,000.00, which means the slippage from $60,770.00 to $61,000.00 represents 0.37%.

For this reason, it’s not recommended to use exchanges with low liquidity. The impact of your orders will obviously increase by the size of your buy or sell. Which means that the larger the quantity you want to trade with is, the more important it is to use a liquid exchange.

Moving the Bitcoin market price by $230 with an order of only 0.05 BTC is problematic and is a clear sign of an illiquid exchange – the one you should generally steer clear from.

Globally, the Bitcoin market is the most liquid market in crypto. With trading volumes up to 10x higher compared to its alternatives in the cryptocurrency environment. This is one of the reasons why big buyers and traders enjoy speculating on Bitcoin, besides the fundamental differences with its alternative cryptocurrencies.

How can you find a liquid exchange? Good Crypto has created the Liquidity Checker, let’s continue and look into why this tool can change your experience with cryptocurrencies.

How to detect a liquid exchange

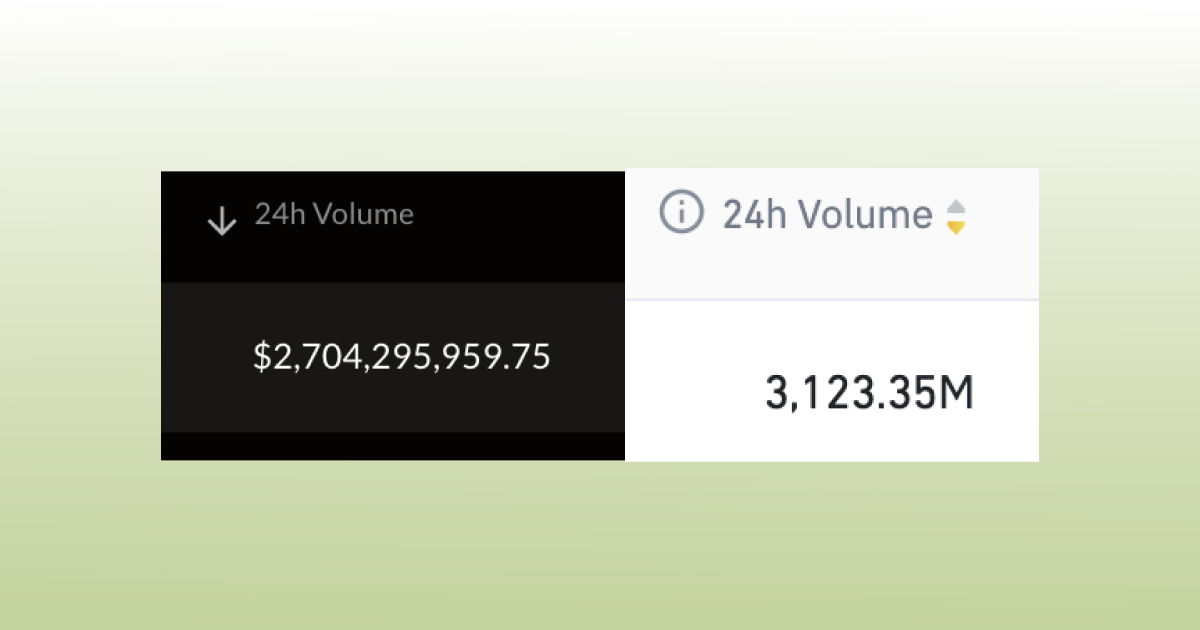

Exchanges always show their volume, expressed as the last 24H volume of that market. Sometimes this is shown in the base currency you trade withase, for example, in Bitcoins for BTC/USD pair, and sometimes it is shown in the quoted currency it is traded with, for example, USD. High numbers of volume don’t necessarily indicate how full the books are, especially at the top levels, however, you can be certain that the higher the volume is, the more buyers and sellers there are on that specific market.

On the left the amount of USD volume on FTX, on the right the volume of Binance. Both represent the Bitcoin liquidity traded with USD on their platform.

Important to note: A liquid exchange not only has a small spread (the difference between the price offered by the highest buyer and the lowest seller) which should be < 0.15%, but it also has a decent volume in the orders which are closest to the current market price. Point being, spread is usually closed by bots that create orders to fill up the books, but the most important is the size of these orders. On come exchanges you can see a very small spread but the order sizes at the top of the order book are miniscule. That’s not real liquidity but the ‘ghost’ liquidity.

Current crypto market liquidity

One notable thing about crypto markets and industry, in general, is that despite the speculative spikes, one could see a slow but steady adoption. This is reflected not only in the real-world use cases, a growing number of wallets, and on-chain transactions but also in the growing liquidity of the crypto market in general. It can be seen when looking at the crypto trading volume on major exchanges: in 2021 volumes were much higher than in 2017 or 2018 when BTC was all over the news with an all-time high price of $18,000 – $20,000.

Though undeniably growing in general, crypto liquidity is shifting. Some of these shifts represent secular trends such as growing liquidity of derivative and margin exchanges vs the spot exchanges, and some are cyclical, such as periodic shifts from BTC to altcoins (altseason) and back, or the evergreen ‘flippening’ of BTC and ETH.

What influences Bitcoin liquidity?

Especially when it comes to altcoins, liquidity is often hard to find. Some altcoins are very young, have few exchanges trading their token or coin, or they are simply not popular enough. Let’s list the different elements that play together into creating liquidity.

Popularity

The stronger the crypto community scales, the more liquid major crypto assets are. This fact is undeniable and the proof is the performance of Bitcoin in 2017, when it rapidly gained in price, volume, social media mentions, and Google trends. In the very same way, we see 2021 has an increase of value that corresponds with the increase of popularity,

However, if the cryptocurrency is new and a great number of crypto traders haven’t heard about it, it will lack volume. The asset would be considered of low liquidity ot illiquid, which has the downside of creating strong moves in either direction when a big buyer or seller enters or leaves the market.

At the same time, the asset has every chance to change its position, drawing attention to it with marketing activities, constant development, and a solid team behind the project. This will in turn attract speculators that place their orders in the books, which will create a more liquid market and eventually attract short-term traders that create even more volume.

The more popular a market becomes, the more participation it will trigger, the more liquid it becomes, and the healthier it looks.

Exchange listings

When popularity rises, an asset usually lists on more exchanges. This will inevitably increase the exposure of the asset and raise awareness about the project, as well as attract traders.

Though, in general, new cryptocurrencies are characterized by low liquidity due to their absence from major exchanges. The size and popularity of the exchange are very important. It’s for this reason that many speculators enjoy trading the listing of new assets on for example Coinbase Pro, Binance, or other major platforms.

One last note, exchanges don’t always provide liquidity. This often creates markets with very poor volume, no matter how popular an asset or project is. You can find the most liquid exchanges through our Liquidity Checker.

Market making

Market making is very frowned upon by traders that lack understanding of what it’s supposed to do. Often market making is understood as market manipulation, but this is not entirely true.

The cryptocurrency markets are still unregulated, and therefore it’s easy for market makers to influence the market in their favor.

However, market makers are vital for a healthy market. The main purpose of a market maker is to provide enough Buy and Sell orders in the books, so big traders can enter or exit a position immediately without moving the market too much. In other words, market makers help buyers and sellers find each other on a particular market at different times.

Market makers:

– Reduce slippage (the movement a market makes when a big order is bought or sold)

– Reduce the spread (the difference between the highest buy order and lowest sell order)

– Increase volumes, which creates a healthier market and attracts traders

Use cases outside the crypto industry

A holy grail of every crypto project is wide user adoption. Real adoption is achieved only by a few of the coins on the market. Apart from BTC being “digital gold” and store of value, Ethereum managed to get real usage back in 2017, when the boom of Smart Contracts and ICOs occurred and established itself as an undeniable force in 2020 with the proliferation of DeFi platforms built on it. ETH is the biggest platform for fundraising money, never before has the world seen such big amounts of value stream into ideas and startups.

Binance Smart Chain is also gaining a lot of traction with DeFi. BSC ‘evolved’ from Binance Coin, which became a lottery ticket to the IEO hype of 2019 and for the NFT boom today. Though, both of these cases still weren’t a “wide adoption outside of the crypto industry” – more like wide adoption inside of it. True adoption is considered to be achieved when regular people without understanding or knowledge of cryptocurrencies are making use of a service or product which has the underlying technology of cryptocurrencies, for example, blockchain.

All of the above points are not only applicable to altcoins but also to Bitcoin. The more widespread the network and currency becomes, the more liquid BTC markets will be. The liquidity of Bitcoin is mostly influenced by its popularity, which is greatly influenced by the media. The most traded pair of BTC is the BTC/USDT market, with high amounts of USDT liquidity.

The most liquid exchanges all on Good Crypto

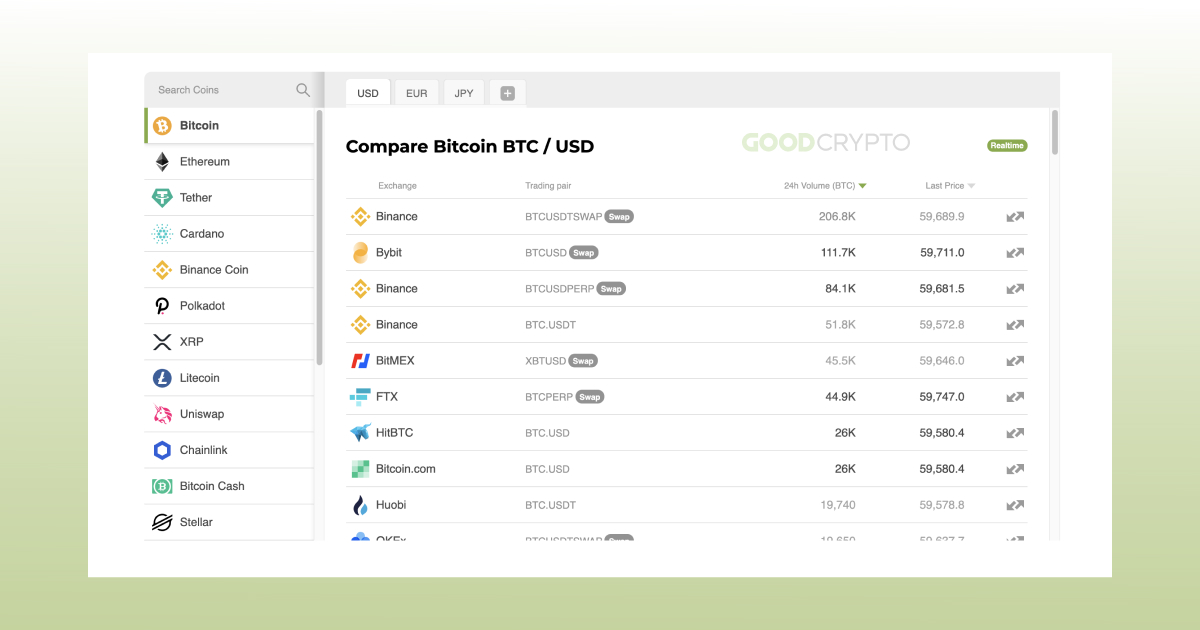

Now that there is a clear understanding of liquidity, and the importance of high liquidity is shown, we can explore the Good Crypto Liquidity Checker. Through the checker, you can find your most preferred liquid coin exchange.

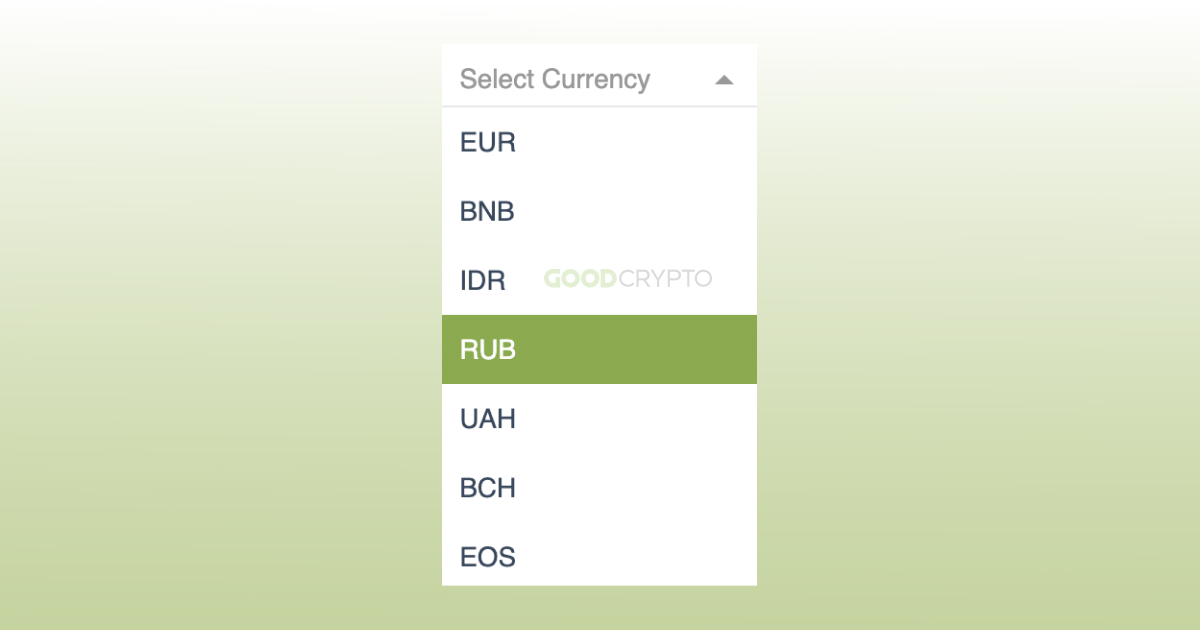

Clicking a different fiat currency like EUR or JPY will give an appropriate list of markets for your preferred traditional currency. You can add different currencies by clicking the + button, as shown in the screenshot on the left. USD or USDT liquidity is the highest overall.

On the left side of the Liquidity Checker page, you can discover alternative cryptocurrency markets.

As a reminder, a liquid BTC exchange shows the market is healthy. A high liquidity exchange is the most ideal to make use of.

In regards to altcoins, low liquidity crypto will be harder to enter or exit without slippage.

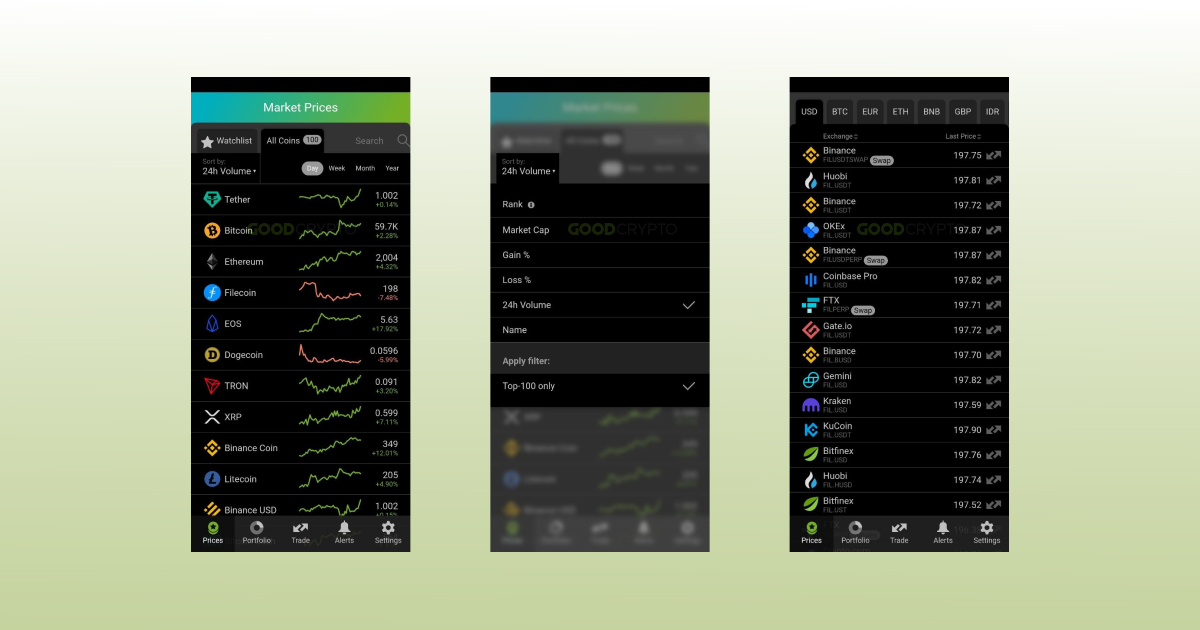

When it comes to the Good Crypto mobile app, you can rank the most liquid markets from high to low. Once you have selected a market you would like to trade, for example, Filecoin or FIL in the third screenshot above, you can discover a list of exchanges that offer the asset.

Other benefits Good Crypto can bring you

The advantages you get by using Good Crypto are significant.

- A portfolio tracker that can connect with over 30 exchanges and blockchain wallets.

- Trading with advanced order types that never freeze your balance for all these exchanges. Order types include Stop Market, Stop Limit, Trailing Stop, Trailing Stop Limit, auto Take Profit, auto Stop Loss, Trailing Take Profit, Concurrent Take Profit, and Stop Loss.

- Alerts for order fills.

- Alerts for significant price changes, price alerts you customize to your desires, alerts for DeFi market movements, transaction deposits, and general market overview reports or portfolio summaries.

- Professional charting tools by TradingView.

- A market overview that provides the possibility to discover assets by trading volumes, price increase, and much more.

To conclude

Cryptocurrency markets are becoming more and more popular, attracting more speculators and traders with it. This growth will create a healthier environment that avoids slippage made by big traders. However, small markets will always exist, and new cryptocurrency markets will keep being created. After reading this article, hopefully, you are aware of what high or low liquidity exactly is, and how it affects your trading.

Good Crypto is dedicated to creating professional tools to help both amateur and advanced traders to make profits with cryptocurrencies. The Liquidity Checker is one of these tools.

Download the free application to find more advanced trading tools, discover markets and projects, receive price alerts, charts with indicators, a beautiful portfolio overview, and much more.

Good Crypto is available free both for iOS and for Android.