Hello there! 👋

This week we have witnessed some important news and events that occurred in the industry that shift the cryptocurrency market. Let’s recall the most outstanding ones together in our weekly digest. If you would like to receive more updates on the crypto market, follow us on Twitter.

quick weekly news

BTC’s bullish momentum returns: analysts forecast $200K+ Bitcoin price

The pseudonymous crypto analyst on Twitter, Cryptonary, stated that Bitcoin could reach a $220,000 price after reclaiming major support levels during this market recovery phase. This prognosis is based on the Bitcoin’s historical returns after the end of Bitcoin Miner Capitulation periods.

According to the chart shared in his recent Twitter post, during the 2012, 2016 and 2020 bull market cycles, Bitcoin’s price has experienced significant gains of 5,110%, 3,346%, and 591%, respectively.

Furthermore, another crypto analyst and founder of MN Capital, Michael van de Poppe said that as Bitcoin moves to and holds above $65,000, backed by the “consistent institutional inflows”, it has the potential to climb to $100,000. Quote:

“It’s only a matter of time before we see Bitcoin at $100K”

Ethereum may climb above $5,000 until the end of 2024

Bitwise’s Chief Investment Officer, Matt Hougan, assumed that while a spot Ethereum ETF may possibly have a rough start as “money may flow out of the $11B Grayscale (ETHE) after it converts to an ETP,” by the end of the year, the product will push Ether’s price above $5,000.

Hougan is confident in his statements because of three main reasons:

- ETH inflation is nearing zero, considering the massive adoption of the currency across various dApps and the small amount of ETH created daily;

- Ethereum’s node runners don’t have a direct need to sell ETH in order to maintain operations as they do not have “significant direct costs” like Bitcoin miners;

- Over 28% of all ETH supply is currently staked and locked away for a certain period of time, which is indeed a positive sign for Ethereum.

Meanwhile, the pseudonymous crypto trader, Daan Crypto Trade, foresees an even more optimistic scenario on Ethereum, suggesting a strong breakout in the BTC/ETH market because of the ETH ETF launch, as it sits directly on top of the 200MA/EMA.

What do you think of Bitcoin’s growth potential? 🤔

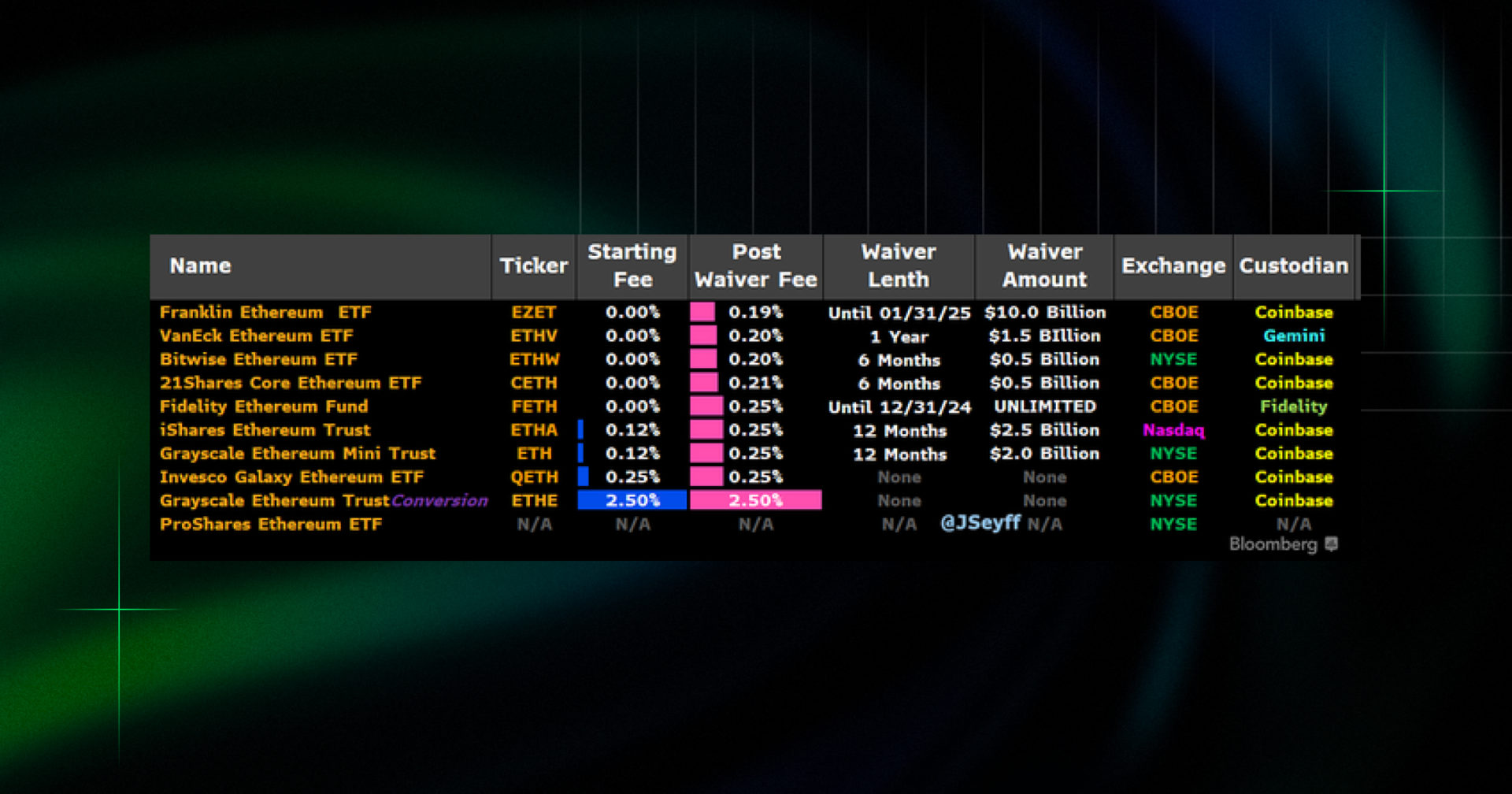

Bloomberg’s analyst has revealed ETH ETF issuers’ fee rates

Bloomberg’s research analyst, James Seyffart, shared on Twitter information on the fees funds will charge for their ETH ETF. The launch of these products is expected to occur as early as next week. The list of fees at the beginning and after the fee waiver period will be the following:

(source: James Seyffart)

As you can see in this table, Bitwise, Fidelity, Franklin Templeton, 21Shares, and VanEck are planning to launch ETH ETFs with zero fee commissions, while BlackRock and Grayscale Ethereum Mini Trust are going to start with a 0.12% fee rate. Franklin Ethereum ETF will have the lowest fee on the market, while the Bitwise and VanEck ETFs are set at a 0.20% rate.

Furthermore, the analyst added that 10% of the $10B ETHE ETF will be automatically spun off into ETH, which means Ethereum will get a $1B (approximately 0.24% of the market cap) inflow right from the launch of the ETF.

Vitalik Buterin warns of politicians claiming to be “pro-crypto”

Vitalik Buterin, co-founder of Ethereum, warned against “choosing your political allegiances based on who is pro-crypto” in his recent blog post released on July 17th, 2024. He stated that some of the politicians while being publicly “pro-crypto”, don’t have clear positions on privacy in communications, digital identity, and access to information. Quote:

“If a politician is in favor of your freedom to trade coins, but they have said nothing about the topics above, then the underlying thought process that causes them to support the freedom to trade coins is very different from mine”

As an example, he provided the Russian government, which claimed that it is “open to crypto”, but in reality was aiming to utilize the technology to avoid sanctions instead of making surveillance of its citizens and enemies more difficult.

Although he didn’t mention any names he has worries about, it is important to note that the post came at the same time when lawmakers nominated Donald Trump as the Republican party’s presidential candidate. This also comes in contrast with the fact that Donald Trump has changed his tone about Bitcoin from “scam” in 2021 to accepting donations in crypto in 2024.

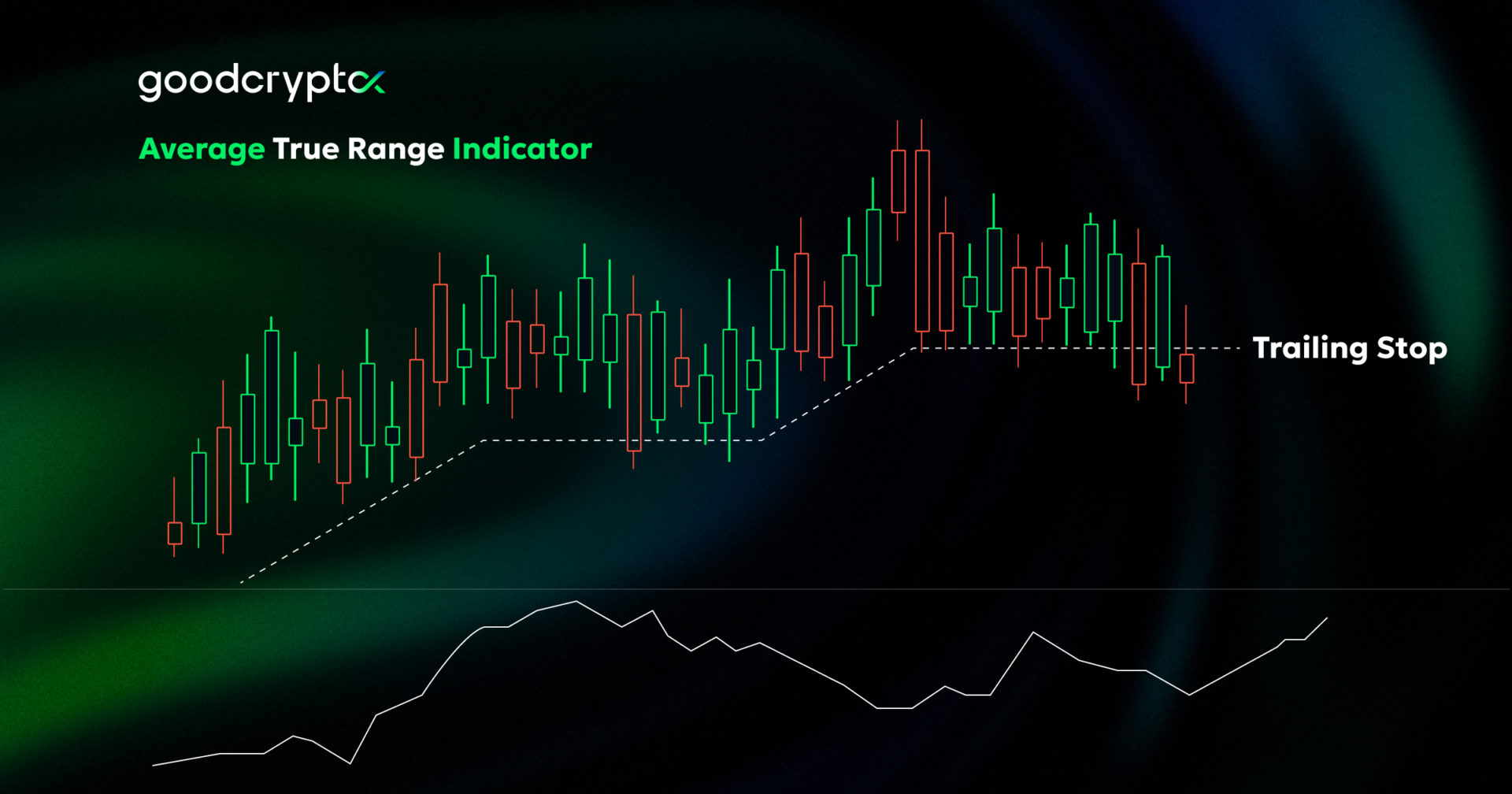

Understanding ATR (Average True Range) Indicator

Average True Range (ATR) is an indicator developed by professional technical analyst J. Welles Wilder Jr. in the 1970s, designed to measure the volatility of an asset over a certain period of time. ATR indicator use cases:

🔸 Measuring market volatility: Use the Average True Range indicator to estimate market volatility or determine whether the market is in an accumulation or trending stage.

🔸 Setting SL and TP orders: Determine the price’s potential highs and lows using the ATR indicator to place more accurate Stop Loss and Take Profit orders.

Want to find out more about the Average True Range indicator? Check out our comprehensive guide on the ATR indicator and start using this powerful tool in your trading strategy! 📈

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!