- 1. What is DeFi?

- 2. A brief history of DeFi projects

- 3. Decentralized (DeFi) vs Centralized (CeFi)

- 4. Problems with DeFi mass adoption

- 5. A Bird’s eye view on yield farming

- 6. Yield farming strategies

- 7. Yield farming protocols

- 8. DeFi ecosystem in numbers

- 9. Is DeFi a fad or a secular trend?

- 10. Key takeaways

- 11. What is Good Crypto?

Have you ever played Lego as a kid? If you like to piece things together, there is a good chance you’ll like DeFi, the fifteen-billion-dollar ecosystem of interconnected, strangely alike projects where big boys and girls lock their assets via smart contracts, provide liquidity, lend and borrow crypto assets, risk a lot of crypto – to earn a lot of crypto… or lose it. Let’s play!

What is DeFi?

Decentralized Finance (DeFi for short) is a lot of things but one simple definition. DeFi in crypto might mean several things. First of all, it’s a community of libertarian-minded developers and startupers who aim to replace traditional banking with new distributed algorithms.

Why? This will help eliminate the problem of trust, excessive fees as well as single points of failure and control – issues common for the long-established financial sector.

Second, DeFi is a nickname for a wide ecosystem of dApps for borrowing/lending, monetary banking, staking, trading and so much more – built mostly on top of Ethereum and sometimes on other blockchains such as TRON or EOS.

And last but not least, it’s a movement with its leaders, crystal-clear logic, and philosophy. Here it goes.

Crypto DeFi projects are interoperable for all dApps to be woven together on a technical level. They are accessible to anyone with an Internet connection: every developer can fork your code, every person on Earth can sign up with your app. All the market-level information, say, the history of your crypto transactions, is transparent to all participants, although nobody knows (except for forensics maybe) that this history is yours.

At the end of this summer, for the first time ever, DEXes (decentralized exchanges) built on Ethereum set three consecutive records, aggregating a volume of $11.6 billion in a matter of just one month, up from $4.5 billion in July. But this game has not always been that big.

So, what is a DeFi crypto project and where, actually, has everything begun?

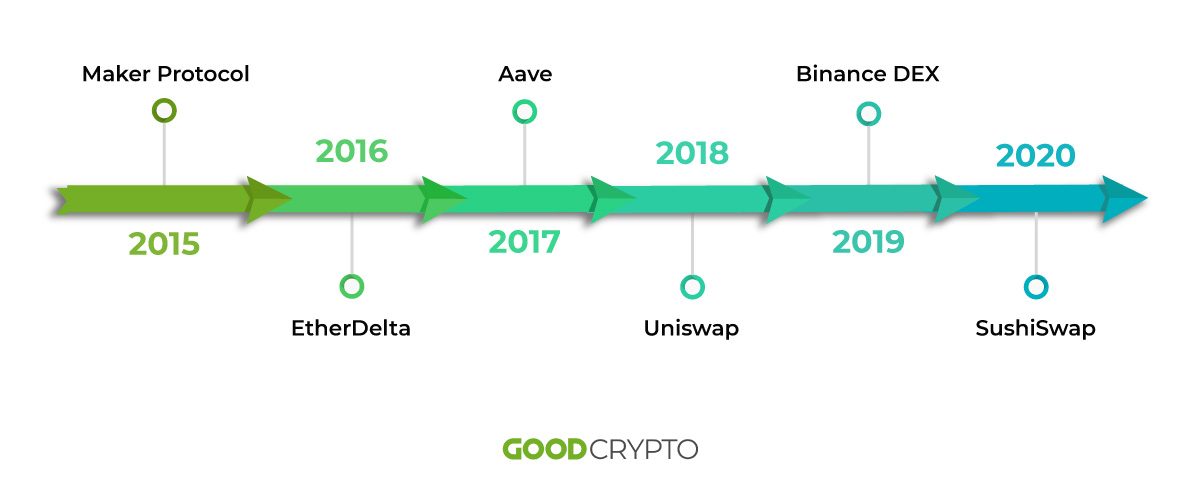

A brief history of DeFi projects

Everything started with Satoshi in 2008 when he pitched his whitepaper to the cypherpunks on the mailing list he was subscribed to. Bitcoin was the very first crypto DeFi project.

Still not convinced? OK.

Everything started with Vitalik in 2013. In the very first version of the Ethereum whitepaper, he described three categories of possible applications on his blockchain: financial, semi-financial, and non-financial. Buterin envisioned much of what we see playing out right now: derivatives, prediction markets, lending…

Still not convinced?

In May 2018, Polychain offices in San Francisco hosted a meetup where 150 visitors proclaimed their projects to be DeFi projects – Maker Foundation, Compound Labs, 0x, Wyre, dYdX were there – early dApps focused on monetary economics. But not everybody has attended.

So, again, where does it leave us? What is DeFi in crypto? Take a look!

Maker Protocol – a collateral-backed stablecoin (est. 2015)

Maker Foundation, today you might know it as MakerDAO, came into existence 5 years ago.

As of now, it has bottled up some dark algorithmic magic inside of its stablecoin, Dai, for it (almost) always to be equal to $1. But it’s not everything the protocol can do.

DeFi crypto loans are one of the other famous features of the platform.

Put your Ether into a smart contract, generate some Dai, borrow it, repay 0,5% per-year interest, and get your Ether back. Lost in translation? What sounds too complicated didn’t stop DeFi kids from locking $2.6 billion in the protocol’s smart contracts, as of this writing.

In such a competitive ecosystem as crypto DeFi is, it’s no wonder that after Maker had emerged, other akin projects started to pop up, too.

Lending, being a fundamental part of traditional finance, has seen a DeFi crypto frenzy this year, with the record inflow of more than $6 billion. That being said, in the crypto niche, there was seemingly a pressing demand to migrate the elements of well-established banking to the blockchain, which DeFi has done.

EtherDelta – the first decentralized exchange (est. 2016)

One of the first decentralized exchanges (and of the first DeFi crypto projects) was EtherDelta, the trading platform that relies on smart contracts to automatically execute trades. No middlemen, no centralized governance – just smart contracts executing orders.

If you buy and sell on top of this exchange, you don’t need an account with it, just MetaMask in order to send and receive ERC20 tokens.

However, in 2020, EtherDelta’s order book processing, such as executing, modifying, and canceling the order, looks slow. Because everything happens on Ethereum’s mainchain you have to spend gas whenever creating, modifying, and canceling orders.

That being said, the era of EtherDelta is rumored to have come to an end due to low trading volume and market liquidity. However, such DeFi platforms as 0x have tried to address the above issues.

0x – when a DEX meets a centralized exchange (est. 2016)

Another pioneering DEX out there, 0x, with its $27-million 24h trading volume, these days is not among top dogs in DeFi. However, the founders of this exchange described an interesting Automated Market Maker (AMM) model in their whitepaper that very few people noticed at the time.

Automated Market Making effectively replaces a traditional order book with a system where anyone can add crypto assets to the liquidity pool and those assets can be automatically swapped against the pool’s latest price that is set by a predefined formula.

Whenever you add liquidity to a pool, you earn fees for any trade facilitated by that pool. Thus, people earn fees for providing pool liquidity, and seemingly they like it a lot since it has created these surreal monthly volumes on top of not only Uniswap but also Curve and Balancer. But everything started on 0x.

Back at the time, the engine under the hood of this exchange looked very impressive not only because it offered the AMM functionality but also because it offered off-chain transactions, which significantly lowered trading fees, processing time and in theory could compete with such market players as Coinbase.

Aave – DeFi lending platform (est. 2017)

In 2017, Stani Kulechov founded ETHLend, a peer-to-peer exchange now rebranded as Aave, where you can lend and borrow a wide range of crypto, including DAI, USDC, TUSD, USDT, sUSD, BUSD, ETH, BAT, etc.

With Aave, lenders deposit their funds into a pool from which users borrow. While borrowing, you will need to pledge collateral that is larger than your DeFi loan (very typical for DeFi) and pay either stable or algorithmically based variable interest fees. While lending or depositing collateral, you’d be given aTokens that will allow you to earn interest.

The Aave pools also reserve a small percentage of the assets to hedge against volatility within the protocol and allow lenders to withdraw at any time.

Along with other DeFi lending, this protocol grew tremendously by the end of the summer 2020 and even gained first place in DeFi-protocol rankings surpassing Compound and MakerDAO in terms of total value locked (TVL). It currently has over $1 billion TVL.

Binance DEX – (de)centralized? (est. 2019)

But wait, you should say right now. All those DEXes are great, but what about the industry whale, Binance? Its $25-billion 24h trading volume surpasses all the records set by other exchanges over months.

Binance had jumped on the DeFi bandwagon early on, launching Binance DEX in 2019. At the time it looked like a clever move by CZ – if DEXes truly took off and became a threat to the centralized exchanges, Binance would be at the forefront with its DEX. True, it’s better to disrupt yourself than to get disrupted by someone else.

So they’ve developed a new blockchain for its decentralized exchange, which boasted low latency, high throughput, and low fees in sharp contrast to Ethereum. Later they’ve migrated their BNB token from the ERC20 standard on Ethereum to Binance Chain and had even acquired Trust Wallet in a bid to jumpstart the Binance Chain ecosystem and, most probably, to try and challenge Ethereum.

Binance DEX started with a $1.2-million 24h trading volume which was an impressive number for a 2019 DEX, pushed the likes of Huobi, OKEx, and Bithumb to work on their own DEXes and for a moment it looked like CZ might actually pull it off. However, Binance DEX 24h volume is slightly more than $645K, as of this writing, and the DeFi ‘revolution’ is happening on Ethereum. Whether it’s due to the technical superiority of the Ethereum’s Virtual Machine or the fact that no one really perceived Binance Chain as independent and decentralized remains anyone’s guess.

Decentralized (DeFi) vs Centralized (CeFi)

Is it true that DeFi, a futuristic and exotic niche, is something that crypto has always tried to grow into?

Centralized crypto exchanges, wallets, and stablecoins have brought a lot to the table: convenience, ease, and even some conservatism, but the challenger called DeFi showed the ambition to cover all that and even add something on top of the existing value proposition.

DeFi and CeFi present different advantages and flaws in terms of governance, private key management, interest rates, risks, and oracles. But together they’ve definitely innovated the crypto sector and might be able to overtake traditional finance.

Here are the pros and cons of both concepts – so, back to your corners, and let’s have a clean fight.

Crypto exchange – one definition, two different market segments

A centralized crypto exchange (CEX) is an online platform to trade cryptocurrencies 24/7. Not only is it a middleman between traders, but also a sitting target for hackers and a large-scale authority to watch over every trading operation on the platform.

Such an exchange has full access to your funds (remember: not your keys – not your crypto) and, importantly, stores these funds in the way they think is secure.

For example, 95% of all Kraken’s funds are stored offline, air-gapped, and geographically distributed. This exchange’s servers are also claimed to be in “secure cages” that are under 24/7 surveillance by armed guards and video monitors. So, the funds stored that vigilantly will be hard to siphon off if you’re a crook, but… as you see, they don’t really belong to the exchange’s regular users either.

The other centralized crypto exchanges that take care of your money include but are not limited to Coinbase, Binance, Bitfinex, Bittrex, etc.

By contrast, decentralized crypto exchanges (DEXes) are instant exchanges for ERC20 tokens where you don’t have to worry about KYC, custody, or fishing. Your money is your money – well, at least, on paper.

Truly decentralized exchanges are non-custodial, they require no identification and operate across multiple blockchains and cryptocurrencies.

They have a decentralized order book instead of a piece of code matching sellers and buyers, plus, their access point looks like some decentralized service instead of a regular website – sounds too good? In practice, not all DEXes live up to these standards.

This is the list of DEXes that includes but not limited to such platforms as Balancer, Bancor, Bisq, Matcha, etc. There you can find core characteristics needed to define the level of an exchange’s decentralization.

Liquidity

Liquidity is an important metric for any exchange because it shows how active the trading process on top of a particular venue is.

Normally, in order to assess the liquidity of an asset, you can take a few steps.

First, compare a 24h trading volume of the asset across different exchanges. Well, how?

If we’re talking about CeFi, you can go to CoinMarketCap, click on the Exchanges tab, then, proceed to a particular exchange – et voila! You’ll see the markets with their 24h trading volume.

Now that you know which crypto trading platforms offer the biggest 24h trading volume for the asset of your preference, you should take a deeper look into a particular trading pair. Indeed, what will you trade for what? Ethereum for Ripple? Bitcoin for Litecoin?

Say, you want to trade Bitcoin for Ether – sorry, Captain Obvious! Investigate a few crypto exchanges with the most 24h trading volume for this pair. Analyze the total volume of buy and sell orders in each of their order books, mind price slippage while placing your order, and last but not least, keep an eye out for how tight the spread is.

If the exchange is not popular, the order book is not active and the asset of your preference is scarce, by placing a sell order, for example, you may create a drawdown in price and end up losing money.

As you can guess, the liquidity for a pair like ETH/BTC on CeFi exchanges is quite high compared to exotic altcoins, so DEXes solve this problem.

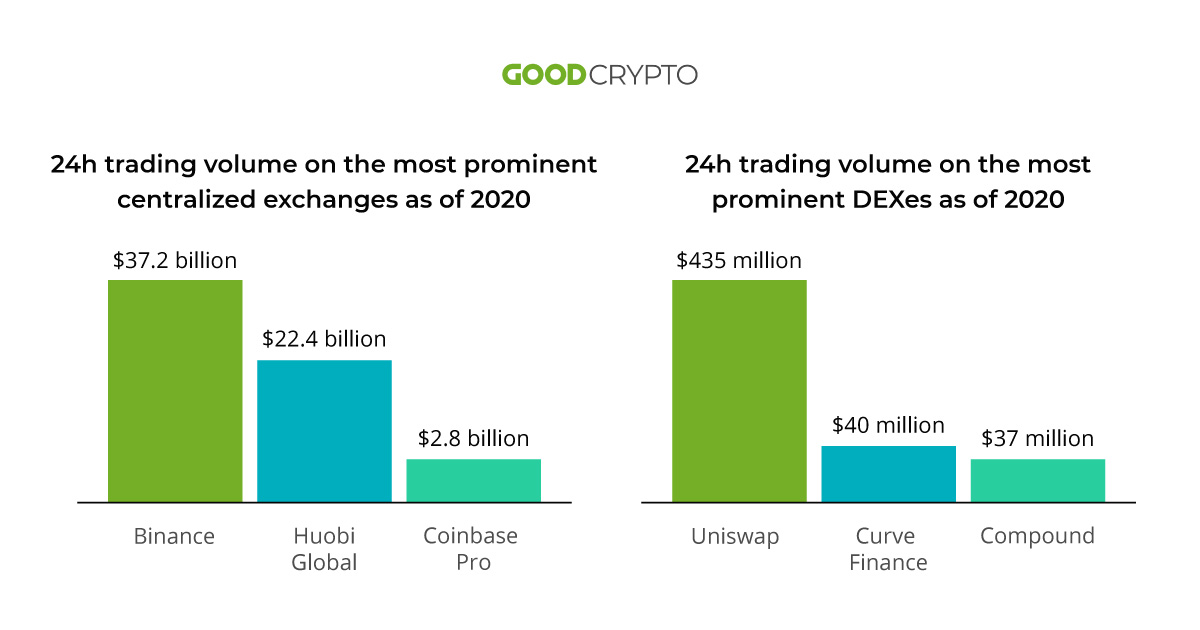

However, numbers-wise, the liquidity on CeFi exchanges is much higher, of course. Take a look at spot trading stats!

As of writing (November, 2020), Binance occupies the first place with $37.2 billion trading volume over the past 24 hours, Huobi Global holds second place demonstrating $22.4 billion, and Coinbase Pro is ranked third with $2.8 billion. The total trading volume for these three leading centralized exchanges makes around $62.4 billion.

Now let’s look at three top DEXes with Uniswap showing $435 million, Curve Finance $40 million, and Compound $37 million.

Even without adding up those numbers, we can see already how the trading volume on top of DEXes is much lower, $512 million.

So, what does it mean?

On top of centralized exchanges, the liquidity is better for traditional tokens, on DeFi exchanges, the liquidity is better for obscure, exotic crypto, such as Chainlink, Wrapped Bitcoin, Dai, etc.

Types of Trading

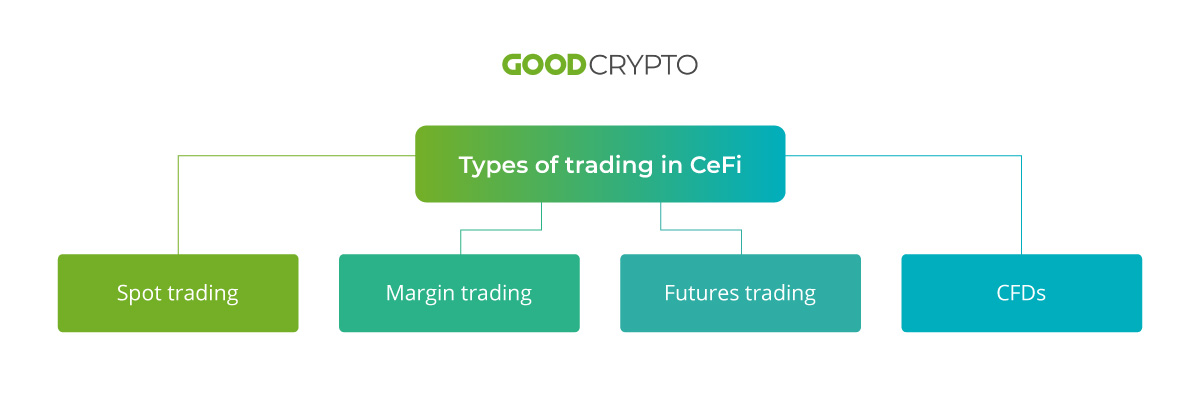

After all these ruminations with different token types, you’ll probably not be surprised to hear that an important difference between centralized and decentralized exchanges is the types of trading.

With such giants as Binance, Bifinex, UPbit, etc, not only can you go for spot trading but also margin trading, futures trading, and even CFDs. On top of BitMEX, you can leverage up to 100X, with Bitfinex, you can borrow assets to later margin trade, Kraken offers you Bitcoin futures, and these are by no means all of the options.

As for DEXes, they are not designed for trading, but rather for a bold new world of yield farming, which we’ll discuss later. Exchange-wise, at the moment, they act more like currency exchange kiosks rather than trading venues. There are notable exceptions, of course, such as dYdX, that is offering margin and derivatives on a DEX – but that is an exception nonetheless.

And since we’re laughing at decentralized exchanges off the stage again, let’s not forget that these platforms might be slow, there are no traditional trading tools on top of them and no established prices since the bandwidth of blockchains may change as a result of high or low latency.

That being said, it’s not quite clear if DEXes will ever be close to the point where they replace traditional exchanges. At the moment only centralized exchanges are good enough for trading, offering tight spreads, good liquidity, different trading tools, and various order types you’re so used to.

Fees

As you probably know the fees on top of centralized crypto exchanges might be of a few types: market maker/market taker fees, deposit and withdrawal fees, and the fees that payment services might ask you to pay when you transfer fiat.

| Fee types on centralized exchanges |

| Market maker/market taker fees | Deposit and withdrawal fees | Fees for fiat transactions |

With DEXes, the situation is slightly different.

| Fee types on DEXes |

| Smart-contract fees | Fees for transacting fiat into a multi-sig escrow | Fees for atomic swaps |

One type of fee is a smart-contract fee for a transaction on the Ethereum chain. Say, you have to pay 43 Gwei for a transaction, as of writing.

Also, DEXes could charge you for transacting fiat into a multi-sig escrow, which protects you from theft.

Additionally, there might be a fee if you’re doing an atomic swap between different chains, and a fee for market takers. Anytime a swap is made, the fees go straight to people who provide pool liquidity.

Ease of Using

All it takes for you to purchase an asset on a big centralized exchange, such as Coinbase, is your debit/credit card. With such a card, you can buy almost any crypto coin for fiat in a few clicks. There are also other payment methods available: wire transfer and bank account, for example.

| Popular Payment Methods in CeFi |

| Debit/credit card | Wire transfer | Bank account |

Every major centralized crypto exchange offers you a relatively easy way to dip your toes into the cryptocurrency river.

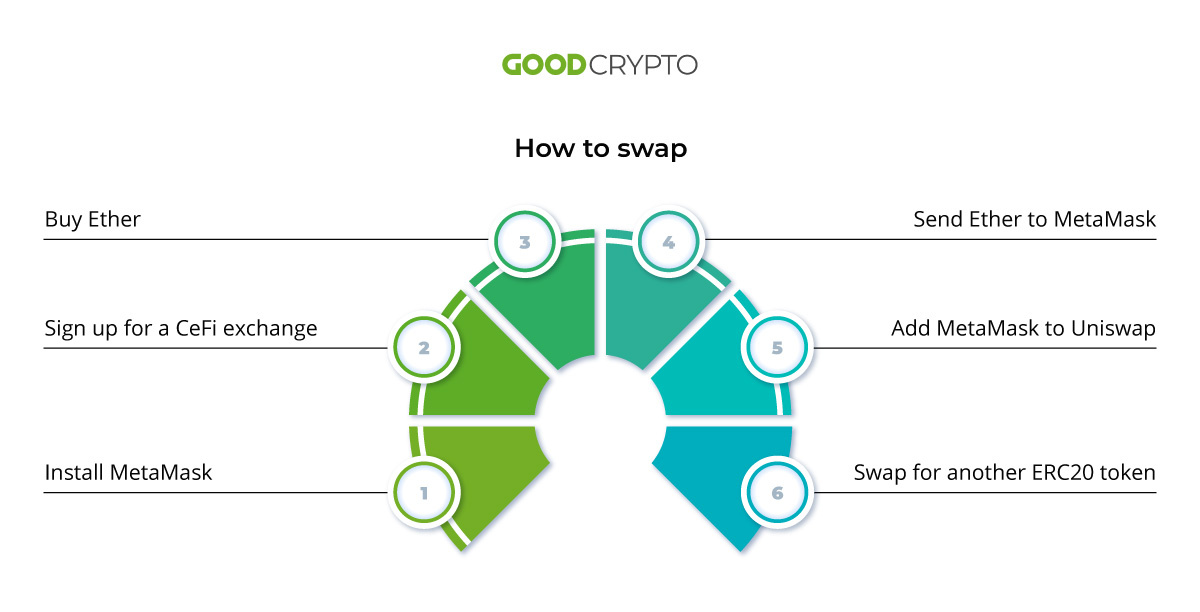

With DeFi exchanges, such as Uniswap, Bancor, Kyber, Curve Finance, etc, the situation’s a little bit different. You should be prepared to start using them.

Say, in order to swap on Uniswap, you already have to know something about crypto and specifically, about Ethereum and ERC20 tokens.

For a swap to take place, you input a token to sell and the output token to purchase instead – but for that, you need to have those tokens, say, Dai and WBTC, and an ERC20 wallet, such as MetaMask.

Not rocket science, of course, and yet, it’s still more complicated than Coinbase where everything happens in a few clicks literally, and where, quite honestly, even your Gran can buy BTC.

Try and ask her to purchase Dai and don’t download the video on YouTube, this kind of struggle is not funny.

Privacy

What you should keep in mind is that the thorough KYC/AML procedure that you have to go through on top of every major centralized exchange will make you totally visible to the government. Don’t like it?

Well, decentralized exchanges are considered more private since they don’t require you to complete KYC/AML.

How so? The ERC20 wallets you use to swap tokens are anonymously stored on your machine, and your transactions recorded to the blockchain look like long strings that are hard to decrypt unless you’re a forensic like Dave Kleiman.

Security

While storing your funds in centralized crypto exchanges’ accounts, you arrange a sort of a backup for yourself in case of losing valuable information such as passwords. But remember that all of the online platforms are very vulnerable to hackers. Well, basically everything that touches the Internet is vulnerable to hackers.

| Have you heard of these CeFi Exchanges’ hacks? |

|

|

||

| 2016 | 2018 | 2018 | 2019 |

| $72 milion stolen | $31.5 milion stolen | $500 million stolen | $40 milion stolen |

Or, take for instance the very latest breach (as of writing) that happened in September 2020, when a Slovak centralized cryptocurrency exchange Eterbase was hacked for $5.4 million. According to the statement made by the exchange, the cybercriminals stole Bitcoin, Ripple, Litecoin, and other top-dog coins. The exchange is now ready to reimburse their clients from their reserved funds, but it’s not always the case.

Generally, in terms of the hacks attempted, the number of DEX breaches is of course much lower than the number of centralized exchanges’ breaches since the DeFi niche is very young.

But 2020 saw at least a few disconcerting hacks on top of major DeFi exchanges. Why disconcerting? Because they were facilitated through flash loans that are so popular on top of Aave, Compound, etc., and happen in one click only.

In June 2020, an attacker stole over $500k in WETH, WBTC, SNX, LINK from Balancer through the flash-loan scheme. The hacker used a smart contract to automate multiple actions in a single transaction. February this year, through a flash-loan attack, the bZx protocol lost 1193 ETH and then $645k – in a matter of just a few days. The hack, in fact, was a clever arbitrage execution, which did exploit a bug in bZx smart contract implementation.

Wallets: custodial vs non-custodial

Now that we’re done with CeFi and DeFi exchanges, let’s move on to wallets. Just as with the crypto exchanges, there are two main wallet types in the niche, custodial crypto wallets and non-custodial crypto wallets.

A few basic pros and cons to consider while choosing a wallet

| Custodial | Non-Custodial |

| Pros | Cons | Pros | Cons | |

| Free transactions | Custodian’s control over your money | User’s control over their money | Being in charge of your own security | |

| Backup for your keys | KYC | Safety | More complicated user interfaces | |

| Can be hacked | Offline accessibility |

A non-custodial wallet allows you to maintain your private keys in the form of a mnemonic seed or just a raw alphanumeric string. Take a look at the list of these wallets!

On the other hand, the custodial wallets don’t let you have complete control over your money.

Just like in CeFi, in DeFi, there are several wallet categories: web wallets, hardware wallets, mobile light wallets, desktop wallets, and paper wallets. So these don’t depend on DeFi or CeFi, they are present in both niches.

Despite a type of wallet you use, it’s better to track its performance in real-time to keep updated on your protfolio’s performance

Here are a few aspects you might want to consider while picking a custodial or a non-custodial wallet:

Security

Generally, with custodial wallets, the sensitive data is being stored in hot and cold storages. Say, Coinbase keeps 98% of customer funds offline distributing them geographically in safe deposit boxes and vaults around the world.

As for non-custodial wallets, such as Blockchain.com, you’re solely responsible for your funds since you store them on your machine. That’s why before using such a wallet, you should take additional precautionary measures: write down your mnemonic phrase, keep it in a safe place and set up 2FA.

Usability

You were waiting for it, and here it comes: a very important thing to factor in while choosing a wallet: usability.

Often custodial wallet providers make it very easy for the end-user to interact with their services.

The fees they might charge – not for transactions but rather for some other services – basically cover your comfort when you lose your password, start learning about crypto or look for well-thought interfaces.

With non-custodial wallets, the situation is a little bit different. Yes, most modern DeFi wallets are very easy, but some of them might be slightly geeky, raw, or complicated.

So once running across a pretty funny interface to store your Dai, don’t be surprised: early users of these apps, programmers, and crypto enthusiasts, don’t always care about the looks.

Stablecoins – obscure in both, CeFi and DeFi

As you probably know, stablecoins are cryptocurrency coins that maintain a peg to another asset or a basket of assets: fiat currency (e.g. USD), commodity (e.g. gold), a price index, etc.

Just like with other Lego bricks, exchanges and wallets, there are more and less centralized stablecoins in crypto.

Centralized Stablecoins

The most popular centralized stablecoin you probably know about is Tether (USDT).

It claims to have one dollar in their bank account for every one Tether they’ve put out in the market. The drawback? Because the project is not transparent enough this fact has been disputed over the years.

The coin is rumored to not have 100% of traditional currency backing, but presumably other cryptocurrencies and reserves held as loans instead.

That might be also true for other stablecoin projects that are considered centralized since it’s totally up to an issuing authority how to maintain the peg.

Decentralized Stablecoins

Now, wouldn’t it be great if the decentralized stablecoins turned out to be the answer to our prayers about transparency and solved the problems listed above?

Unfortunately, real life doesn’t work this way, and the most prominent decentralized stablecoin protocol MakerDAO that breeds Dai is a striking example of that. In theory, reserves backing Dai are 100% transparent by the virtue of being on-chain.

In reality, due to the complicated nature of this stablecoin, there are not so many people out there who truly understand what is hidden under the hood of Dai. We’ll look into that later.

Complicated algorithms underpinning decentralized stablecoins introduce an additional set of problems: are those algorithms good enough? Can they be gamed? Are they bug-free? How will they hold up against the 50% market drawdown?

Those are questions that still need to be addressed.

Problems with DeFi mass adoption

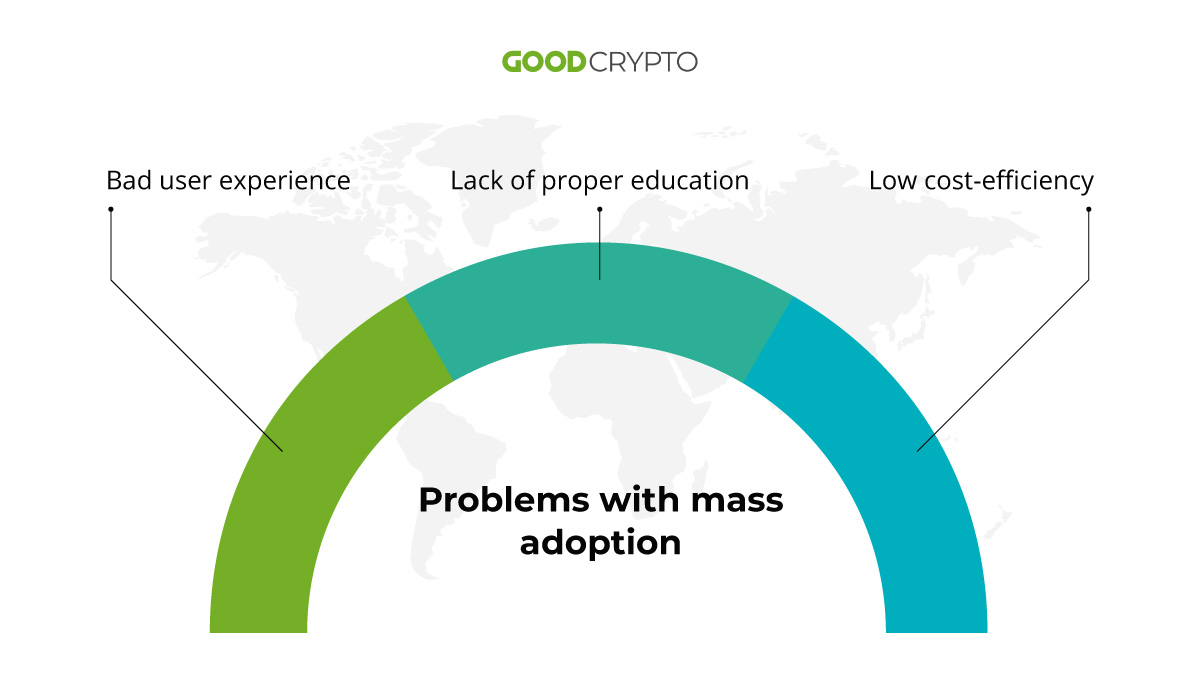

DeFi sounds promising in terms of varying degrees of decentralization, security, and simplicity. It provides users with flexible options. But according to the research conducted by CoinTelegraph, the majority of the surveyed projects evaluate the time frame for reaching the maturity stage as 3-5 years, with 32% believing that it will take them from 6 up to 10 years.

So, what will take them so long? In fact, a few things: bad user experience, a lack of proper education, and low cost efficiency. Let’s take a look at a couple of more things that hamper DeFi mass adoption.

Complexity

If you feel like DeFi gives off the vibe of intricacy, you’re not alone. The bad news is that the complexity levels are, unfortunately, expected to get even higher after some time because of the fierce competition.

The platforms need to become more and more creative to design instruments for generating bigger returns, and that gives birth to projects like MakerDAO with somewhat complicated, obscure logic under the hood that only a few experts could minutely analyze.

Ethereum-based

Although the team behind Ethereum works actively to come nearer to the Serenity state, the load on the network is growing, which makes it more costly to use.

High gas fees, especially for small transactions, seem like a major roadblock for user growth in DeFi.

That’s why it may be important for DeFi to differentiate itself from Ethereum and start building solutions on other blockchains.

That being said, complexity, Ethereum’s high latency, bad user experience, lack of proper education, and low cost-efficiency are all obstacles DeFi still needs to overcome for mass adoption to happen.

A Bird’s eye view on yield farming

Yield farming is the process of earning a return on your crypto capital by putting it to productive use.

Say, you hold some crypto assets and want to park them with the maximum return – totally understandable!

With yield farming, it’s possible to maximize a rate of return on your crypto capital, moving your funds between manifold platforms, such as Uniswap, Compound, Balancer, Curve Finance, etc.

Simplifying this a lot for illustration’s sake, you can compare yield farming to traditional finance where banks’ clients look for the highest APY (annual percentage yield) across varying interest-bearing accounts.

Think about a savings account at a traditional bank. The return earned in one year is 0.1% on average, which contrasts with yield farmers’ mad-as-a-March-hare returns that might reach 100%.

How is it possible? To get to that, we need to talk a little bit about other concepts, and let’s start with liquidity mining.

Liquidity mining

Liquidity mining is the process of token distribution to the users of a platform for doing something useful on this platform.

The concept was introduced by Synthetix (SNX), a DeFi exchange that rewarded their community with the SNX token for providing liquidity to their SETH/ETH pool on top of Uniswap.

Compound went even further by giving users more rewards for when they borrowed funds with the highest APYs, which started a huge trend in the niche.

Leveraging

You probably know that in traditional trading, leveraging is a mechanism that allows you to use borrowed money in order to increase the potential return on the investment.

In DeFi, farmers can use the borrowed coins as further collateral on another platform and borrow even more coins. By repeating this cycle, they can leverage their capital a few times over, which comes along with a high risk, and – yes, this is where a less pleasant part of yield farming begins.

Risks

If you remember the origins of the global financial crisis of 2007-2008, the cycle DeFi farmers go through might somewhat remind you of those times. Before the worldwide economy plummeted, the U.S. banks were massively providing loans regardless of a borrower’s credit history and income level.

Later, they resold those loans to investment banks that turned those loans into investment products and made rating agencies give them the highest issuer credit ratings, namely, AA or AAA – on top of which they could create synthetic products.

All told, this has electrified the economy for quite some time, but at the end, the pyramid collapsed.

So, next time, while deciding if you want to go for a DeFi farming cycle, make sure to assess the quality of the product adequately and do your own research in an attempt to understand what its whole tokenomics is all about.

Back in 2007, people didn’t want to check the quality of the financial products and lost a lot of money.

Are there any other risks in place, though, while investing in DeFi tokens?

All DeFi loans that yield farmers are taking are overcollateralized. It’s necessary to reduce lending platform’s risks. Supplied collaterals are susceptible to liquidation when a collateralization ratio drops beyond a certain threshold.

In addition to this kind of risk, there are smart-contract bugs and attacks on liquidity pools that drain them, which all explain insane yields: high risk (in theory) equals high reward.

For example, in August 2020, attackers raided the Opyn protocol, making off with over 370,000 USDC due to an exploited smart-contract bug.

In November 2020, Pickle Finance was attacked by exploiting two bugs in the smart contract, and the hack resulted in draining 19.76 million in Dai.

Yield farming strategies

So, now that you’re familiar with the basic principles yield farming is built on, let’s talk strategies.

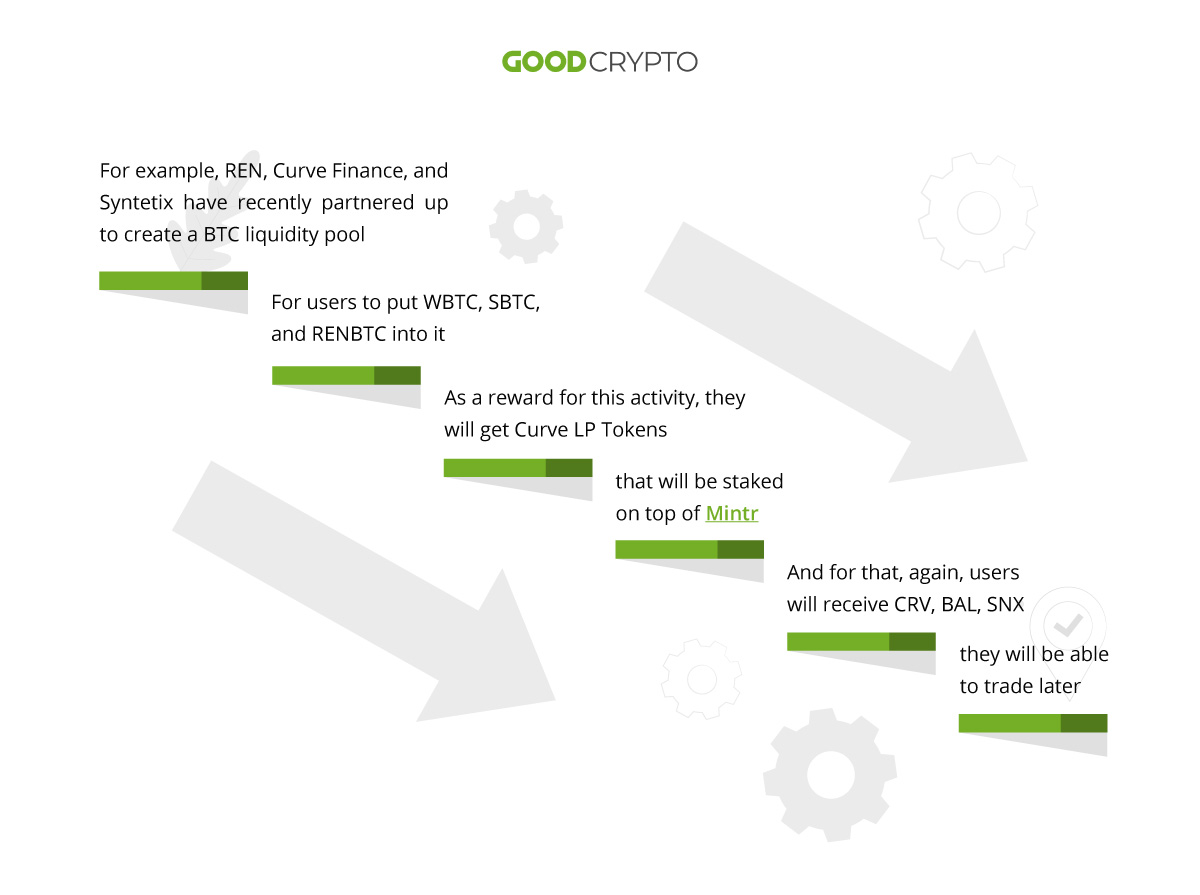

There are several ways to farm tokens in DeFi, and here they are: lending, borrowing, supplying capital to liquidity pools or staking LP tokens.

Say, while lending or borrowing, you can increase your returns when the platform awards you with their tokens for your activity.

Or, you can supply liquidity to liquidity pools, and for that, you will be rewarded, too. Say, on top of Balancer, you’ll get BAL tokens.

Or, it’s possible to stake LP tokens, liquidity pool tokens, that represent your participation in a liquidity pool.

Phew, what a story, right? But there is even a more famous graph you can take a look at if you want to understand the DeFi lifecycle better. Check out this short description:

Yes, after all, Alice might even end up losing money with that small volume of Ether invested.

So, to farm or not to farm? Whatever your answer is, there’s no easy way to earn in DeFi. On the other hand, nobody said it was easy, as Coldplay’s Chris Martin sings.

Yield farming protocols

MakerDAO

MakerDAO is a multi-layered defi crypto lending protocol that is quite challenging to understand from the word go, so let’s try to put it in the easiest way possible:

- MakerDao is essentially a system that lets you generate Dai by using your Ether and several other cryptos (and, potentially, any tokenized asset).

- Dai is a collateral-backed stablecoin that maintains a soft peg to $1.

- You have to supply 150% of Ethereum value to generate 100% Dai.

- You have to pay back in Dai to get back your Ether.

- MKR is a token that has three primary uses on the platform: as a governance token, as a utility token, and as a resource for recapitalization.

To complicate things a bit, MakerDAO had long existed with a single-collateral Dai – accepting only ETH as collateral. In late 2019, they launched multi-collateral Dai that at the moment accepts several different cryptos as collateral.

Now, take a look at the example. Say, you deposit $150 worth of Ether into the smart contract. That will generate you 100 Dai, and 100 Dai you’ll owe to the system.

By going through the famous crypto DeFi cycle, you’ll probably leverage your Dai and get your Ether back at the end. But also you will have to pay the system an interest rate that is set by MKR token holders and transaction fees that can swing from $10 to $40 depending on Ethereum’s latency.

Curve Finance

CurveFinance is a DEX that makes cost-efficient swaps between different stablecoins by using advanced bonding curves. Let’s deconstruct this definition step by step:

- Stablecoins are cryptocurrencies that attempt to peg their market value to some external reference, in many cases, to $1.

- Value of stablecoins, due to market fluctuations, isn’t often equal to $1 sharp, rather to $0.96 or maybe $1.1. That’s why while swapping, say, USDT to USDC, you sometimes lose money. For example, for 1000 USDT you might get 9600 USDC. But $400 slippage is inefficient!

- Advanced bonding curve is a formula used by Michael Egorov, a Russian physicist and Curve.fi CEO, to automate the relationship between price and supply. The formula gets the loss amount between different stablecoins to be less than 1% generally. So using our example with USDT and USDC, while swapping, you’d lose a maximum of $10. In this video, there’s a good explanation of how the advanced bonding curve works: to put it in layman’s terms, the formula provides the most liquidity where the price is closest to the peg.

- CRV is an LP token you receive as a reward for providing liquidity to Curve Finance pools. The more your contribution to the pool is, the more CRV tokens you’ll receive. Also, CRV is a governance token that increases your voting power in the protocol.

Say, you’ve got Dai, TUSD, and USDT in your ERC20 wallet and want to put it to productive use.

Supply these tokens to the Y pool on top of Curve.fi, get the yCRV tokens in return, stake them in yearn.finance vaults and get APY (annual percentage yield) in addition to trading fees from the swaps other users facilitate by using tokens you’ve provided to the Curve Finance pool.

Chainlink

Chainlink is a decentralized network of oracles that provide real-world data to smart contracts on different blockchains.

- A blockchain oracle is any device that connects a blockchain with off-chain data from the world of finance, supply chain, payment applications, insurance, etc.

- A smart contract in Chainlink may be a securities smart contract that will require access to APIs reporting market prices. Insurance smart contracts will need data feeds about the data related to the insurable event in question. Trade finance smart contracts will need GPS data about shipments, data from supply chain ERP systems, and customs data about the goods being shipped, etc.

As Chainlink CEO Sergey Nazarov explained in his interview to Anthony Pompiliano, the number one problem with the mass adoption of blockchain technology is that it cannot pertain to real-life data.

And even when it can, another problem arises: the oracles that connect the data to the blockchain get regulated by a centralized third-party.

By being a decentralized network of oracles designed to send data to blockchains, Chainlink solves this problem.

At the time of writing, however, you can only earn tokens by running your own oracle or by staking your LINK in a staking pool like LinkPool or on top of an aggregator such as yearn.finance.

Compound

Compound is a famous DeFi solution amongst global lending services. It creates money markets and is algorithmically-operated. Its interest rates are set by the real-time supply and demand of assets.

Let’s deconstruct.

- Borrowers and lenders obtain COMP tokens as a reward for borrowing and lending through the platform. According to the company’s website, each time you interact with the platform by supplying, borrowing, withdrawing, or repaying an asset, COMP will be automatically transferred into your wallet, if you’ve accrued at least 0.001 COMP; at any time, you can manually withdraw all undistributed COMP.

- cTokens are users’ balances in their Ethereum wallets. Those tokens can be minted by supplying assets to the Compound market.

- For example, locking up USDC in the protocol generates cUSDC tokens, which automatically earn interest for you.

What are those interest rates, then, and how are they calculated? The whitepaper of the project explains how those rates are automatically operated: “The interest rate model achieves an interest rate equilibrium in each money market based on supply and demand. Following the economic theory, interest rates (the “price” of money) should increase as a function of demand; when demand is low, interest rates should be low, and vise versa when demand is high.”

You can always check out the latest borrowing and lending rates for every market yourself.

But just to give you an example, say, you want to borrow 1,000 Dai and have 500 USDC to supply. Let’s calculate your annual percentage yield.

All told, you’ll “farm” 0.35 COMP ($41.84 with COMP price $120.44) and 1.0% net APY ($14.98 on $1.496.89 liquidity mining capital) minus $26.86 in net borrowing costs and fees for every transaction.

Yep, you could have done better, but just think of the concept. What traditional bank will reward you for simply borrowing from them?

Uniswap

Uniswap is a crypto exchange where decentralized token swaps are facilitated by pink unicorns, or at least this is what the exchange’s logo suggests. OK, joking apart, Uniswap is a protocol for trading and automated liquidity provision on Ethereum. Basically, you can earn LP tokens by providing liquidity to the exchange’s pools.

- Whenever somebody trades on Uniswap, the trader pays a 0.3% fee, and that fee is distributed proportionally amongst liquidity providers.

Say, you add the Dai-ETH pair to the exchange’s pool, and it constitutes 0.005% of the whole pool. For this, the system will airdrop LP tokens to your Metamask wallet. Then, when somebody swaps 10 Ether for 5,012 Dai, the pool will receive 0.03 ETH from that transaction (0.3%), and you will get your 0.005% share of 0.03 ETH. So, you see, the longer you keep your funds in the Uniswap pool, the more LP tokens you “farm”.

On the other hand, while your tokens have been locked in the pool, the price volatility might put you in a place where you’d end up withdrawing less value from the pool than you began with even when accounting for all the fees earned. Uniswap’s core idea is that you supply both Dai and ETH to the pool and theoretically you should be able to withdraw the same value plus fees from the pool at any time. However, as the research referenced on Uniswap’s own website shows, high volatility can lead to liquidity providers actually losing money.

DeFi ecosystem in numbers

Depending on when you’re reading this piece, the situation might look differently from when it was written – which is November 2020.

But no worries. What DeFi crypto projects have brought to the table is a lot of new web resources. To track all the current updates, you can always go to the web resources listed down below no matter when you read this guide, and you’ll catch up.

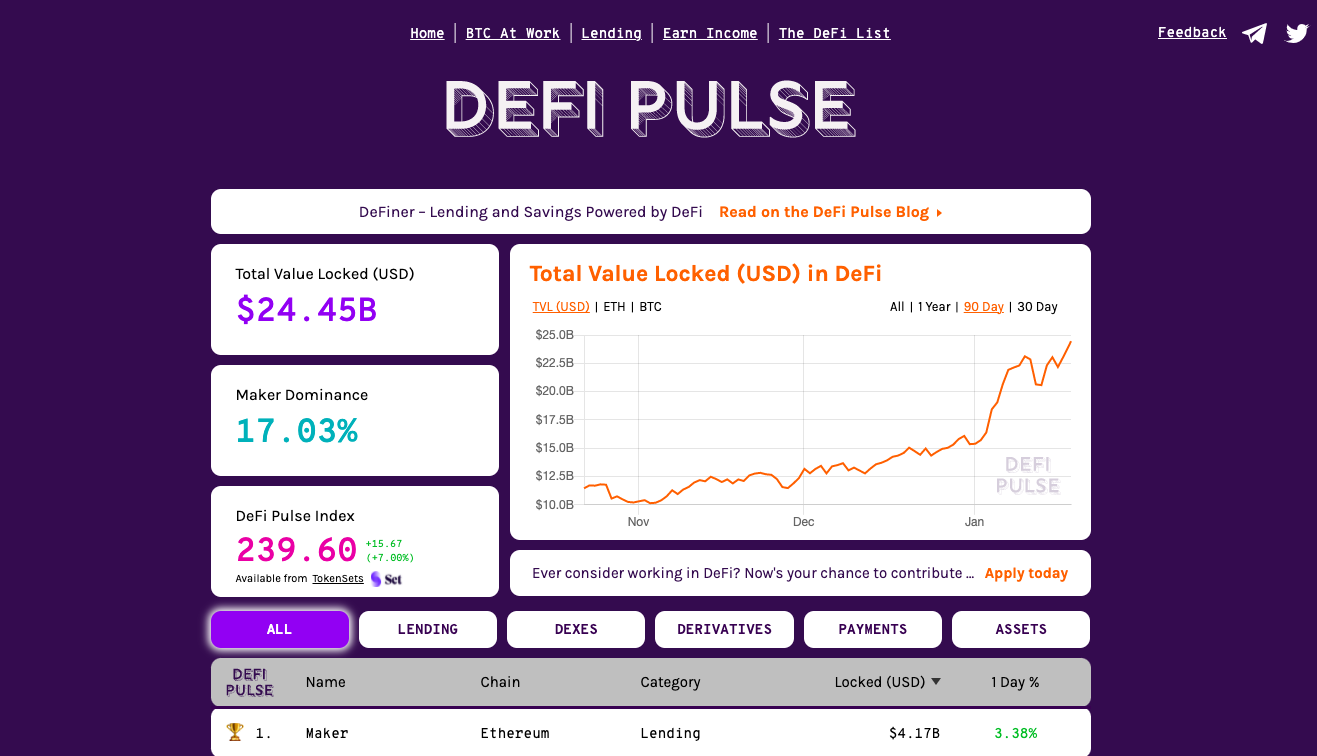

DeFi Pulse

For example, check out DeFi Pulse – a great resource with DeFi rankings and all the latest data such as total value locked; the market dominance of a particular project, or, in other words, the project with more liquidity locked inside it than the rest of the market; and DeFi Pulse Index, or a capitalization-weighted index, that tracks the performance of DeFi assets on the crypto market.

As of now, the market dominance of the MakerDao is 17.63%, the total value locked in DeFi projects is slightly higher than $14 billion, and the DeFi Pulse Index is climbing up again – hmm, sounds too optimistic. What do the other stats tell us?

CoinMarketCap

In addition to DeFi Pulse you can also check out CoinMarketCap that tracks all the statistics of DeFi coins and exchanges.

According to the platform, the top three exchanges in terms of 24h trading volume as of now are Uniswap ($310,135,447), Sushiswap ($85,923,800), and 1inch Exchange ($85,403,594).

As for the coins, Chainlink (LINK), Wrapped Bitcoin (WBTC), and Dai (Dai) have changed hands more often over the past day than the other projects.

LINK’s market cap is almost $6 billion with a trading volume of around $1.5 billion. WBTC shows more than a $2-billion market cap with almost $45 million in trading volume. And as for Dai, it’s market cap is above $1 billion with around $123 million in trading volume.

Just to give you a perspective, as of now, Bitcoin’s market cap is around $345 billion with a trading volume of $38 billion. Ether’s market cap is $57 billion with around $18.5 million in trading volume.

Dune Analytics

One more interesting web resource you can always check out to understand what’s happening in the niche is Dune Analytics.

For example, we can see from the current analytics presented on the website that the monthly DEX volume has dropped almost twice since last month (October, 2020), from $25 billion to $10 billion.

Uniswap currently has a 55% market share, Curve – 19.4% and Sushiswap – 12%.

LoanScan

There is also a web resource where you can track all the latest stats on DeFi lending platforms. LoanScan explores the volume of DeFi loans over different time periods so that you can add some new information to your big-picture puzzle.

For instance, you can see that the one-year volume of DeFi loans in 2020 on such platforms as Maker, Compound and dYdX is $23,392,435,548, with the overall repayment slightly less than $21.874.280.049.

But, of course, DeFi Pulse, CoinMarketCap, Dune Analytics, and LoanScan are not the only platforms you can check to be in the know. 0x tracker, Alethio and many other resources can also be of use.

Is DeFi a fad or a secular trend?

So, what is DeFi? Some people believe that it’s a new model that will revolutionize how the financial world is meant to function in the near future. The others, however, think that DeFi is wringing money out of the thin air.

Indeed, the traditional financial markets have a lot of issues to address, such as limited access to manifold services, non-transparent banks or the factor of human error: everything is slow, centralized and expensive in the old financial world.

So, in theory, this new impersonalized DeFi system built on strict mathematical principles should be able to solve many of those issues, right? It doesn’t seem like so. At least not yet. Numerous DeFi projects that we’ve seen pop up over the last year can truly lay the foundation for such a better financial system in the future – but not for now because DeFi in itself is not ready.

There are a few red flags that hamper the progress, such as no regulation, complicated logic under the hood and the Ponzi scheme vibe.

DeFi is not regulated, which makes it very easy for frauds to pull a con game; plus, while bottling up millions of dollars in their platforms, some founders don’t even always do proper code audits or release the products with a perfectly working logic under the hood.

Also, the market structure looks very similar to the likes of the U.S. economics shortly before the financial crisis of 2007-2008.

To conclude on a lighter note, it’s hard to overlook a lot of the potential DeFi radiates: it can address many of the pain points, given some time. But without pointing fingers, beware of suspicious yield-farming platforms that promise whole mountains of gold or maybe have a food name in them.

Because, just like it happens in any other market segment, in DeFi, there are not only high-quality, but fraudulent projects, too.

Key takeaways

DeFi is a nickname for a wide ecosystem of dApps for borrowing/lending, monetary banking, staking, trading built mostly on top of Ethereum and sometimes on other blockchains such as TRON or EOS.

It’s hard to say when DeFi started. Some people argue it started with Bitcoin, the others will say with Ethereum.

But probably it began to shape into something interesting within the MakerDAO ecosystem in 2015.

From EtherDelta to Aave, to Binance DEX, the DeFi ecosystem had been slowly growing over the years to boom in the summer of 2020.

Such a breakthrough led to the situation where we can talk about CeFi and DeFi as two different niches, although both of those niches come down to crypto.

Centralized crypto exchanges, wallets, and stablecoins have brought a lot to the table: convenience, ease, and even some conservatism, but the challenger called DeFi showed the ambition to cover all that and even add something to the existing value.

For example, you can mine LP tokens on such DEXes as Uniswap, store funds on your end in your non-custodial wallets and have stablecoins governed by the community (or so they say).

But no matter how much we want it, DeFi doesn’t solve all the problems existing out there. For example, Ethereum is clogged, and soon enough we might need another blockchain for DeFi, such as Tron, or maybe even Bitcoin?

According to Dune Analytics, the DeFi hype is slowly fading away: the monthly DEX volume has dropped almost twice since last month (October 2020), from $25 billion to $10 billion. However, the total value locked in DeFi projects is slightly higher than $14 billion, which is an all-time high.

So, what DeFi crypto projects have brought to the table? As the inventor of the world wide web Tim Berners-Lee once said, “I should be able to pick which applications I use for managing my life” – and DeFi gave us highly attractive financial opportunities, but more importantly, it gave us a choice, to either go with the old traditional system or become a part of a future web 3.0 society.

So, the only question left is what would you choose?

What is Good Crypto?

Good Crypto is a next-gen all-in-one crypto portfolio tracker and multi-exchange trading app that will help you become a better trader while enjoying your trading process.

Choose from 30+ most popular crypto exchanges to trade on together with various order types suitable for causal and advanced traders:

- Stop-limit order

- Stop-market order

- Stop-limit with funds unlocked

- Stop-market order with funds unlocked

- Trailing stop-limit & trailing stop-market

- Connected orders to automate your trading

A simple and intuitive interface of the app will let you enjoy the overview of your portfolio across different platforms. Keep an eye on all of your exchange accounts as well as blockchain wallets in real time:

- Connect and monitor 30+ exchanges

- Track Bitcoin, Ethereum and other blockchain wallets

- Choose from 40+ fiat currencies to display the value of your portfolio

Tired of constant multitasking? Good Crypto will send you custom push notifications for 10,000+ trading pairs, including exotic, under-the-radar cryptocurrencies:

- Order execution alerts

- Trading, portfolio and price movement alerts

- Significant coins performance alerts

- New exchange listing alerts

Good Crypto is available for iOS, Android and Web. If you have any questions, don’t hesitate to ask them on our Telegram group!

Authors:

Julia Gerstein, fintech content writer

Maksim Hramadtsou, co-founder at GoodCrypto.App

Gleb Myrko, founder at RGray.io