Hello there! 👋

This week has brought several exciting developments in the crypto space that could shape your outlook on the entire market. Let’s dive into the most important events to help you stay up to date in the ever-evolving Web3 industry.

quick weekly news

Crypto bulls endure second-biggest liquidation day in October

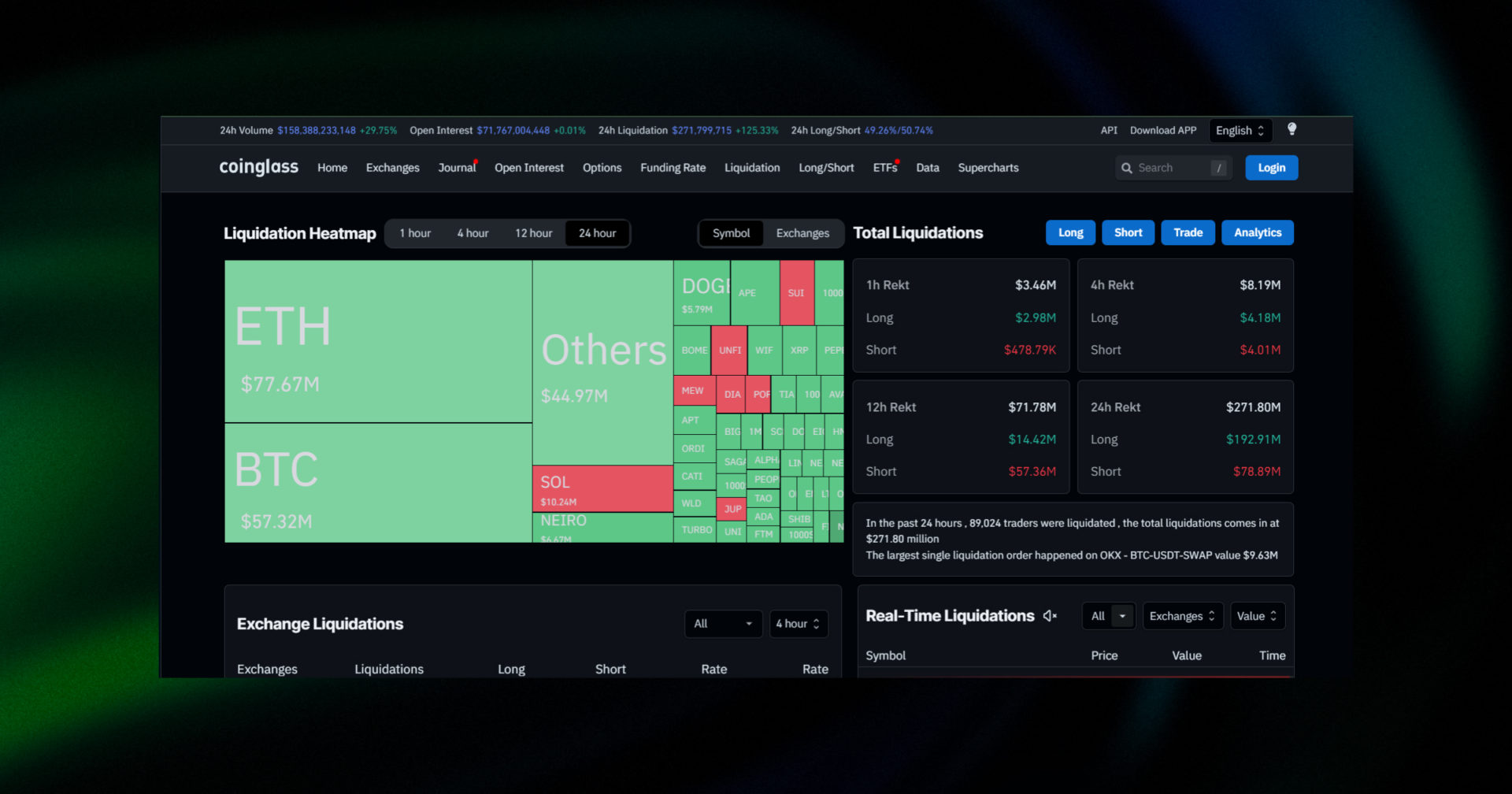

October 23 has become the second biggest liquidation day of this month, causing many losses among bull crypto traders. Over $271.82M has been liquidated over the past 24 hours while the long liquidations equal to almost $192.92M, according to CoinGlass Data.

Source: CoinGlass

Notably, Ethereum saw even bigger liquidations than the first cryptocurrency showing a $77.67M long liquidations over October 23th. We have already covered the problem of Ethereum L2s luring liquidity from the L1 to those scaling solutions, thereby dumping Ethereum, price which impacts overall Ethereum performance and potentially its liquidation rate as well. On the Bitcoin side, the CoinTelegraph suggests that such a large amount of long liquidations was caused by optimistic narratives among the traders regarding Bitcoin’s price for the near future, as it began to significantly recover over the past two weeks.

Source: GoodCrypto

Yet, on the chart, it looks like a healthy correction rather than a FUD or dump, as very often traders tend to overleverage their positions in the midst of both bullish and bearish narratives.

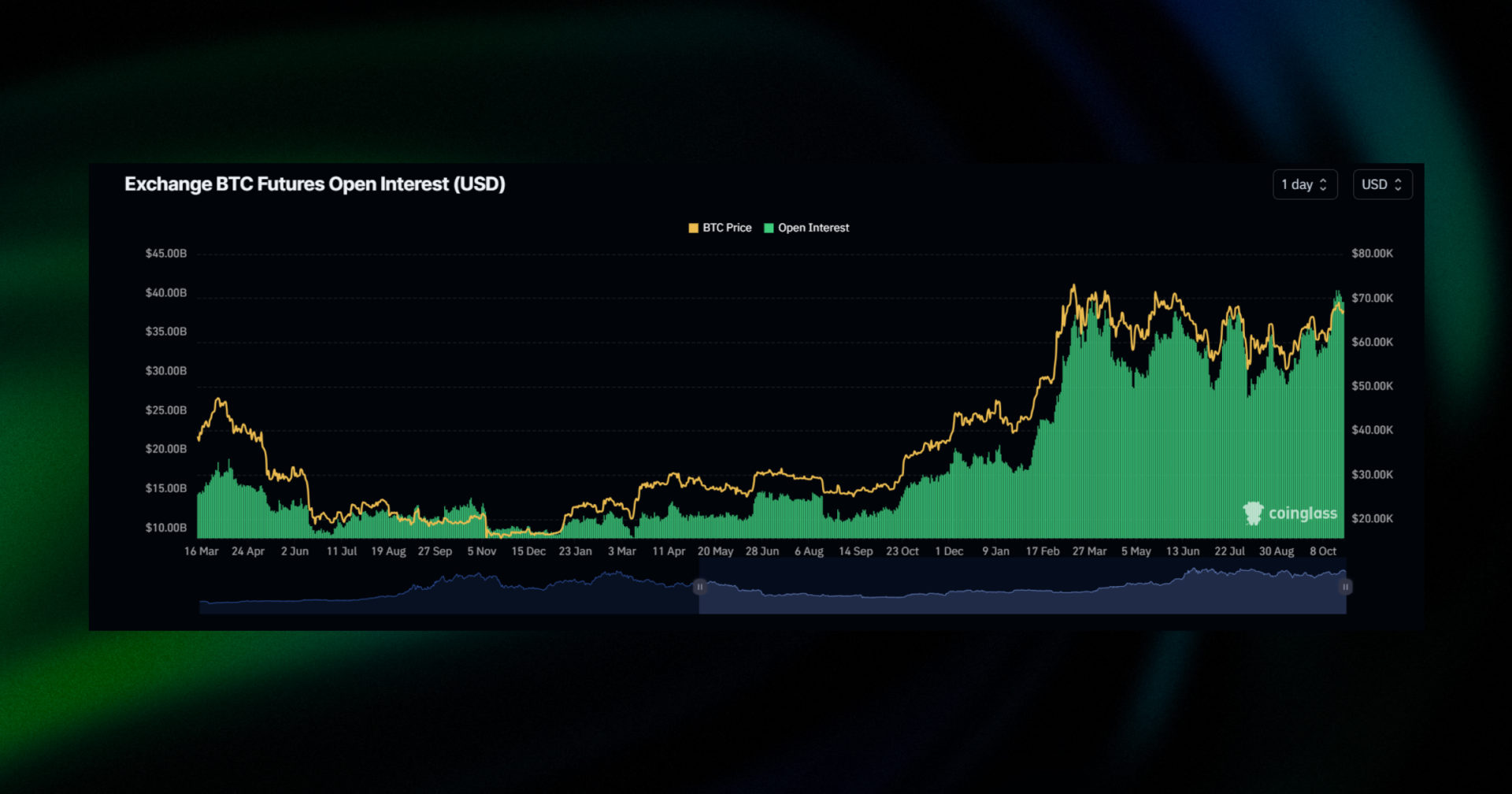

*The open interest chart suggests “over leverage” and usually forecasts corrections once the open interest exceeds the price chart. Source: CoinGlass

It is also worth mentioning that it was only the second largest “liquidation” day in Uptober history while the most massive one occurred on Oct. 1st, where over $450M in longs have been liquidated.

Source: CoinGlasss

Tesla reveals it didn’t sell any Bitcoin holdings in Q3

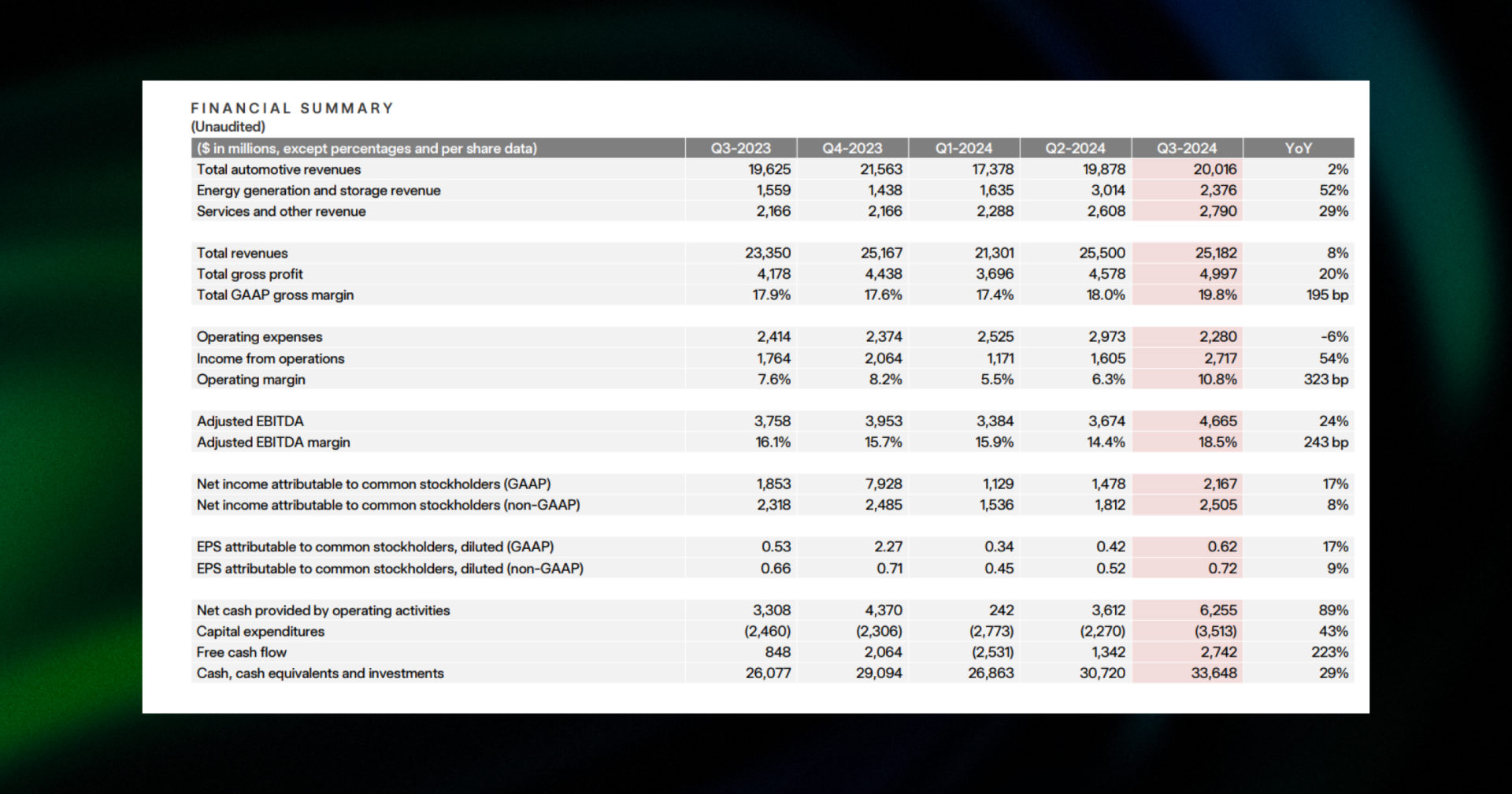

On October 23th, Tesla, one of the largest companies in the US managed by the billionaire Elon Musk revealed its Balance Sheet and revenue records for Q3 2024

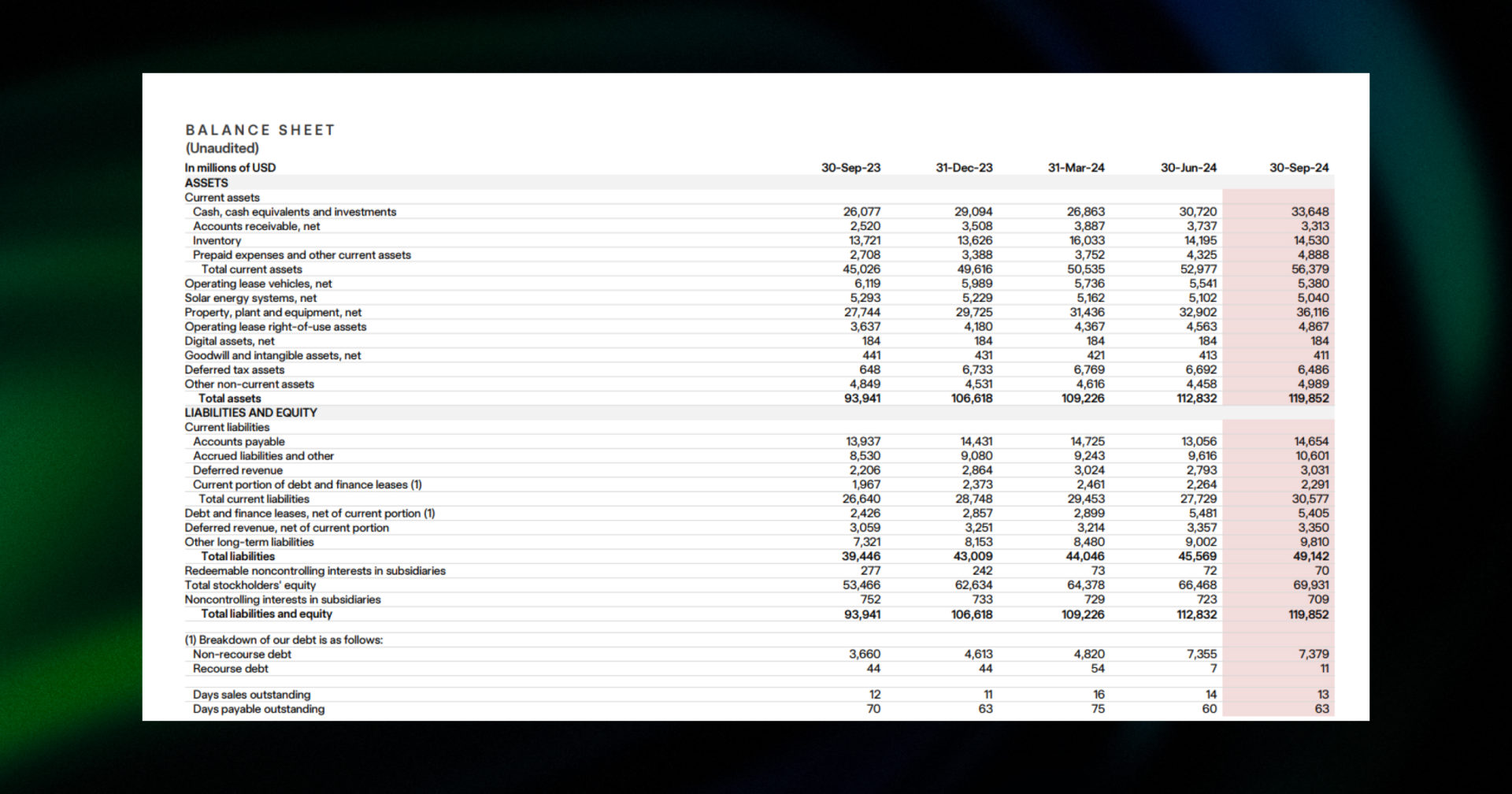

According to its numbers, it has not sold any of the $184,000,000 in digital asset investments during this and other previous 4 quarters. To recall, at the beginning of the previous week, Arkham detected that Tesla came to move their Bitcoins from its well-known wallet to the anonymous one so the crypto community suggested that it may be a preparation step for Tesla to sell the crypto. This caused a big FUD among the traders as Elon Musk impacted the markets not just as a big investor but also as an influencer, giving the entire market-specific narrative.

Source: Tesla’s report

Such FUD had been also supported by the suggestion that Tesla is going to have much less revenue and subsequently profit for Q3 2024. However, although things weren’t good for Tesla, the last report Q3 recorded a $25.18B revenue — slightly down compared to Q2 revenue of approximately $25.5B while net income for the quarter was roughly $2.18B — a sharp increase from Q2’s roughly $1.5B. It seems like this state of affairs wasn’t too dramatic to force Elon Musk to urgently sell his crypto holdings now.

Source: Tesla’s report

As of October 24th, Arkham displays that the wallets purportedly controlled by Tesla have a balance of 11,509 BTC.

Bitcoin is forecast to hit $200K by the end of 2025

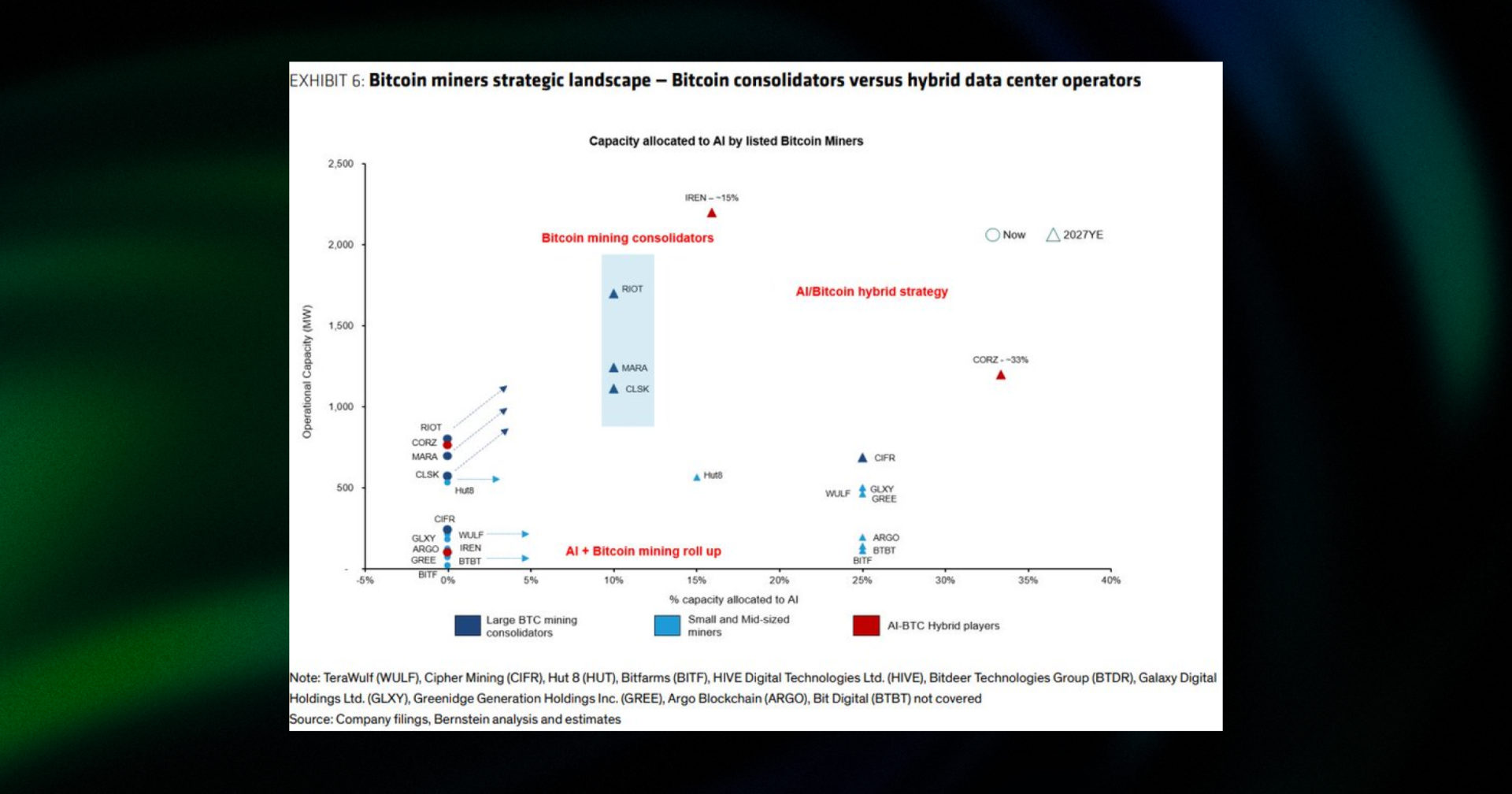

Recently, Bernstein Research stated in a report that Bitcoin may reach $200K by the end of 2025. Although the report is not yet publicly available, Matthew Sigel, Head of Digital Assets Research at VanEck, who is known for his price predictions on key cryptocurrencies, shared some insights from this report. He revealed that the report focuses mainly on Bitcoin miners, their future profitability, and the impact of mining on Bitcoin’s price.

Sigel shared some data from the report on Twitter, highlighting the projected growth in Bitcoin mining’s popularity and the influence of AI on the industry. He suggested that Bitcoin miners will continue to “consolidate the market” as Bernstein reports a rapid recovery of Bitcoin miners following the halving.

Source: Matthew Sigel

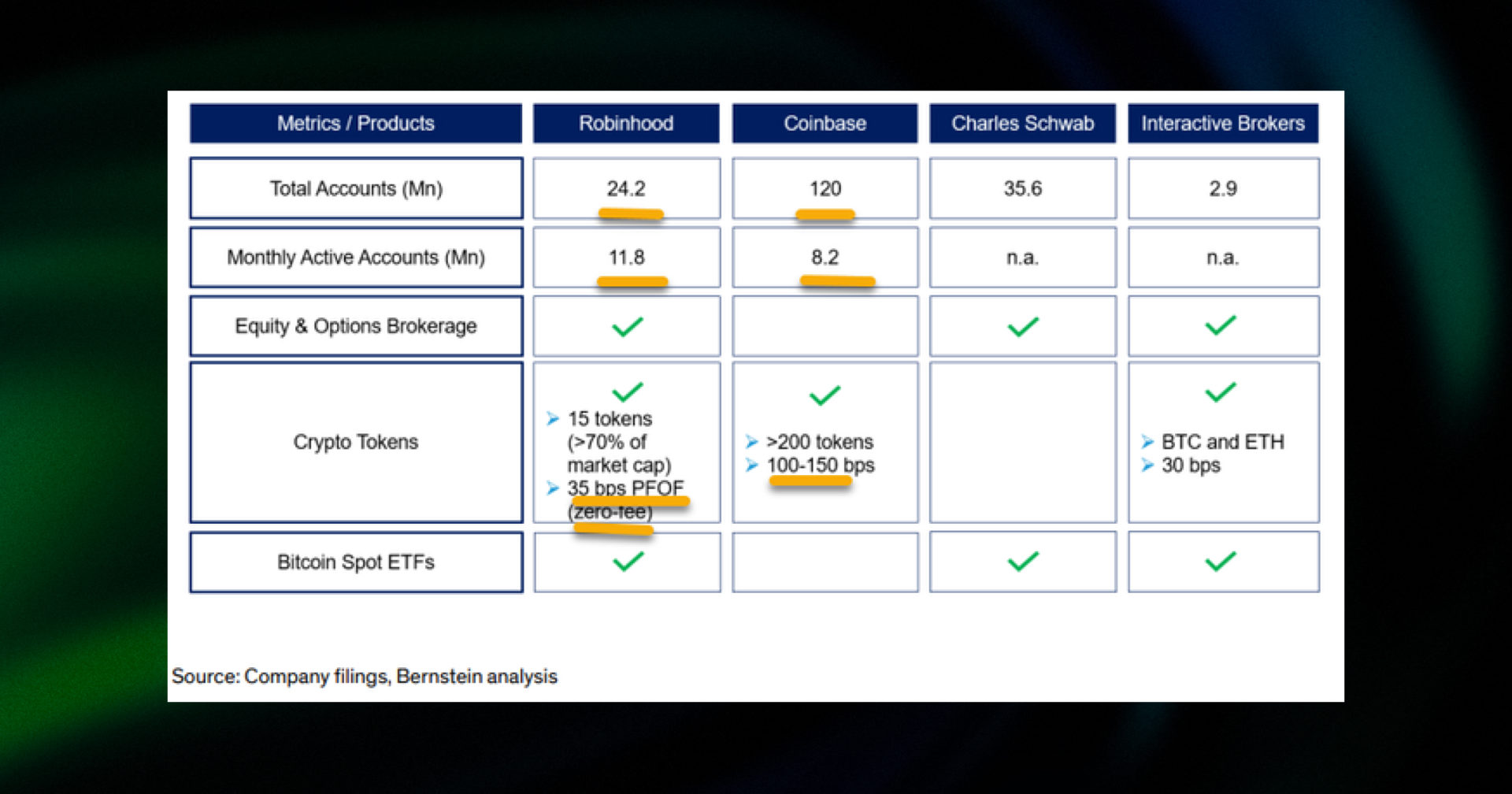

Bullish signs also come from the increasing number of active monthly accounts on major trading platforms like Robinhood and Coinbase, which indicate a surge of interest in crypto from retail investors.

Source: Matthew Sigel

Finally, according to CoinTelegraph, the report notes substantial growth in Bitcoin exchange-traded funds, rising from $12B in 2022 to nearly $60B in 2024. “By the end of 2024, we expect Wall Street to replace Satoshi as the top Bitcoin wallet,” Bernstein added. The research firm suggests that the crypto market is entering “a new institutional era,” where large funds will continue to play an active role in the space.

Lazarus Group exploited Chrome vulnerability with fake NFT game

On October 23rd, the Secure List released a detailed report on its investigation and shutdown of a fake NFT game created by the Lazarus Group, a notorious North Korean hacking organization. The group’s goal was to gain access to the credentials of users’ wallets connected to the fraudulent game, hosted on a site called detankzone[.]com.

According to the report, the hackers exploited a zero-day vulnerability in the latest version of Google Chrome to access victims’ PCs and make unauthorized transactions from their wallets. Specifically, the Lazarus Group created a website mimicking a legitimate product page for an NFT-based multiplayer online battle arena (MOBA) tank game, inviting users to download a trial version. However, the downloaded file contained a hidden script that executed in the user’s Chrome browser, along with the zero-day exploit, granting the attackers remote control over the victims’ devices.

While the report does not delve into the exploit’s code structure, it highlights the hackers’ efforts to appear legitimate. The group maintained an active presence on X (formerly Twitter), posting frequently and engaging with the community to create the illusion of a legitimate NFT project. They even set up a professional-looking premium LinkedIn account to bolster credibility and launched spear-phishing campaigns through email. Fortunately, the Secure List identified and thwarted the attack in its early stages, reporting the exploit to Google, which promptly patched the vulnerability.

Interestingly, the hackers had developed a significant portion of the game. Secure List managed to launch it on their custom servers to test its functionality.

introduction to the DEX 💎 Gems Screener

Discover gems before anyone else with DEX 💎 Gems Screener by goodcryptoX. Track the entire token universe across Ethereum, Arbitrum, Base, and BNB Chain networks on multiple advanced metrics. Here’s what sets it apart:

🔸 Sort tokens based on the advanced token metrics available only on goodcryptoX 💎 Gems Screener such as security score, honeypot detection, experienced buyers, followers on X, liquidity, and more;

🔸 Set filters to instantly exclude tokens that don’t meet your specific criteria and save the setups quickly get back to the filters after you set it once;

🔸 Receive alerts when a new token matches your chosen criteria, allowing you to enter the trade immediately.

🔸 Use our test sniper bot to see how your sniping strategy would have performed in the market.

🔸 Auto trade mode for the sniper bot is coming soon, allowing you to automatically buy a token once it meets specific metrics or criteria, with connected Take Profit and Stop Loss settings.

Want to learn more about how to use it or integrate it into your trading strategy? Check out our comprehensive DEX 💎 Gems Screener review! 📈

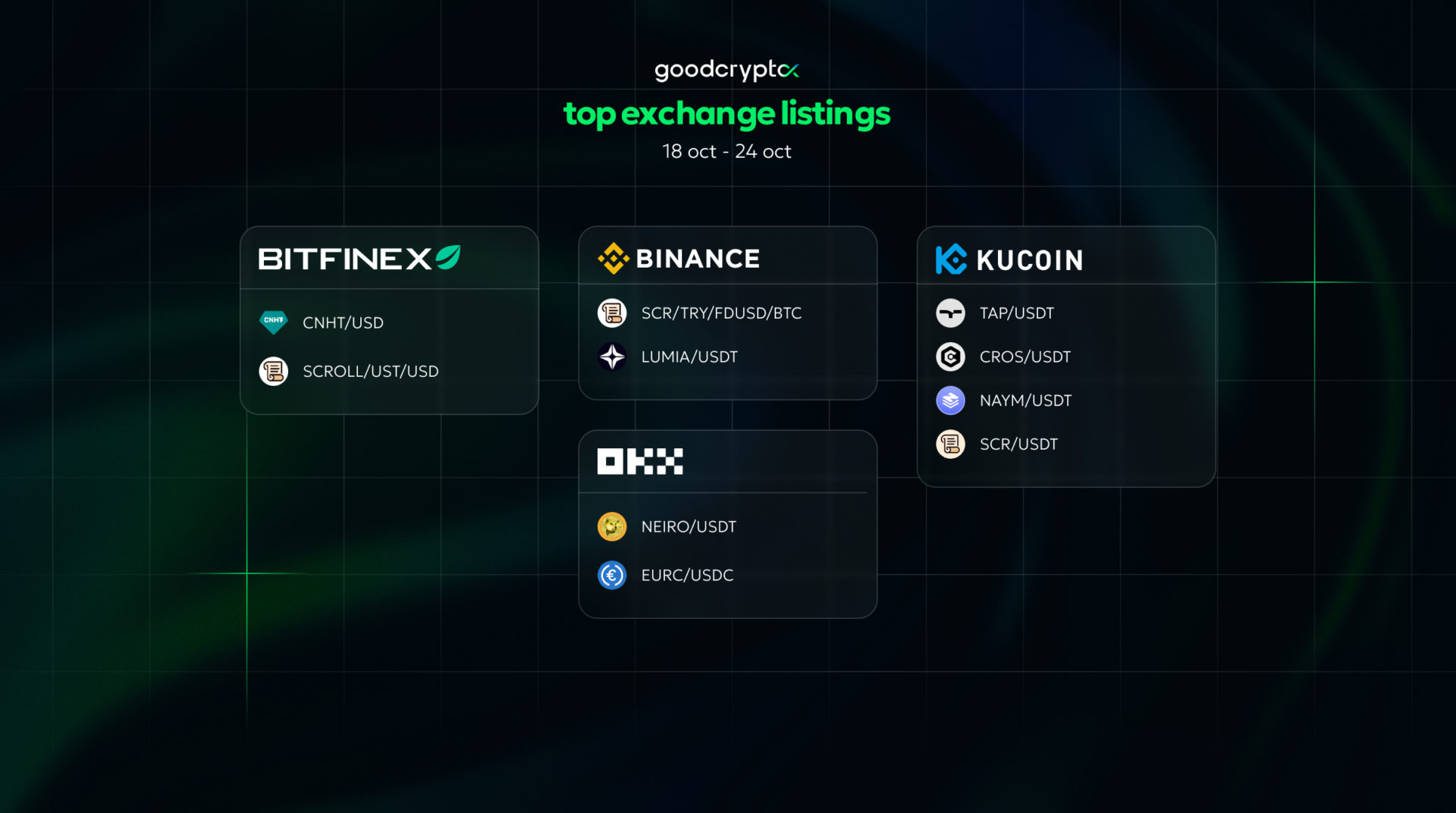

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!