🌲 Happy New Year, fam!

2024 has definitely been a breakthrough year with many new achievements. But as the bull market doesn’t seem to stop in 2024, it’s important to stay focused in 2025 to aim for even greater returns. 💪

So, let’s review the hottest crypto news from the past week to get back on track with the blockchain and crypto industries. 👇

quick weekly news

IRS issues temporary relief on crypto cost-basis method changes

On December 31, 2024, Stephan, the Head of Tax at CoinTracker, released a post announcing that the US IRS has provided relief on taxing crypto gains, which could cause “disastrous consequences” for the current bull market.

Under the initial rule, all US crypto users who held their assets on CeFis and did not choose a preferable accounting method (HIFO, Spec ID, or FIFO) would be forced to sell their assets using the FIFO method. FIFO, or “First In, First Out,” is a default accounting method in the US that assumes the oldest purchase of a specific cryptocurrency is sold first. This means that if users “unintentionally” sell their earliest purchased assets – most likely to have the highest gains – they could “unknowingly maximize their capital gains.”

According to the IRS, US users had the option to pick alternative accounting methods, such as LIFO or Spec ID. However, Stephan claims that CeFis were unprepared for such changes, resulting in most US crypto investors being automatically subjected to the FIFO method. With the release of the latest relief, the IRS will give CeFis time to prepare for alternative taxation methods until the end of 2025, allowing users to adopt LIFO and Spec ID as originally intended.

Proposal mandating the Swiss National Bank to hold Bitcoin now underway

Giw Zanganeh, VP of Energy and Mining at Tether, announced on December 31, 2024, that he and his team are launching an initiative to pressure the Swiss National Bank to add Bitcoin to the bank’s balance sheet. “All we’re saying is that gold is in the constitution, and Bitcoin is the best-performing asset of the last decade,” said Yves Bennaïm, a co-founder of the “Bitcoin Initiative Group,” to DL News.

According to Swiss regulations, the group has 18 months to collect at least 100,000 signatures in support of the proposal and present it to the Swiss National Assembly. The group plans to gather votes by engaging with existing crypto enthusiasts in the country and their networks, rather than trying to convince newcomers to the crypto space. As of January 2, the initiative group has approximately 2,400 followers on Twitter, though it is difficult to determine the exact number of “real people” and “Swiss citizens” among them.

Source: Bitcoin Initiative Twitter

If the required signatures are collected in time and the proposal is presented to the National Assembly, it will move to a national referendum where citizens will vote on whether it is worthwhile for the Swiss National Bank (SNB) to invest in Bitcoin. However, Bennaïm estimates that it could take as long as 3.5 years before the proposal reaches the national voting stage, citing ongoing skepticism and unanswered questions among current government members regarding Bitcoin. The Swiss National Bank has previously criticized Bitcoin for its illiquidity and volatility.

Nevertheless, if the vote succeeds, Bitcoin could secure a share of the Swiss national reserves, which amount to $927B a significant sum given Bitcoin’s current market capitalization of $1.9T.

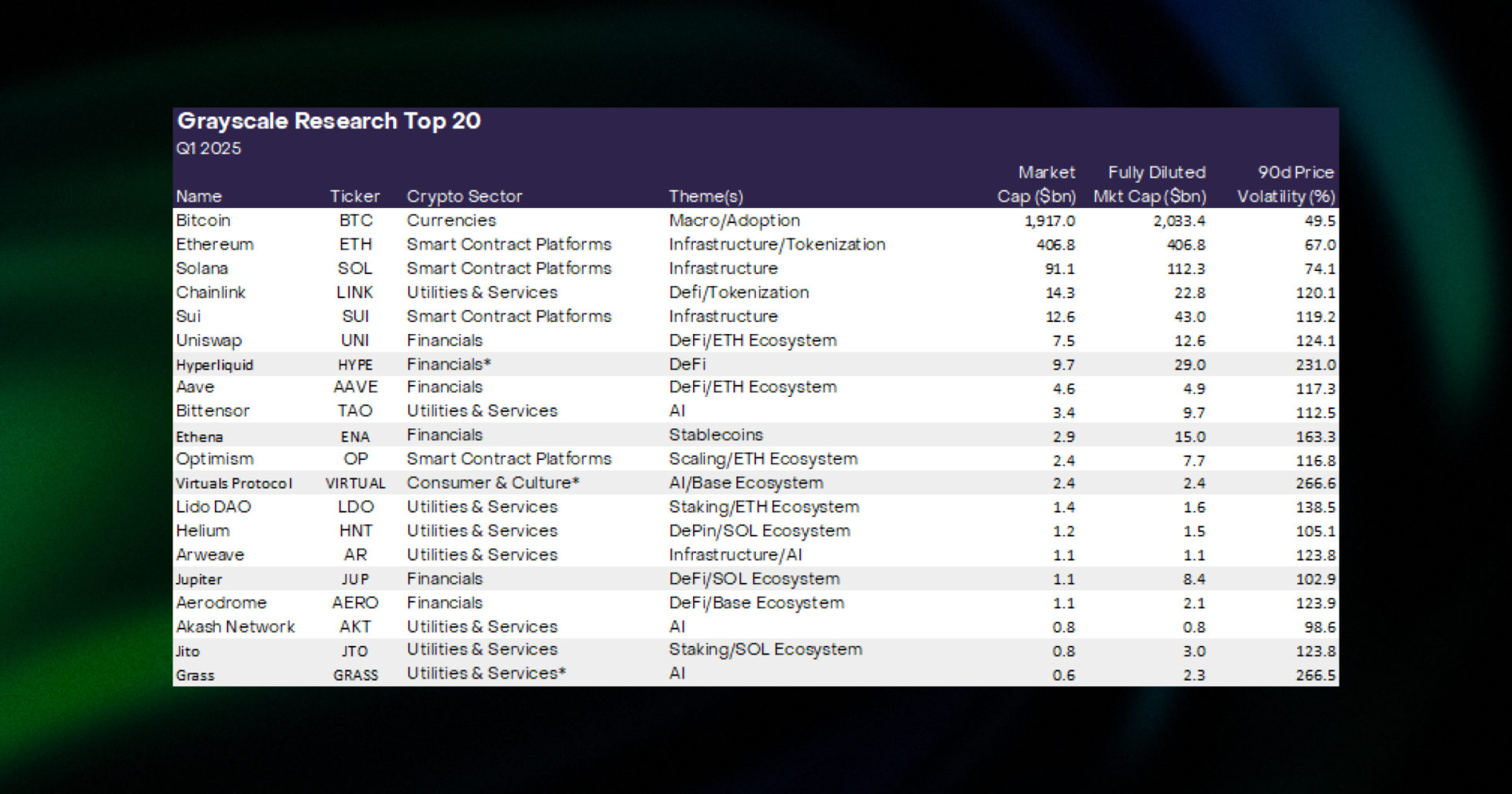

Grayscale adds Solana, AI tokens to top 20 list

Recently, the leading asset management firm Grayscale claimed that crypto in 2025 won’t be limited to Bitcoin and Ethereum, introducing a new Research Top 20 list.

For the first time, the list includes AI-focused cryptocurrencies such as TAO, AKT, VIRTUAL, and GRASS, as well as Solana ecosystem projects like JTO and JUP. Notably, the list also features alternative Layer 1s like Sui and Hyperliquid, as well as the recently launched synthetic dollar protocol, Ethena.

On the other hand, the fund has excluded tokens such as TON, NEAR, STX, SKY (MKR), UMA, and CELO from the list.

Source: Grayscale research report

The Top 20 list highlights 20 cryptocurrencies with high potential for the upcoming quarter, in Grayscale’s opinion. While it does not bring direct investments or investment products to the listed assets, it still increases their exposure and attention, not only among retail investors but also private ones. Furthermore, Grayscale is already known for pioneering new crypto investment funds, being among the first to create an Ether investment fund. It continues to add new assets to its portfolio, including TAO, OP, LINK, and LIDO investment funds.

This suggests that, while not guaranteed, there is still a chance for new assets on the list to be included in a future Grayscale trust fund.

Crypto hacks, scam losses reach $29M in December, lowest in 2024

Web3 security company CertiK shared statistics on crypto scams in December, reporting losses of $28.6M. This marks a significant decrease compared to November’s $63.8M and October’s $115.8M. Notably, the majority of December’s losses were due to exploits, which accounted for $26.7M. Flash loan attacks caused $1.7M in losses, while exit scams amounted to $0.2M.

Among the month’s major incidents, the largest exploit was a $2.1M attack on GemPad, a multi-chain launchpad. A $1M exploit involving FED ranked as the second-largest scam, followed by a $0.5M flash loan attack on ClobberDex as the third-largest.

Source: CertiK

Similarly, another blockchain security firm, PeckShield, confirmed comparable data on January 1st, reporting $24.7M in losses for December, a 71% decrease compared to the previous month. Interestingly, PeckShield’s report included additional major incidents not covered by CertiK, such as a $12.38M hack of LastPass, a $2.2M exploit of Yeifinance, and a $2.2M drain on Solana.

Source: PeckShield

GoodCrypto DCA bot and TradingView webhooks

📈 The bull market is here, bringing countless new trading opportunities—but keeping track of all of them can be overwhelming. Why not simplify your workflow by automating your research process and trading routine?

Explore the TradingView webhooks integration for the DCA bot and take advantage of market volatility with minimal effort!

If you’re unsure how to get started, we’ve got you covered with a detailed video guide review, where you’ll learn 👇

🔸 How to set up webhooks for our DCA bot

🔸 The DCA features available for webhooks

🔸 A review of multiple webhook trigger scenarios

Check out our comprehensive review and unlock the full potential of automation with GoodCrypto! 🤖

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!