Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

BlackRock’s Bitcoin ETF faces first outflow amidst market downturn

BlackRock’s iShares Bitcoin Trust (IBIT) experienced its first day of outflows on May 1, with a withdrawal of $36.9 million, amidst a broader trend of record outflows from U.S.-based spot Bitcoin ETFs. The collective outflow from these ETFs reached over $526.8 million, with the Fidelity Wise Origin Bitcoin Fund leading the pack at $191.1 million, followed by the Grayscale Bitcoin Trust at $167.4 million.

This marked the largest single-day outflow for U.S. Bitcoin ETFs since their inception in January, with other funds like the ARK 21Shares Bitcoin ETF and Franklin Bitcoin ETF also reporting significant outflows. The outflow coincides with a 10.7% drop in Bitcoin’s value over the past week, underscoring the volatility in the cryptocurrency market.

Despite the outflows and market downturn, industry experts like Nate Geraci, president of ETF Store, and Bloomberg ETF analyst James Seyffart suggest that such movements are normal for ETFs. They point out that ETFs are designed to handle inflows and outflows efficiently, and the current activity does not necessarily reflect the health or performance of the underlying asset, as evidenced by the contrasting performance of gold ETFs and the price of gold itself.

Bankman-Fried faces 25-year sentence, Zhao gets 4 months

Crypto industry leaders Sam Bankman-Fried, the ex-CEO of FTX, and Changpeng Zhao, the ex-CEO of Binance, have received starkly different sentences in the U.S. Bankman-Fried was sentenced to 25 years after a trial where he was found guilty of multiple felony charges, including fraud and misuse of customer funds. Zhao, on the other hand, pleaded guilty to a single charge of failing to implement an effective Anti-Money Laundering program and received a four-month sentence.

The severity of the charges and their legal strategies largely influenced the disparity in their sentences. Bankman-Fried maintained his innocence and faced a trial, while Zhao admitted guilt and cooperated with authorities, resulting in a lighter sentence. Additionally, Zhao’s plea deal included a $50 million settlement with the Department of Justice, and he received significant support from the community through letters.

While both men will serve time, their experiences will differ greatly. Bankman-Fried may remain in New York for his appeal, while Zhao is set to serve his sentence at a federal correctional facility, with the exact location and reporting date yet to be determined. The contrast in their sentences highlights the complexities of legal outcomes in the crypto industry and the impact of cooperation and plea negotiations.

Zeus Network plans Q3 2024 launch for Solana-to-Bitcoin bridge

The Zeus Network is set to introduce a cross-chain bridge between Solana and Bitcoin by the third quarter of 2024, leveraging its Zeus Program Library (ZPL) to facilitate seamless interaction with Solana’s DeFi ecosystem. This integration will enable Bitcoin holders to utilize their assets within Solana’s diverse range of decentralized applications, including DeFi, GameFi, and SocialFi platforms, which were previously less accessible to Bitcoin due to its blockchain’s limitations.

ZPL will act as a suite of programs within the Solana Virtual Machine, allowing for the creation of both fungible and non-fungible assets that can be transacted across blockchains. The introduction of zBTC, a ZPL-wrapped Bitcoin token, will allow users to deposit Bitcoin and receive an equivalent token on Solana, unlocking new possibilities for asset utilization in various decentralized services.

The initiative has gained support from notable industry figures such as Solana co-founder Anatoly Yakovenko and has recently raised $8 million in funding. With the upcoming expansion to include Bitcoin Runes and Ordinals, Zeus Network aims to enhance the Bitcoin dApp ecosystem, which has seen growth with new protocols enabling tokenization and unique asset minting on the Bitcoin blockchain.

U.S. investigates Jack Dorsey’s Block for sanction breaches

U.S. federal prosecutors are investigating Block, Inc., the financial technology company led by Jack Dorsey, following allegations from a whistleblower. The claims suggest that Block’s services, including Square and Cash App, have been processing transactions for users in sanctioned countries and potentially for terrorist groups. Documents provided by a former employee indicate that the company may have failed to report thousands of questionable transactions, including those in fiat and Bitcoin, to the authorities.

The whistleblower, who has shared information with the Southern District of New York, accuses Block of persistent compliance failures, even after being made aware of the issues. The allegations, supported by a second source familiar with Block’s operations, imply that the company’s leadership and board were informed of the compliance lapses in recent years but did not take adequate corrective action.

Block, Inc. has responded to the allegations by asserting that it maintains a robust and responsible compliance program, which is continuously updated to address new threats and regulatory changes. This investigation into Block comes amidst a broader pattern of legal scrutiny facing crypto firms in the U.S., with several high-profile cases and regulatory actions emerging against industry players.

Momentum Oscillator divergence strategy

📈 Divergences can be powerful signals in trading, and the Momentum Oscillator is excellent at detecting them. Similar to other momentum indicators like Stochastic or RSI oscillators, MOM divergence can hint at potential price direction changes.

There are two main types of price divergences: classic (or regular) divergence and hidden divergence. Classic divergence signals trend reversal, while hidden divergence indicates trend continuation.

In our MOM divergence trading example, we’ve attached a 200-period Exponential Moving Average (EMA) to the chart to spot the long-term market trend direction.

🚀 Remember the basic 200-EMA rule:

Uptrend: Price trades above the 200-period EMA, suggesting a long position.

Downtrend: Price trades below the 200-period EMA, suggesting a short position.

In our ADA/BNB chart, the market is in an uptrend, so we’re looking for bullish divergence patterns. We’ve identified two MOM divergence signals: one hidden bullish divergence suggesting trend continuation and one classic bullish divergence.

💰 Learn how MOM indicator can help you spot potential price direction changes and master divergence trading in our comprehensive guide!

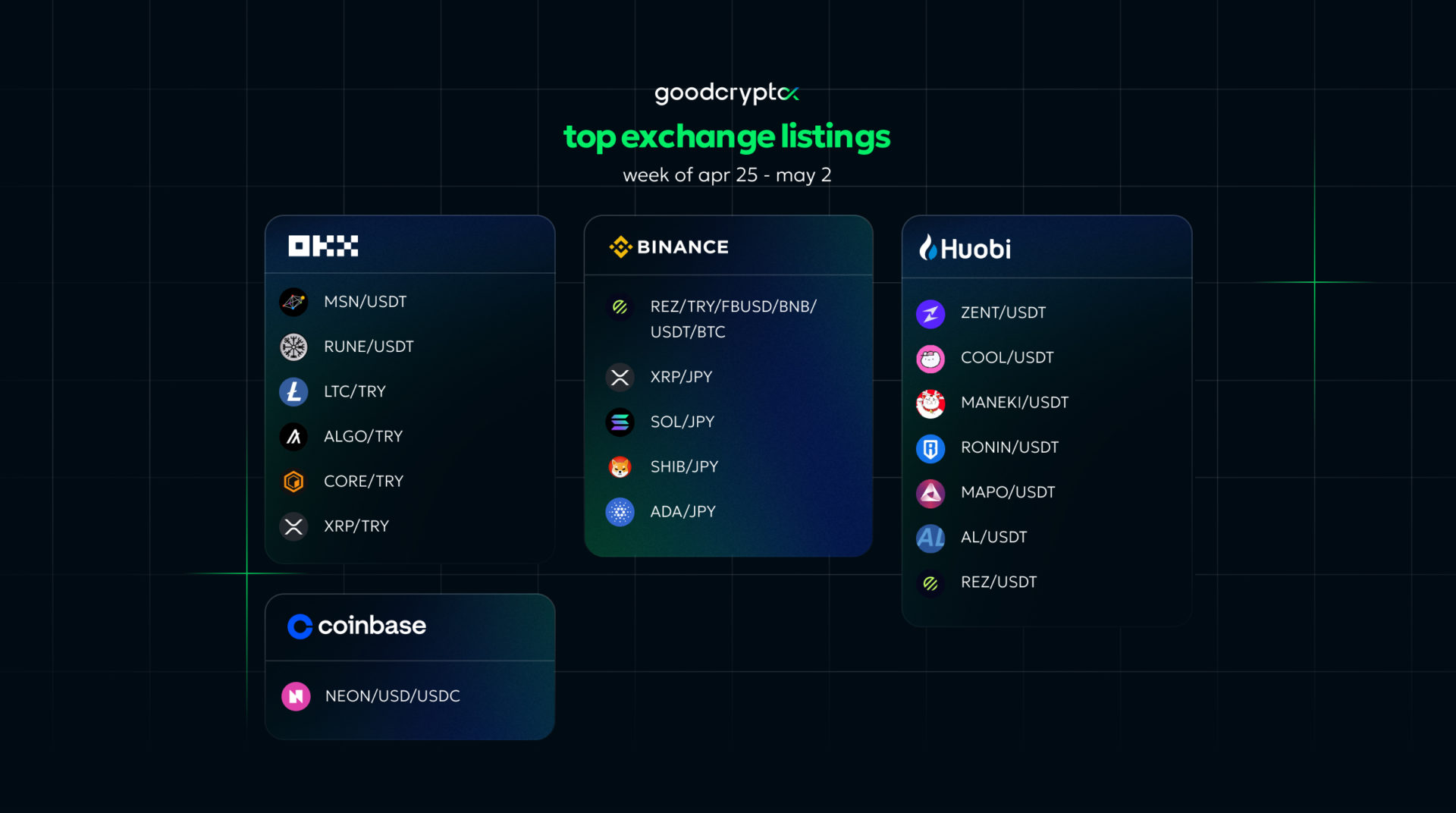

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!